How to Fill Out Form 1120 for 2021. Step-by-Step Instructions

How to fill out Form 1120 for the 2021 tax year. We have a simple example for a C corporation with a simple profit and loss, a balance sheet, and six U.S.-based shareholders.

For other form tutorials that might be applicable to your return, check our videos here:

Form 851 Affiliations: https://youtu.be/lxs14MnJ7BM

Schedule L: https://youtu.be/tAQ0u2bMZnU

Schedule B: https://youtu.be/VxxeHZOQkK8

Schedule C: https://youtu.be/2RdUqVT7fRE

Schedule G: https://youtu.be/ZgP_UYApZ5A

Schedule N: https://youtu.be/L46i87R-g0s

Deferred Tax Assets & Liabilities: https://youtu.be/n-4_GifD6xk

Form 5472 Nondividends: https://youtu.be/jSRcatAdhJg

Form 1122 Consolidated: https://youtu.be/fBSZonaIPKU

Do you have a personal holding company?

https://youtu.be/Q096Vp18-5c

Purchase our tax guides and tutorials here:

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

Follow Jason here:

Patreon: https://www.patreon.com/jasonknott

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Quora: https://www.quora.com/profile/Jason-Knott-17

#IRS #Form1120S #Scorporation

DISCLAIMER: I am a licensed attorney and certified public accountant (CPA) in the State of Florida. I am not a financial advisor. The information provided in this video is for entertainment purposes only. No such communication is provided in the course of an attorney-client relationship, and no communication is intended to constitute legal advice. You should speak with your own tax and legal professionals to discuss your circumstances before performing any of the tax, legal, or accounting strategies demonstrated in this video. Thank you.

-

36:14

36:14

Jason D Knott

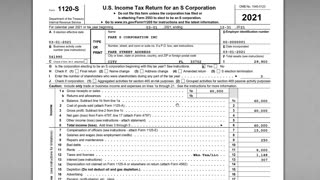

2 years agoHow to Fill Out Form 1120-S for 2021. Step-by-Step Instructions

94 -

41:01

41:01

Jason D Knott

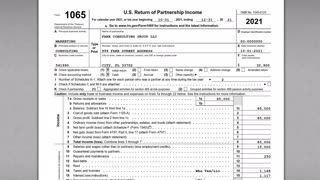

2 years agoHow to Fill Out Form 1065 for 2021. Step-by-Step Instructions

102 -

34:27

34:27

Jason D Knott

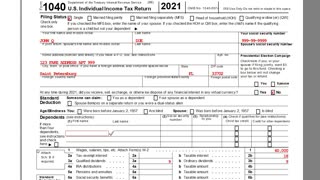

2 years agoHow to Fill Out Form 1040 for 2021. Step-by-Step Instructions

7831 -

1:38

1:38

Exeter 1031 Exchange Services, LLC

3 years agoStep-By-Step Instructions

44 -

5:37

5:37

Jason D Knott

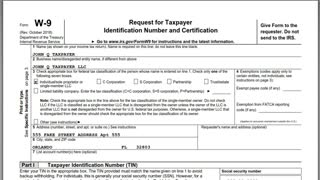

2 years agoHow to Fill Out a Form W-9 for Single Member LLCs

85 -

11:20

11:20

JasonDKnott

2 years agoHow to Fill Out a Protective Form 1120-F for a Foreign Corporation

54 -

2:57:55

2:57:55

Wendy Bell Radio

14 hours agoReturn Of The King

95K170 -

7:27

7:27

Breaking Points

3 days ago72%: Biden 'NOT COGNITIVELY FIT' For Presidency

69.7K66 -

6:08

6:08

Caleb Hammer

28 days agoCaleb Decides To Help Out Homeless Guest Mid Show

55.4K2 -

LIVE

LIVE

SoniCentric

19 hours agoHappy Fourth of July Fireworks & Patriotic Music

364 watching