IRS Form 1040 Schedule B - Interest and Dividend Income

When a taxpayer files their Form 1040, they should attach a Schedule B to report interest income, dividend income, and disclose any foreign bank account holdings.

But, not all interest and dividends are reported on Schedule B.

So what are the rules? View the video to learn more.

Purchase our tax guides and tutorials here:

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

#Taxes #IRS #ScheduleB

Follow Jason here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

-

11:13

11:13

Jason D Knott

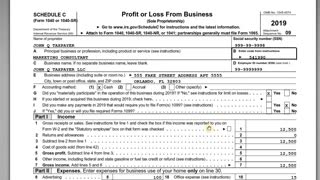

2 years agoIRS Schedule C with Form 1040 - Self Employment Taxes

811 -

8:00

8:00

Jason D Knott

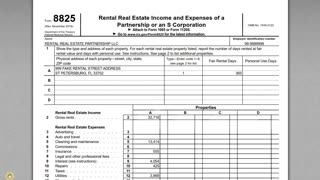

2 years agoIRS Form 8825 - Reporting Rental Income and Expenses

229 -

6:15

6:15

IPOMarketWatch

2 years agoHelp Yourself With Dividend ETFs! Build A Second Retirement Or Passive Income

129 -

21:27

21:27

barstoolsports

1 day agoJersey Jerry Forces Dave Portnoy into Impromptu Contract Negotiation

56.7K8 -

50:56

50:56

The Osbournes

12 days ago $1.56 earnedBEST OF OZZY: Iconic Ozzy Osbourne Moments

71.4K23 -

6:43

6:43

Vigilant News Network

1 day agoTrump Shooter's Body GONE, FBI Cleans up Biological Evidence | Beyond the Headlines

48.5K86 -

46:00

46:00

Spinnin Backfist

14 hours agoDDP SUBMITS IZZY TO RETAIN HIS BELT....FULL UFC 305 RECAP!

64.2K24 -

2:23:52

2:23:52

The Kirk Minihane Show

21 hours agoThe 420 Show- August 17, 2024

57.4K10 -

33:03

33:03

Man in America

23 hours agoTOTAL CHAOS: America’s Next Step Toward Communist Takeover w/ James Lindsay

120K187 -

LIVE

LIVE

Right Side Broadcasting Network

6 days agoLIVE REPLAY: President Trump to Hold a Rally in Wilkes-Barre, PA - 8/17/24

4,290 watching