Reinvestment Requirements

"How much do I have to reinvest in order to avoid paying capital gains taxes?"

We are often asked "Do I have to purchase a replacement property equal to my sales price or just the amount of my capital gain?"

The 1031 Exchange allows you to defer the payment of all taxes as long as you remain fully invested. In order to remain fully invested, you should follow three guidelines.

First, the replacement property that you purchase should be equal to or greater in value than the net sale price of the property you are selling. You compute the net sale price by deducting the routine selling expenses from your gross sales price such as broker's commissions, title charges, escrow fees, recording fees and exchange fees. You compute the net purchase price of your replacement property by adding the routine purchase expenses to your purchase price.

Second, you must reinvest 100% of the net cash proceeds received by your Qualified Intermediary from the sale of your existing property.

Third, the amount of new debt (mortgage) on your replacement property will be the difference between the total purchase price less the net cash proceeds (equity) reinvested. If you purchase a new property that has a lower purchase price, or you take some of the cash equity out for personal use, you will recognize some of your tax liabilities.

1031 Exchanges are complex, that's why you need an expert! Call Exeter 1031 at 1-619-239-3091 or visit http://www.exeterco.com

-

2:07

2:07

WMAR

3 years agoOnline live instruction requirements

62 -

0:30

0:30

TheBarnista

3 years agoComplying with Mask Requirements

92 -

2:08

2:08

WMAR

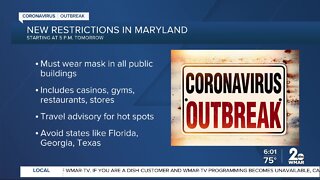

3 years agoNew mask requirements in Maryland

1443 -

1:29

1:29

WGBA

3 years agoVaccine requirements in the workplace

43 -

1:31

1:31

KTNV

3 years agoNew mask requirements for gamblers

21 -

2:29

2:29

KSHB

3 years agoLaw professors: Businesses can enforce vaccine requirements

391 -

0:29

0:29

KTNV

3 years agoOSHA: companies can legally impose vaccine requirements

126 -

0:50

0:50

KTNV

3 years agoReno brothel stepping up safety requirements

18 -

1:51

1:51

KGTV

3 years agoPresident trump rescinds federal fair housing requirements

113 -

1:09

1:09

BANG Gaming En

3 years ago'Cyberpunk 2077's PC system requirements have been revealed

7