Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Finance Help

saxi753

- 5 / 17

1

Finance Help: In eight years, when he is discharged from the Air Force, Steve wants to buy a $16,000

saxi753

In eight years, when he is discharged from the Air Force, Steve wants to buy a $16,000 power boat.

Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables.

Required:

What lump-sum amount must Steve invest now to have $16,000 at the end of eight years if he can invest money at:

#FinanceHelp

#futurevalue

#PresentValue

2

Finance Help: Julie just retired and has two options for receiving her retirement benefits. Under

saxi753

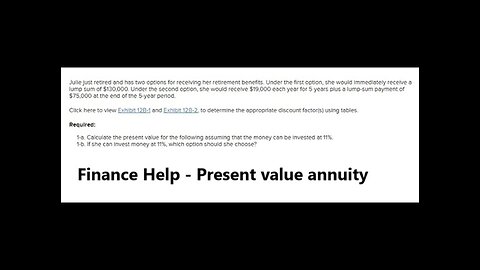

Julie just retired and has two options for receiving her retirement benefits. Under the first option, she would immediately receive a lump sum of $130,000. Under the second option, she would receive $19,000 each year for 5 years plus a lump-sum payment of $75,000 at the end of the 5-year period.

Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables.

Required:

1-a. Calculate the present value for the following assuming that the money can be invested at 11%.

1-b. If she can invest money at 11%, which option should she choose?

#FInanceHelp

#PresentValueAnnuity

#Annuity

#Compounded

3

Finance Help: The Atlantic Medical Clinic can purchase a new computer system that will save $4,000

saxi753

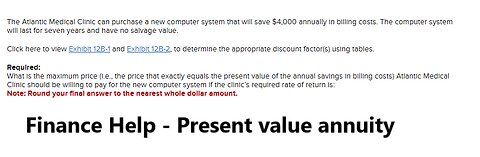

The Atlantic Medical Clinic can purchase a new computer system that will save $4,000 annually in billing costs. The computer system will last for seven years and have no salvage value.

Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables.

Required:

What is the maximum price (i.e., the price that exactly equals the present value of the annual savings in billing costs) Atlantic Medical Clinic should be willing to pay for the new computer system if the clinic’s required rate of return is:

#FinanceHelp

#PresentValueAnnuity

#Formula

4

Finance Help: Annual cash inflows from two competing investment projects are given below

saxi753

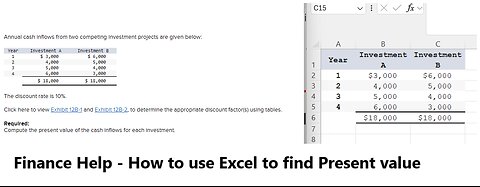

Annual cash inflows from two competing investment projects are given below:

Year Investment A Investment B

1 $ 3,000 $ 6,000

2 4,000 5,000

3 5,000 4,000

4 6,000 3,000

$ 18,000 $ 18,000

The discount rate is 10%.

Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables.

#FinanceHelp

#AnnualCashFlows

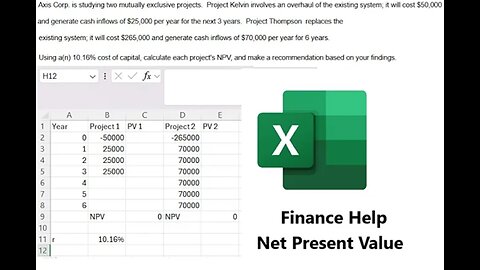

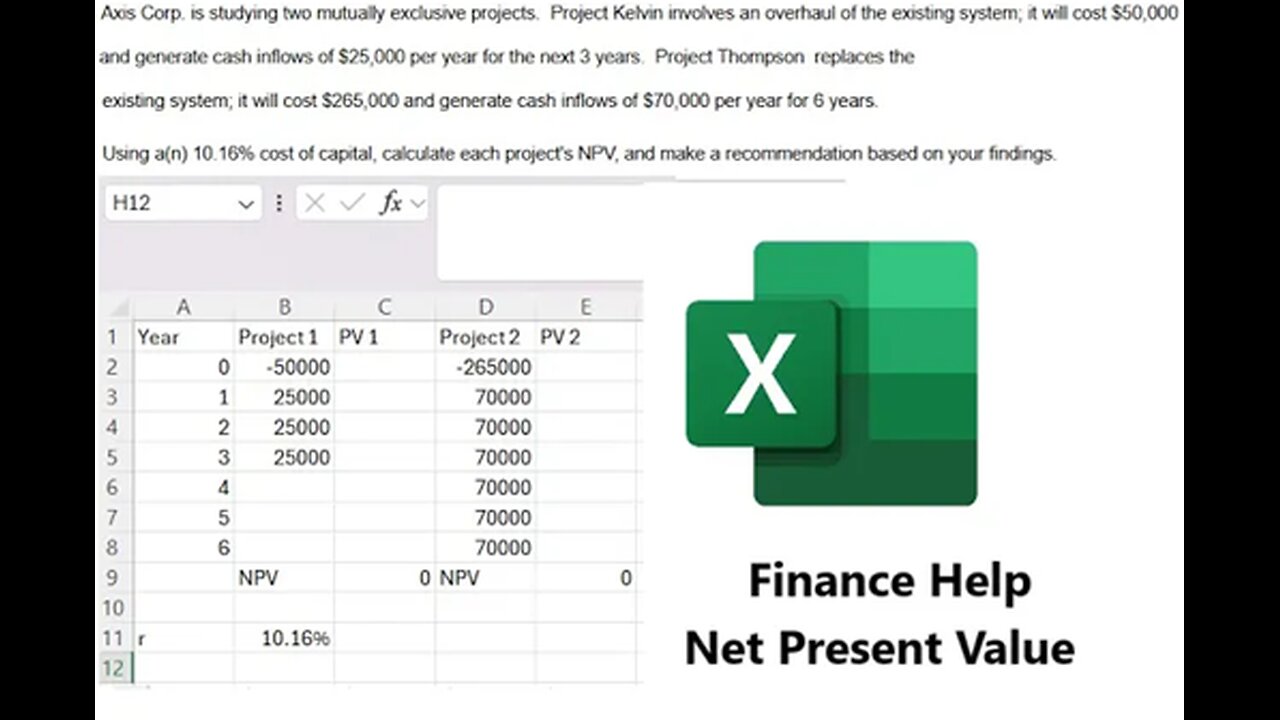

Axis Corp. is studying two mutually exclusive projects. Project Kelvin involves an

saxi753

Axis Corp. is studying two mutually exclusive projects. Project Kelvin involves an overhaul of the existing system; it will cost $50 comma 000 and generate cash inflows of $25 comma 000 per year for the next 3 years. Project Thompson replaces the existing system; it will cost $265 comma 000 and generate cash inflows of $70 comma 000 per year for 6 years. Using a(n) 10.16% cost of capital, calculate each project's NPV, and make a recommendation based on your findings.

#NetPresentValue

#FinanceHelp

#Finance

#Techniques

6

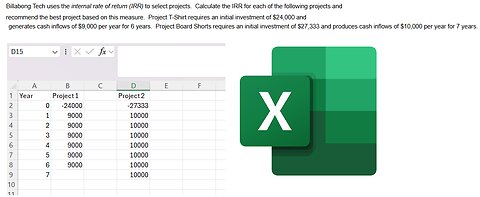

Finance Help: Billabong Tech uses the internal rate of return (IRR) to select projects.

saxi753

Billabong Tech uses the internal rate of return (IRR) to select projects. Calculate the IRR for each of the following projects and recommend the best project based on this measure. Project T-Shirt requires an initial investment of $24 comma 000 and generates cash inflows of $9 comma 000 per year for 6 years. Project Board Shorts requires an initial investment of $27 comma 333 and produces cash inflows of $10 comma 000 per year for 7 years.

#Techniques

#FinanceHelp

#InternalRateOfReturn

#Finance

7

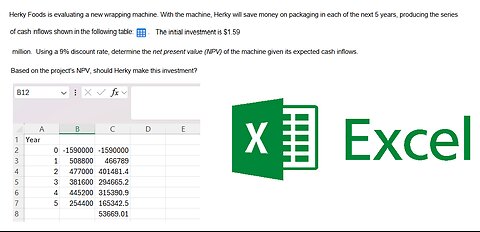

Finance Help: Herky Foods is evaluating a new wrapping machine. With the machine, Herky will

saxi753

Herky Foods is evaluating a new wrapping machine. With the machine, Herky will save money on packaging in each of the next 5 years, producing the series of cash inflows shown in the following table: LOADING.... The initial investment is $1.59 million. Using a 9% discount rate, determine the net present value (NPV) of the machine given its expected cash inflows. Based on the project's NPV, should Herky make this investment?

#NetPresentValue

#Excel

#MicrosoftExcel

#Technqiues

8

Finance Help: Figurate Industries has 780,000 shares of cumulative preferred stock outstanding.

saxi753

Figurate Industries has 780,000 shares of cumulative preferred stock outstanding. It has passed the last three quarterly dividends of $1.60 per share and now (at the end of the current quarter) wishes to distribute a total of $12 million to its shareholders. If Figurate has 2.6 million shares of common stock outstanding, how large a per-share common stock dividend will it be able to pay?

#AccountingHelp

#Commonstock

#PreferredStock

#FinanceHelp

9

Finance Help: Tim Smith is shopping for a used luxury car. He has found one priced at $ 36,000.

saxi753

Monthly loan payments Personal Finance Problem Tim Smith is shopping for a used luxury car. He has found one priced at $ 36,000. The dealer has told Tim that if he can come up with a down payment of $6,600, the dealer will finance the balance of the price at a 6% annual rate over 4 years (48 months).

a. Assuming that Tim accepts the dealer's offer, what will his monthly (end-of-month) payment amount be?

b. Use a financial calculator or spreadsheet to help you figure out what Tim's monthly payment would be if the dealer were willing to finance the balance of the car price at an annual rate of 3.4%?

#FinanceHelp

#AccountingHelp

#PresentValue

10

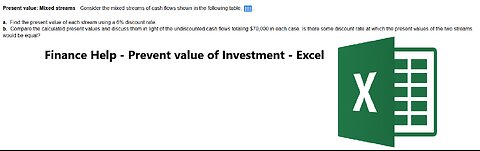

Finance Help: Consider the mixed streams of cash flows shown in the following table

saxi753

Present value: Mixed streams Consider the mixed streams of cash flows shown in the following table

a. Find the present value of each stream using a 6% discount rate.

b. Compare the calculated present values and discuss them in light of the undiscounted cash flows totaling $70 comma 000 in each case. Is there some discount rate at which the present values of the two streams would be equal?

#FInanceHelp

#AccountingHelp

#Excel

#FutureValue

#Investments

11

Finance Help: Manuel Rios wishes to determine how long it will take an initial deposit of $9000

saxi753

Time to accumulate a given sum Personal Finance Problem Manuel Rios wishes to determine how long it will take an initial deposit of $9000 to double.

a. If Manuel earns 9% annual interest on the deposit, how long will it take for him to double his money?

b. How long will it take if he earns only 6% annual interest?

c. How long will it take if he can earn 11% annual interest?

d. Reviewing your findings in parts a, b, and c, indicate what relationship exists between the interest rate and the amount of time it will take Manuel to double his money.

#FinanceHelp

#Accounting

#Excel

#MicrosoftExcel

12

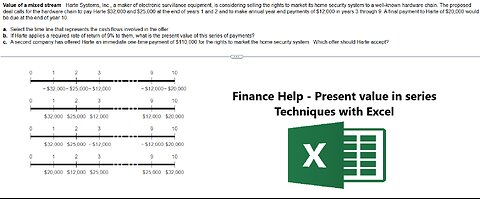

Finance Help: Value of a mixed stream Harte Systems, Inc., a maker of electronic survillance

saxi753

Value of a mixed stream Harte Systems, Inc., a maker of electronic survillance equipment, is considering selling the rights to market its home security system to a well-known hardware chain. The proposed deal calls for the hardware chain to pay Harte $32000 and $25 000 at the end of years 1 and 2 and to make annual year-end payments of $12 000 in years 3 through 9. A final payment to Harte of $20 000 would be due at the end of year 10.

a. Select the time line that represents the cash flows involved in the offer.

b. If Harte applies a required rate of return of 9% to them, what is the present value of this series of payments?

c. A second company has offered Harte an immediate one-time payment of $110 000 for the rights to market the home security system. Which offer should Harte accept?

#FinanceHelp

#Excel

#AccountingHelp

13

Finance Help: Single-payment loan repayment Personal Finance Problem. A person borrows $360 that

saxi753

Single-payment loan repayment Personal Finance Problem A person borrows $360 that he must repay in a lump sum no more than 10 years from now. The interest rate is 7.3% annually compounded. The borrower can repay the loan at the end of any earlier year with no prepayment penalty.

a. What amount will be due if the borrower repays the loan after 2 year?

b. How much would the borrower have to repay after 4 years?

c. What amount is due at the end of the tenth year?

#FinanceHelp

#FutureValue

#PresentValue

14

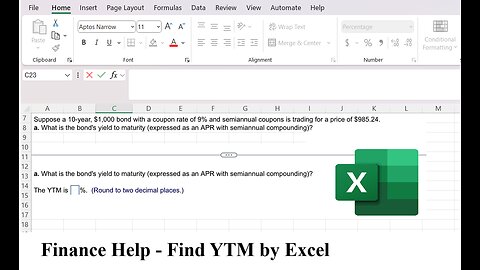

Finance Help: Suppose a 10-year, $1000 bond with a coupon rate of 9% and semiannual coupons is trade

saxi753

Finance Help: Suppose a 10-year, $1000 bond with a coupon rate of 9% and semiannual coupons is trade

#Excel

#MicrosoftExcel

#FinanceHelp

#Finance

#YeildToMaturity

#InterestRates

15

Finance Help: Refer to the following table. What is the forward rate for year 5

saxi753

Finance Help: Refer to the following table. What is the forward rate for year 5

#AccountingHelp

#FinanceHelp

#ForwardRate

16

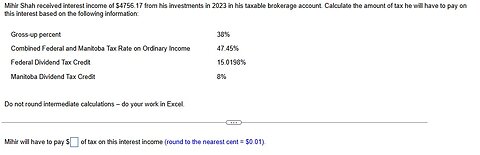

Mihir Shah received interest income of $4756.17 from his investment in 2023 in his

saxi753

Here is the technique to solve this question and how to find them in step-by-step

#Techniques

#InterestIncome

#FinanceHelp

17

Felicia Hong received dividends of $8417.74 from her investment in 2023 in her taxable

saxi753

Felicia Hong received dividends of $8417.74 from her investment in 2023 in her taxable brokerage account. Calculate the amount of tax she will have to pay on these dividends bi following information:

Gross-up percent 38%

Combined Federal and Manitoba Tax Rate on Ordinary Income 49.18%

Federal Dividend Tax Credit 15.0198%

Manitoba Dividend Tax Credit 8%

#FinanceHelp

#Dividends

#Investment

Axis Corp. is studying two mutually exclusive projects. Project Kelvin involves an

6 months ago

28

Axis Corp. is studying two mutually exclusive projects. Project Kelvin involves an overhaul of the existing system; it will cost $50 comma 000 and generate cash inflows of $25 comma 000 per year for the next 3 years. Project Thompson replaces the existing system; it will cost $265 comma 000 and generate cash inflows of $70 comma 000 per year for 6 years. Using a(n) 10.16% cost of capital, calculate each project's NPV, and make a recommendation based on your findings.

#NetPresentValue

#FinanceHelp

#Finance

#Techniques

Loading comments...

-

LIVE

LIVE

Roseanne Barr

2 hours ago“MI6, Mossad & The Royals” W/ Bishop Larry Gaiters | The Roseanne Barr Podcast #112

19,479 watching -

LIVE

LIVE

Kim Iversen

1 hour agoNetanyahu Declares WAR On Algorithms | Zionists Demand Megyn Kelly's Head

634 watching -

LIVE

LIVE

Nerdrotic

2 hours agoDisney HATES YOU! But Needs You, James Gunn's Peacemaker, Alien: Earth | Friday Night Tights 368

1,625 watching -

LIVE

LIVE

Sarah Westall

1 hour agoSocrates: 300 Year Cycle of Unprecedented Change after Worldwide War w/ Martin Armstrong

152 watching -

LIVE

LIVE

Dr Disrespect

5 hours ago🔴LIVE - DR DISRESPECT - WARZONE NUKE IS BACK? - SHOTTY BOYS®

2,554 watching -

LIVE

LIVE

LFA TV

13 hours agoLFA TV ALL DAY STREAM - FRIDAY 8/22/25

1,581 watching -

1:05:29

1:05:29

vivafrei

3 hours agoMeanwhile in Canada... Government Cull OK'ed! D.C. Success Story! John Bolton RAIDED! & MORE!

71.4K39 -

LIVE

LIVE

StoneMountain64

4 hours agoBattlefield 6 UNLOCKS and MOVEMENT Changes

133 watching -

3:40:28

3:40:28

Barry Cunningham

9 hours agoBREAKING NEWS: PRESIDENT TRUMP ADDRESSES AMERICA FROM THE OVAL OFFICE!

76.6K23 -

50:30

50:30

Sean Unpaved

6 hours agoInside the NFL: Ed Werder Talks Cowboys, Contracts, & Coaches

31.1K1