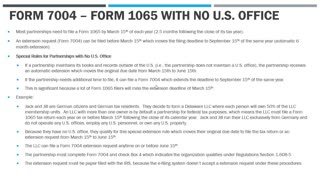

Form 7004 Extension Request for Partnerships with no U.S. Office

If you have a multi-member LLC that is taxable as a partnership, you need to file a Form 1065 tax return each year, which is due by March 15th of each tax year.

Form 1065 is required even if all of the owners are non-U.S. persons. If the partnership has no U.S. office, it may qualify for a special extension rule under Treas. Reg. Section 1.608-5 that moves the original due date from March 15 to June 15.

If you thought you "missed" the March 15th deadline to file a Form 7004, you might be in luck if you have no U.S. office...

Purchase our tax guides and tutorials here:

https://gumroad.com/jasondknott

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

Follow Jason here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

#IRS #Form7004 #Form1065

DISCLAIMER: I am a licensed attorney and certified public accountant (CPA) in the State of Florida. I am not a financial advisor. The information provided in this video is for entertainment purposes only. No such communication is provided in the course of an attorney-client relationship, and no communication is intended to constitute legal advice. You should speak with your own tax and legal professionals to discuss your circumstances before performing any of the tax, legal, or accounting strategies demonstrated in this video. Thank you.

-

5:39

5:39

Jason D Knott

2 years agoIRS Form 7004 Extension Request Partnerships with No U.S. Office

45 -

11:52

11:52

Jason D Knott

2 years agoIRS Form 8829 - Home Office Deductions

60 -

9:27

9:27

PJMSS.com

2 years agoHow to Create a Time Extension Request in Primavera P6

29 -

0:38

0:38

WXYZ

2 years agoRobby Fabbri talks about contract extension with Red Wings

11 -

1:29

1:29

Reuters Entertainment

2 years ago'Spider-Man' ignites box office with historic opening

1.3K44 -

24:20

24:20

Brewzle

1 day agoWe Went Unicorn Bourbon Hunting In Louisville, KY

61K8 -

35:39

35:39

Degenerate Jay

1 day agoGoldenEye 007 Saved James Bond - Movie Review

56.9K7 -

14:54

14:54

Mr Reagan

1 day ago $0.46 earnedWE ARE ALL MAGA NOW

47.6K109 -

15:35

15:35

Space Ice

1 day ago'The Beekeeper' Exposes The Dark, Gritty, & Violent World Of Apiculture - Best Movie Ever

49.6K23 -

3:29:53

3:29:53

SonnyFaz

1 day agoEric Kelly Trains Sonny FULL STREAM

48.6K12