-

Finance Help: In eight years, when he is discharged from the Air Force, Steve wants to buy a $16,000

saxi753In eight years, when he is discharged from the Air Force, Steve wants to buy a $16,000 power boat. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: What lump-sum amount must Steve invest now to have $16,000 at the end of eight years if he can invest money at: #FinanceHelp #futurevalue #PresentValue35 views

saxi753In eight years, when he is discharged from the Air Force, Steve wants to buy a $16,000 power boat. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: What lump-sum amount must Steve invest now to have $16,000 at the end of eight years if he can invest money at: #FinanceHelp #futurevalue #PresentValue35 views -

Finance Help: Julie just retired and has two options for receiving her retirement benefits. Under

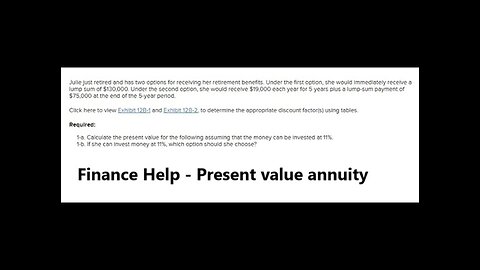

saxi753Julie just retired and has two options for receiving her retirement benefits. Under the first option, she would immediately receive a lump sum of $130,000. Under the second option, she would receive $19,000 each year for 5 years plus a lump-sum payment of $75,000 at the end of the 5-year period. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: 1-a. Calculate the present value for the following assuming that the money can be invested at 11%. 1-b. If she can invest money at 11%, which option should she choose? #FInanceHelp #PresentValueAnnuity #Annuity #Compounded40 views

saxi753Julie just retired and has two options for receiving her retirement benefits. Under the first option, she would immediately receive a lump sum of $130,000. Under the second option, she would receive $19,000 each year for 5 years plus a lump-sum payment of $75,000 at the end of the 5-year period. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: 1-a. Calculate the present value for the following assuming that the money can be invested at 11%. 1-b. If she can invest money at 11%, which option should she choose? #FInanceHelp #PresentValueAnnuity #Annuity #Compounded40 views -

Finance Help: The Atlantic Medical Clinic can purchase a new computer system that will save $4,000

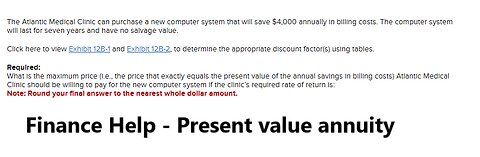

saxi753The Atlantic Medical Clinic can purchase a new computer system that will save $4,000 annually in billing costs. The computer system will last for seven years and have no salvage value. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: What is the maximum price (i.e., the price that exactly equals the present value of the annual savings in billing costs) Atlantic Medical Clinic should be willing to pay for the new computer system if the clinic’s required rate of return is: #FinanceHelp #PresentValueAnnuity #Formula48 views

saxi753The Atlantic Medical Clinic can purchase a new computer system that will save $4,000 annually in billing costs. The computer system will last for seven years and have no salvage value. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: What is the maximum price (i.e., the price that exactly equals the present value of the annual savings in billing costs) Atlantic Medical Clinic should be willing to pay for the new computer system if the clinic’s required rate of return is: #FinanceHelp #PresentValueAnnuity #Formula48 views -

Finance Help: Annual cash inflows from two competing investment projects are given below

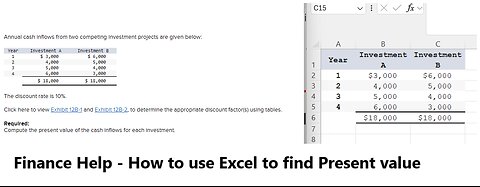

saxi753Annual cash inflows from two competing investment projects are given below: Year Investment A Investment B 1 $ 3,000 $ 6,000 2 4,000 5,000 3 5,000 4,000 4 6,000 3,000 $ 18,000 $ 18,000 The discount rate is 10%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. #FinanceHelp #AnnualCashFlows59 views

saxi753Annual cash inflows from two competing investment projects are given below: Year Investment A Investment B 1 $ 3,000 $ 6,000 2 4,000 5,000 3 5,000 4,000 4 6,000 3,000 $ 18,000 $ 18,000 The discount rate is 10%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. #FinanceHelp #AnnualCashFlows59 views -

Axis Corp. is studying two mutually exclusive projects. Project Kelvin involves an

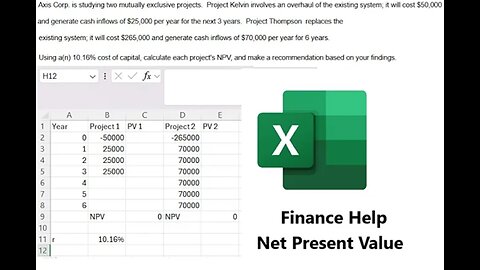

saxi753Axis Corp. is studying two mutually exclusive projects. Project Kelvin involves an overhaul of the existing system; it will cost $50 comma 000 and generate cash inflows of $25 comma 000 per year for the next 3 years. Project Thompson replaces the existing system; it will cost $265 comma 000 and generate cash inflows of $70 comma 000 per year for 6 years. Using a(n) 10.16% cost of capital, calculate each project's NPV, and make a recommendation based on your findings. #NetPresentValue #FinanceHelp #Finance #Techniques23 views

saxi753Axis Corp. is studying two mutually exclusive projects. Project Kelvin involves an overhaul of the existing system; it will cost $50 comma 000 and generate cash inflows of $25 comma 000 per year for the next 3 years. Project Thompson replaces the existing system; it will cost $265 comma 000 and generate cash inflows of $70 comma 000 per year for 6 years. Using a(n) 10.16% cost of capital, calculate each project's NPV, and make a recommendation based on your findings. #NetPresentValue #FinanceHelp #Finance #Techniques23 views -

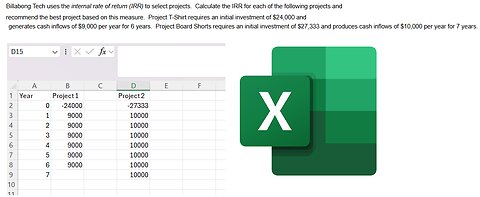

Finance Help: Billabong Tech uses the internal rate of return (IRR) to select projects.

saxi753Billabong Tech uses the internal rate of return (IRR) to select projects. Calculate the IRR for each of the following projects and recommend the best project based on this measure. Project T-Shirt requires an initial investment of $24 comma 000 and generates cash inflows of $9 comma 000 per year for 6 years. Project Board Shorts requires an initial investment of $27 comma 333 and produces cash inflows of $10 comma 000 per year for 7 years. #Techniques #FinanceHelp #InternalRateOfReturn #Finance24 views

saxi753Billabong Tech uses the internal rate of return (IRR) to select projects. Calculate the IRR for each of the following projects and recommend the best project based on this measure. Project T-Shirt requires an initial investment of $24 comma 000 and generates cash inflows of $9 comma 000 per year for 6 years. Project Board Shorts requires an initial investment of $27 comma 333 and produces cash inflows of $10 comma 000 per year for 7 years. #Techniques #FinanceHelp #InternalRateOfReturn #Finance24 views -

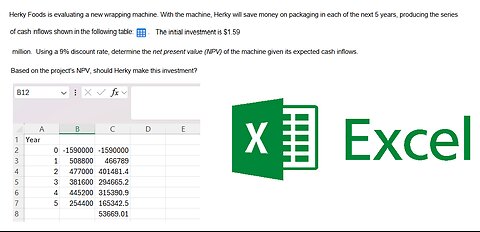

Finance Help: Herky Foods is evaluating a new wrapping machine. With the machine, Herky will

saxi753Herky Foods is evaluating a new wrapping machine. With the machine, Herky will save money on packaging in each of the next 5 years, producing the series of cash inflows shown in the following table: LOADING.... The initial investment is $1.59 million. Using a 9% discount rate, determine the net present value (NPV) of the machine given its expected cash inflows. Based on the project's NPV, should Herky make this investment? #NetPresentValue #Excel #MicrosoftExcel #Technqiues28 views

saxi753Herky Foods is evaluating a new wrapping machine. With the machine, Herky will save money on packaging in each of the next 5 years, producing the series of cash inflows shown in the following table: LOADING.... The initial investment is $1.59 million. Using a 9% discount rate, determine the net present value (NPV) of the machine given its expected cash inflows. Based on the project's NPV, should Herky make this investment? #NetPresentValue #Excel #MicrosoftExcel #Technqiues28 views -

Finance Help: Figurate Industries has 780,000 shares of cumulative preferred stock outstanding.

saxi753Figurate Industries has 780,000 shares of cumulative preferred stock outstanding. It has passed the last three quarterly dividends of $1.60 per share and now (at the end of the current quarter) wishes to distribute a total of $12 million to its shareholders. If Figurate has 2.6 million shares of common stock outstanding, how large a per-share common stock dividend will it be able to pay? #AccountingHelp #Commonstock #PreferredStock #FinanceHelp17 views

saxi753Figurate Industries has 780,000 shares of cumulative preferred stock outstanding. It has passed the last three quarterly dividends of $1.60 per share and now (at the end of the current quarter) wishes to distribute a total of $12 million to its shareholders. If Figurate has 2.6 million shares of common stock outstanding, how large a per-share common stock dividend will it be able to pay? #AccountingHelp #Commonstock #PreferredStock #FinanceHelp17 views -

Finance Help: Tim Smith is shopping for a used luxury car. He has found one priced at $ 36,000.

saxi753Monthly loan payments Personal Finance Problem Tim Smith is shopping for a used luxury car. He has found one priced at $ 36,000. The dealer has told Tim that if he can come up with a down payment of $6,600, the dealer will finance the balance of the price at a 6% annual rate over 4 years (48 months). a. Assuming that Tim accepts the dealer's offer, what will his monthly (end-of-month) payment amount be? b. Use a financial calculator or spreadsheet to help you figure out what Tim's monthly payment would be if the dealer were willing to finance the balance of the car price at an annual rate of 3.4%? #FinanceHelp #AccountingHelp #PresentValue23 views

saxi753Monthly loan payments Personal Finance Problem Tim Smith is shopping for a used luxury car. He has found one priced at $ 36,000. The dealer has told Tim that if he can come up with a down payment of $6,600, the dealer will finance the balance of the price at a 6% annual rate over 4 years (48 months). a. Assuming that Tim accepts the dealer's offer, what will his monthly (end-of-month) payment amount be? b. Use a financial calculator or spreadsheet to help you figure out what Tim's monthly payment would be if the dealer were willing to finance the balance of the car price at an annual rate of 3.4%? #FinanceHelp #AccountingHelp #PresentValue23 views