Premium Only Content

Finance Help: In eight years, when he is discharged from the Air Force, Steve wants to buy a $16,000

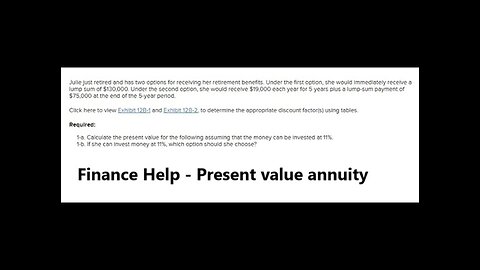

Finance Help: Julie just retired and has two options for receiving her retirement benefits. Under

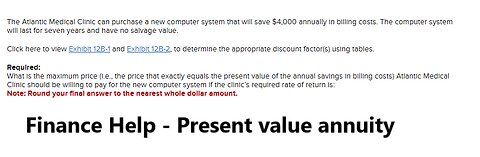

Finance Help: The Atlantic Medical Clinic can purchase a new computer system that will save $4,000

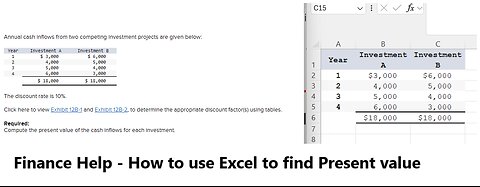

Finance Help: Annual cash inflows from two competing investment projects are given below

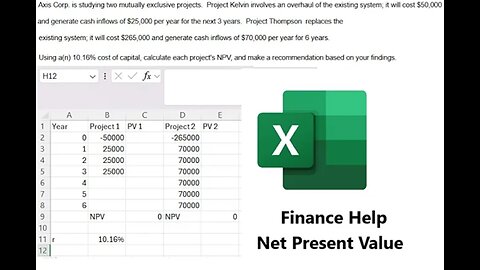

Axis Corp. is studying two mutually exclusive projects. Project Kelvin involves an

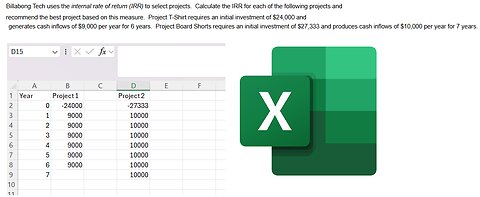

Finance Help: Billabong Tech uses the internal rate of return (IRR) to select projects.

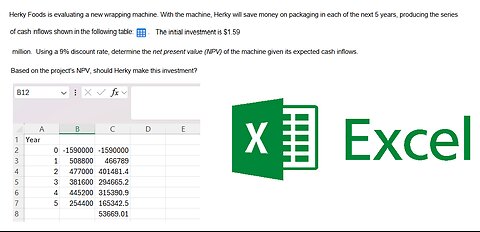

Finance Help: Herky Foods is evaluating a new wrapping machine. With the machine, Herky will

Finance Help: Figurate Industries has 780,000 shares of cumulative preferred stock outstanding.

Finance Help: Tim Smith is shopping for a used luxury car. He has found one priced at $ 36,000.

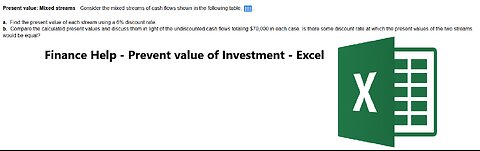

Finance Help: Consider the mixed streams of cash flows shown in the following table

Finance Help: Manuel Rios wishes to determine how long it will take an initial deposit of $9000

Finance Help: Value of a mixed stream Harte Systems, Inc., a maker of electronic survillance

Finance Help: Single-payment loan repayment Personal Finance Problem. A person borrows $360 that

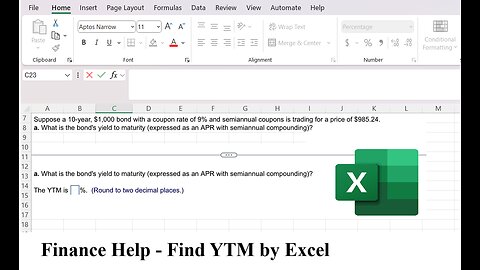

Finance Help: Suppose a 10-year, $1000 bond with a coupon rate of 9% and semiannual coupons is trade

Finance Help: Refer to the following table. What is the forward rate for year 5

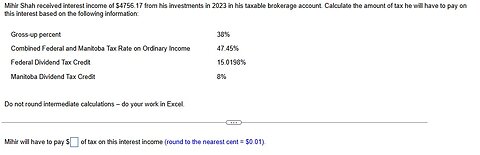

Mihir Shah received interest income of $4756.17 from his investment in 2023 in his

Felicia Hong received dividends of $8417.74 from her investment in 2023 in her taxable

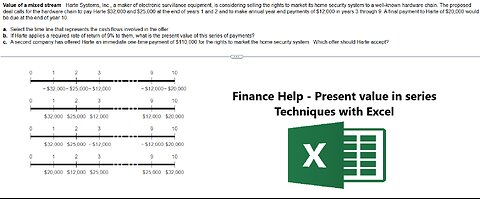

Finance Help: Value of a mixed stream Harte Systems, Inc., a maker of electronic survillance

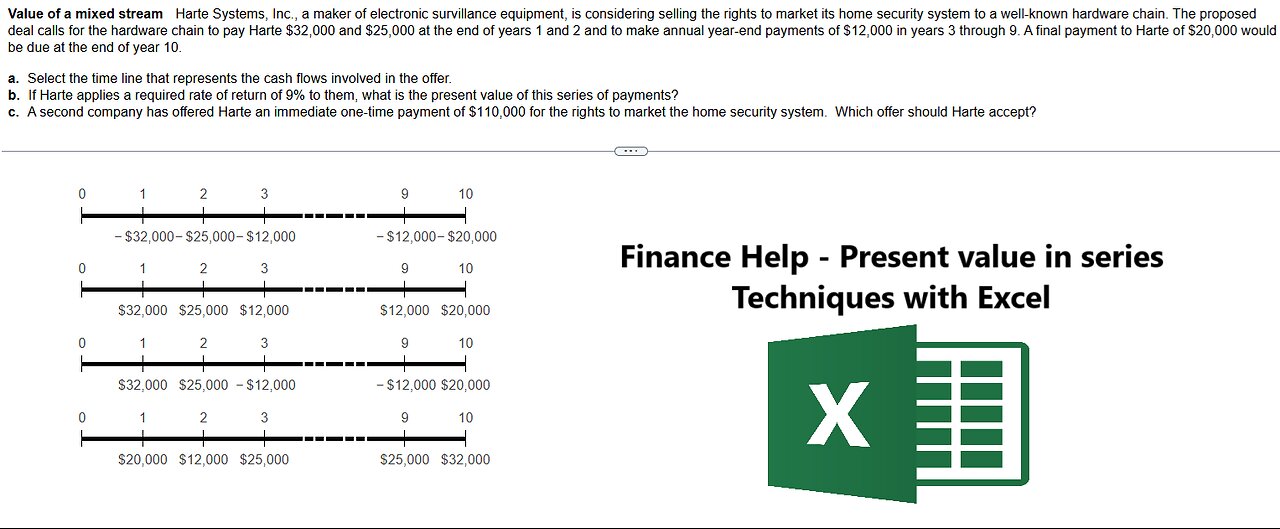

Value of a mixed stream Harte Systems, Inc., a maker of electronic survillance equipment, is considering selling the rights to market its home security system to a well-known hardware chain. The proposed deal calls for the hardware chain to pay Harte $32000 and $25 000 at the end of years 1 and 2 and to make annual year-end payments of $12 000 in years 3 through 9. A final payment to Harte of $20 000 would be due at the end of year 10.

a. Select the time line that represents the cash flows involved in the offer.

b. If Harte applies a required rate of return of 9% to them, what is the present value of this series of payments?

c. A second company has offered Harte an immediate one-time payment of $110 000 for the rights to market the home security system. Which offer should Harte accept?

#FinanceHelp

#Excel

#AccountingHelp

-

3:40:28

3:40:28

Barry Cunningham

7 hours agoBREAKING NEWS: PRESIDENT TRUMP ADDRESSES AMERICA FROM THE OVAL OFFICE!

66K20 -

50:30

50:30

Sean Unpaved

5 hours agoInside the NFL: Ed Werder Talks Cowboys, Contracts, & Coaches

20.8K1 -

LIVE

LIVE

GritsGG

7 hours agoWin Streaking! Most Wins 3390+ 🧠

125 watching -

LIVE

LIVE

WolfsDenBoxing

1 hour agoThe Come Up Boxing Podcast - When you first walk in... What happens?

154 watching -

LIVE

LIVE

Jeff Ahern

1 hour agoFriday Freak out with Jeff Ahern

147 watching -

Crypto Power Hour

1 hour agoDeFi's SWIFT Replacement, 2026 Global Financial Revolution PART II

3.35K4 -

21:07

21:07

Silver Dragons

3 hours agoBullion Dealer on GOLD VS SILVER Next 15 Years (SHOCKING!)

4.39K1 -

20:29

20:29

T-SPLY

17 hours agoWashington Governor Under Risk Of Being Arrested!

13.4K26 -

2:08:43

2:08:43

The Quartering

4 hours agoTrump's Big Announcement LIVE & Today's News!

144K49 -

1:45:59

1:45:59

Tucker Carlson

5 hours agoAaron Lewis on Being Blacklisted from Radio & Why Record Labels Intentionally Promote Terrible Music

55.1K46