How to Fill Out IRS Form 8814 (Election to Report Child's Interest & Dividends)

If a dependent child receives unearned investment income during the tax year, they may have to file a Form 1040 tax return.

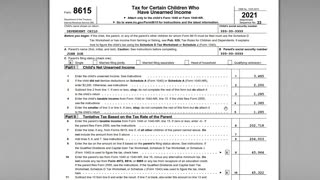

Children may be subject to the "Kiddie Tax" which taxes their investment income at the parents tax rates via IRS Form 8615.

In some cases, the parents can elect to report the investment income on their own tax return, which relieves the child of having to separately file their own Form 1040.

Purchase our tax guides and tutorials here:

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

Follow Jason here:

Patreon: https://www.patreon.com/jasonknott

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Quora: https://www.quora.com/profile/Jason-Knott-17

#IRS #Form8814 #KiddieTax

DISCLAIMER: I am a licensed attorney and certified public accountant (CPA) in the State of Florida. I am not a financial advisor. The information provided in this video is for entertainment purposes only. No such communication is provided in the course of an attorney-client relationship, and no communication is intended to constitute legal advice. You should speak with your own tax and legal professionals to discuss your circumstances before performing any of the tax, legal or accounting strategies demonstrated in this video. Thank you.

-

12:44

12:44

Jason D Knott

2 years agoHow to Report Kiddie Taxes using IRS Form 8615

743 -

10:08

10:08

Jason D Knott

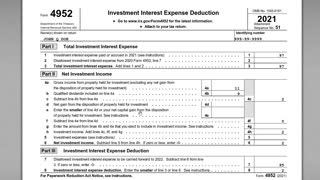

2 years agoIRS Form 4952 - Investment Interest Expense Deduction

64 -

9:33

9:33

Jason D Knott

2 years agoIRS Form 1040 Schedule B - Interest and Dividend Income

49 -

1:43:26

1:43:26

Robert Gouveia

4 hours agoGarland SHAKING over CONTEMPT; Congressional MELTDOWN; Fani RAGES at Senate; Tish INVESTIGATED

24.1K26 -

1:48:05

1:48:05

2 MIKES LIVE

5 hours ago#67 2ML Open Mike Friday, we have a LOT to talk about!

9.13K1 -

2:27:40

2:27:40

WeAreChange

5 hours agoIt’s NOT Just The Frogs — They’re Turning All The Animals GAY??

46.6K29 -

1:02:40

1:02:40

In The Litter Box w/ Jewels & Catturd

23 hours agoPolice State | In the Litter Box w/ Jewels & Catturd - Ep. 570 - 5/17/2024

63.5K49 -

1:57:17

1:57:17

Twins Pod

6 hours agoTwins Pod - Episode 13 - Tim Kennedy: Seals Vs Green Berets, Tigers Vs Bears, & Israel Vs Palestine

58.8K25 -

2:21:43

2:21:43

Tucker Carlson

1 day agoDave Smith: Russia, Israel, Trump & the Swamp, Obama, and the Media Attacks on Joe Rogan

147K414 -

59:55

59:55

shaneyyricch

6 hours agoPERMANENTLY BANNED ON YOUTUBE - LETS RUMBLE

33.4K19