Premium Only Content

Cannabis Valuations

Cannabis stock prices and valuation multiples have been trending downwards since peaking in mid-February 2021 with multiples fluctuating around 15x.

They spiked upward in February 2021 on renewed hopes of federal legalization and have drifted lower ever since, despite improving profitability and cash generation, proven access to both debt and equity capital markets, strong cash positions, scaled operations, and the near-certainty of legalization, albeit with an uncertain timetable.

The market is likely to get an upward boost from news that the Safe Act will be attached to the America COMPETES (Creating Opportunities to Meaningfully Promote Excellence in Technology) Act of 2022, a domestic spending bill. We doubt that the bill will get any further now than before, but it is likely to give the market a temporary boost.

Viridian Capital Advisors projects Federal legalization in 2025 followed by a spike upward in growth. With legalization, they project two years of increased growth followed by slowing growth for the following years as cannabis normalizes into a regular consumer staple.

The macro headwinds are considerable, but multiples are in excellent value territory. Legalization or banking reform is likely to bring new investors into the cannabis market with positive effects.

Episode 884 The #TalkingHedge looks at Viridian Capital Advisors’ report…

https://youtu.be/HTc_ONWz9Xk

#CannabisIndustry #CannabisData #MarijuanaData #CannabisAnalytics #MarijuanaAnalytics #CannabisSalesData #MarijuanaSalesData

-

LIVE

LIVE

Tundra Tactical

3 hours ago $0.68 earned🛑LIVE NOW!! This spits in the face of the Second Amendment.🛑

158 watching -

LIVE

LIVE

DLDAfterDark

2 hours agoIt's SHTF! Do You Have What You Need?? Let's Review Items & Priorities

108 watching -

28:58

28:58

Stephen Gardner

3 hours ago🚨Explosive allegations: Rosie O’Donnell connects Trump to Epstein scandal!?

4.54K31 -

LIVE

LIVE

SavageJayGatsby

1 day agoSpicy Saturday | Let's Play: Grounded

611 watching -

2:06:27

2:06:27

MattMorseTV

4 hours ago $37.17 earned🔴Vance just went SCORCHED EARTH.🔴

110K140 -

46:41

46:41

The Mel K Show

9 hours agoMel K & Corey DeAngelis | The Hopelessly Captured Teacher’s Unions: Biggest Threat to Our Children & Future | 9-6-25

22.3K3 -

2:52:42

2:52:42

Mally_Mouse

1 day ago🔥🍺Spicy HYDRATE Saturday!🍺🔥-- Let's Play: Grounded

23.5K2 -

1:32:27

1:32:27

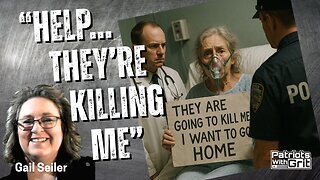

Patriots With Grit

4 hours ago"HELP... They're Killing Me" | Gail Seiler

7.26K1 -

3:07:51

3:07:51

Barry Cunningham

7 hours agoPRESIDENT TRUMP ANNOUNCES THE CHIPOCALYPSE! AND I'M HERE FOR IT! (AND MORE NEWS)

131K57 -

13:37

13:37

Exploring With Nug

11 hours ago $2.74 earnedTrying to Uncover Secrets in St Augustine’s Waters Missing Person Search!

25.6K3