Multifamily Syndication: Basics Explained

Today, I want to explain to friends, family, and anyone that is not familiar with multifamily syndication - the basics of what my partners and I do when we put a deal together.

In real estate, as well as just about any industry a syndication is when a group of people or companies put their resources together - whether it be time, money or expertise to achieve a goal that would be difficult for each person to do on their own. For investors, this is a very effective way to pool their financial and intellectual resources to invest in projects much bigger than they could buy and run by themselves.

As it relates to buying into a multifamily deal, when you invest with a syndicator, you own a percentage of the property along with the other investors in the deal. This means all the great benefits, such as accelerated depreciation and preservation of capital, are enjoyed by all the investors in the deal.

There are many types of real estate syndication deals. You can join a syndication putting up a new building that is to be constructed, cashflow deals when wants to make an exit, or value-add deal, which is what my partners and I specialize in. This mainly consists of forcing the appreciation of the property by driving net operating income.

In these scenarios, there are typically properties that have either fallen prey to mismanagement, have deferred maintenance, or have some big upside play where the property can be repositioned. In any case, the value-add properties we target are all cashflow deals. We are not buying deals for appreciation only.

Now, you may be wondering, how does a syndication work. To get to that, let me first talk about the three main participants of a syndication deal. The people putting the deal together are called the Deal Sponsor. They are also referred to as the General Partner, Syndicator or Operator. Then you have the passive investors, known as the Limited Partners. The final part if the Property Management team. Aside from the structure, there are many supporting functions that go to work to put the entire structure together, like the lender, the SEC attorney, the real estate broker, the accountant, the title company and others.

While there are many players and moving parts, the Deal Sponsor is the one that keeps it all together. They need to identify the market, work with the lender to get the financing locked in, execute the business plan, make sure the renovations are getting done, staying in constant contact with the property management company, and keeping the investors up to date.

The Limited Partners, or the investors, provide the equity in the deal. They are bringing the cash to get the deal done. These people are typically accredited investors and do not have day-to-day operational responsibility. Rather, they rely on the Deal Sponsor to make sure they are doing what they said they would do for the return they targeted at the time they funded the deal. With that said, they usually have very limited decision making in the operation of the property, which reduces their personal liability if a lawsuit crops up. Additionally, they are not on the banknote so if things go very bad for the property, their exposure is what they originally invested and not the entire amount of the property itself.

The Property Management group is of vital importance to the overall success of the deal. A strong management group knows the local area, knows the market’s strength and weaknesses, and has the know how to fill the units with quality tenants. They are also great at running teams of renovators and making sure the tenants are kept happy where they live. This group works closely with the Deal Sponsor in not only running deals, but also identifying opportunities, assisting with underwriting, and working on due diligence and new property on-boarding.

So, let’s recap. So far, you’ve learned what a syndication deal is and its benefits, you learned a few types of multifamily deals and the participants of these deals, who are deal sponsors or syndicators, limited partners or investors, and property managers.

When it comes to the overall deal strategy, there are 4 main parts: Market, Asset, Business Plan and Deal Exit Strategy.

THE MARKET: The first part of any value-add strategy is the definition of the market. Typical target markets are in high growth metropolitan statistical areas, or MSAs with above-average job growth, a growing population, and employer diversification. The sponsor will also look at how the market rents are growing without any major renovations as well as the number of new units coming online and their absorption by the marketplace. All these things are indicative of a good market.

THE ASSET: Once the market has been identified, the search is on to look for the right asset in that market. For many, they are looking for stabilized properties with conservative underwriting with room left for a value-add play.

-

7:26

7:26

Horsegirl5

3 years ago $0.01 earnedBasics of Canning

186 -

5:26

5:26

clintg

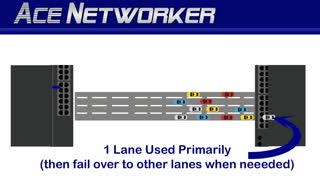

3 years ago $0.01 earnedEtherchannel Explained #etherchannelexplained

142 -

0:14

0:14

tictoc

3 years ago $0.03 earnedHyperInflation explained

153 -

3:48

3:48

Celestialthyme

3 years ago $0.02 earnedSamhain explained

213 -

8:46

8:46

Quadzip

3 years agoHRD V5 Macro Basics

38 -

3:10

3:10

WideOpenEats

3 years agoBeef Grades Explained (Biteseez)

33.2K -

29:06

29:06

glennh

3 years ago $0.08 earnedFreeCad Basics

3212 -

15:11

15:11

Patriot Answers

3 years agoMarxism Explained

512 -

51:31

51:31

Science & Futurism with Isaac Arthur

1 day agoAutomated Justice

31K8 -

28:23

28:23

TampaAerialMedia

1 day agoMiami Travel Guide - Downtown, Key Biscayne, Coral Gables

20.7K4