IRS Form 8829 - Home Office Deductions

Self Employed persons that work from home may be eligible to deduct a portion of their home office expenses each tax year.

The IRS has strict rules regarding what expenses are eligible and under what circumstances the taxpayer may deduct home office expenditures.

In this video, I will discuss the following topics:

1. What qualifies as a home office.

2. What taxpayers are eligible to deduct home office expenses.

3. Which expenses are eligible.

4. What are the deductible limitations

Purchase our tax guides and tutorials here:

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

Follow Jason here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

#Taxes #IRS #HomeOffice #Form8829

DISCLAIMER: I am a licensed attorney and certified public accountant (CPA) in the State of Florida. I am not a financial advisor. The information provided in this video is for entertainment purposes only. No such communication is provided in the course of an attorney-client relationship, and no communication is intended to constitute legal advice. You should speak with your own tax and legal professionals to discuss your circumstances before performing any of the tax, legal, or accounting strategies demonstrated in this video. Thank you.

-

1:05

1:05

WMAR

3 years agoAvoid the Audit: Home Office Tax Deductions

54 -

5:39

5:39

Jason D Knott

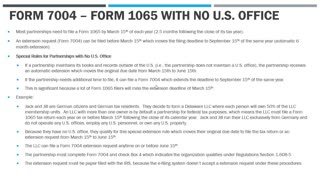

2 years agoIRS Form 7004 Extension Request Partnerships with No U.S. Office

45 -

3:37

3:37

WKBW

2 years agoClean air at home and the office

6 -

14:56

14:56

Aodha21

3 years agoHome Office Based Business

34 -

4:36

4:36

KTNV

3 years agoHome Office Makeover

147 -

0:46

0:46

WPTV

2 years ago'Broward Sheriff's Office. Is anyone home?' burglar announces

12 -

38:24

38:24

Tucker Carlson

12 hours agoTucker Carlson and Donald Trump Jr. Respond to the Trump Verdict

134K517 -

2:01:47

2:01:47

Fresh and Fit

12 hours agoOne Hit Wonder 🤡 Kicked Off For THIS...

199K458 -

34:19

34:19

Alexis Wilkins

19 hours agoBetween the Headlines with Alexis Wilkins: The Verdict and More

52.9K31 -

1:11:21

1:11:21

Kim Iversen

18 hours agoWW3?!? Is The West Secretly Behind Another Color Revolution Aimed At Toppling Russia? | Biden Maniacally Bombs Yemen and Russia

97.6K96