How to Fill Out Form 1120-S for 2021. Step-by-Step Instructions

How to fill out Form 1120-S for the 2021 tax year. We have a simple example for an S corporation with a simple profit and loss, a balance sheet, and three shareholders.

For other form tutorials that might be applicable to your return, check our videos here:

S Corp Health Ins: https://youtu.be/eX4HcEvEtk8

Schedule B-1 Disclosure: https://youtu.be/lpHos4BcMgA

Form 8869 Q Sub Election: https://youtu.be/90MhuuviXCw

How is Income Allocated? https://youtu.be/v5Pn6oHdBvo

S Corp Debt Forgiveness: https://youtu.be/60NldMgiRwY

S Corp Restricted Stock: https://youtu.be/Xx6bZwECBCI

Did your S corp election terminate? https://youtu.be/hAcGsoElcRI

Purchase our tax guides and tutorials here:

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

Follow Jason here:

Patreon: https://www.patreon.com/jasonknott

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Quora: https://www.quora.com/profile/Jason-Knott-17

#IRS #Form1120S #Scorporation

DISCLAIMER: I am a licensed attorney and certified public accountant (CPA) in the State of Florida. I am not a financial advisor. The information provided in this video is for entertainment purposes only. No such communication is provided in the course of an attorney-client relationship, and no communication is intended to constitute legal advice. You should speak with your own tax and legal professionals to discuss your circumstances before performing any of the tax, legal, or accounting strategies demonstrated in this video. Thank you.

-

31:00

31:00

Jason D Knott

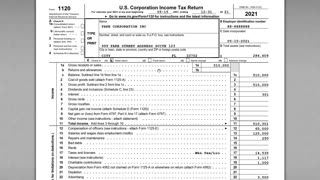

2 years agoHow to Fill Out Form 1120 for 2021. Step-by-Step Instructions

99 -

41:01

41:01

Jason D Knott

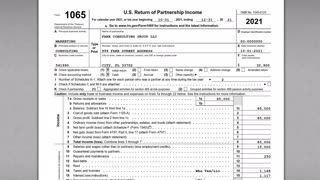

2 years agoHow to Fill Out Form 1065 for 2021. Step-by-Step Instructions

102 -

10:49

10:49

JoeLustica

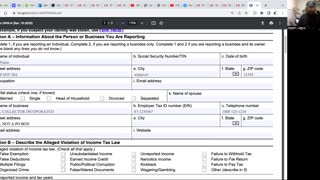

1 year agoHow to fill out the 3949a form

4K20 -

12:09

12:09

JoeLustica

1 year agoHow to fill out the I-9 form

3.74K14 -

4:17

4:17

LaurenSimpson

1 year agoHow To Form An LLC | Step by Step Guide

13 -

15:52

15:52

JoeLustica

1 year agoFilling out the 2848 form

3.91K5 -

0:25

0:25

johnnycarolina

1 year agoEasily File Your Printable 1099 Form Online with Form1099Online

10 -

16:36

16:36

PatrickCamuso

1 year agoHow to Set Up a Web3 Accounting System A Step-by-Step Guide

16 -

2:06

2:06

BusinessTechPlanet

1 year ago🧾 A complete guide to creating fillable forms in SharePoint Online 🧾

9 -

24:50

24:50

cribfox

1 year agoHow to Fill Out a Florida Realtor Purchase Contract