Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Accounting Help

saxi753

- 77 / 83

1

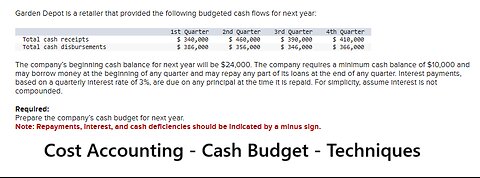

Garden Depot is a retailer that provided the following budgeted cash flows for next year:

saxi753

Garden Depot is a retailer that provided the following budgeted cash flows for next year:

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Total cash receipts $ 340,000 $ 460,000 $ 390,000 $ 410,000

Total cash disbursements $ 386,000 $ 356,000 $ 346,000 $ 366,000

The company’s beginning cash balance for next year will be $24,000. The company requires a minimum cash balance of $10,000 and may borrow money at the beginning of any quarter and may repay any part of its loans at the end of any quarter. Interest payments, based on a quarterly interest rate of 3%, are due on any principal at the time it is repaid. For simplicity, assume interest is not compounded.

Required:

Prepare the company’s cash budget for next year.

Note: Repayments, interest, and cash deficiencies should be indicated by a minus sign.

#CostAccouting

#Accounting

#Techniques

2

Cost Accounting: The production manager of Rordan Corporation prepared the following quarterly

saxi753

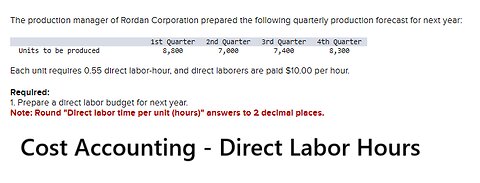

The production manager of Rordan Corporation prepared the following quarterly production forecast for next year:

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Units to be produced 8,800 7,000 7,400 8,300

Each unit requires 0.55 direct labor-hour, and direct laborers are paid $10.00 per hour.

Required:

1. Prepare a direct labor budget for next year.

#CostAccounting

#Accounting

#Techniques

#AccountingHelp

3

Cost Accounting: Silver Company makes a product with peak sales in May of each year. Its sales

saxi753

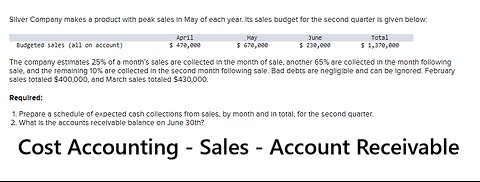

Silver Company makes a product with peak sales in May of each year. Its sales budget for the second quarter is given below:

April May June Total

Budgeted sales (all on account) $ 470,000 $ 670,000 $ 230,000 $ 1,370,000

The company estimates 25% of a month’s sales are collected in the month of sale, another 65% are collected in the month following sale, and the remaining 10% are collected in the second month following sale. Bad debts are negligible and can be ignored. February sales totaled $400,000, and March sales totaled $430,000.

Required:

Prepare a schedule of expected cash collections from sales, by month and in total, for the second quarter.

What is the accounts receivable balance on June 30th?

#CostAccounting

#Accounting

#Technique

4

Ida Company produces a handcrafted musical instrument called a gamelan that

saxi753

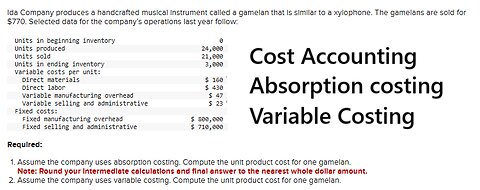

Ida Company produces a handcrafted musical instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $770. Selected data for the company’s operations last year follow:

Units in beginning inventory 0

Units produced 24,000

Units sold 21,000

Units in ending inventory 3,000

Variable costs per unit:

Direct materials $ 160

Direct labor $ 430

Variable manufacturing overhead $ 47

Variable selling and administrative $ 23

Fixed costs:

Fixed manufacturing overhead $ 800,000

Fixed selling and administrative $ 710,000

Required:

Assume the company uses absorption costing. Compute the unit product cost for one gamelan.

Note: Round your intermediate calculations and final answer to the nearest whole dollar amount.

Assume the company uses variable costing. Compute the unit product cost for one gamelan.

#CostAccounting

#Accounting

5

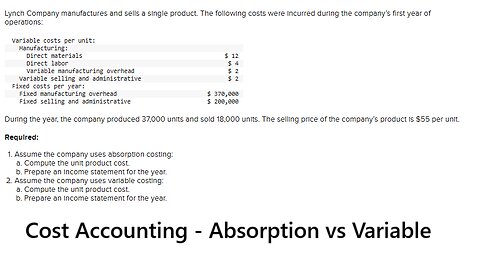

Cost Accounting: Lynch Company manufactures and sells a single product. The following costs were

saxi753

Lynch Company manufactures and sells a single product. The following costs were incurred during the company’s first year of operations:

Variable costs per unit:

Manufacturing:

Direct materials $ 12

Direct labor $ 4

Variable manufacturing overhead $ 2

Variable selling and administrative $ 2

Fixed costs per year:

Fixed manufacturing overhead $ 370,000

Fixed selling and administrative $ 200,000

During the year, the company produced 37,000 units and sold 18,000 units. The selling price of the company’s product is $55 per unit.

Required:

Assume the company uses absorption costing:

Compute the unit product cost.

Prepare an income statement for the year.

Assume the company uses variable costing:

Compute the unit product cost.

Prepare an income statement for the year.

#CostAccounting

#Accounting

#Techniques

#AbsorptionCosting

6

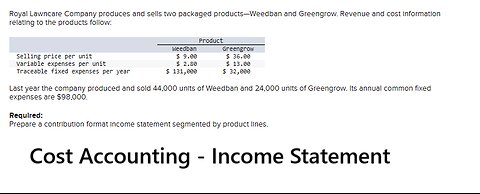

Cost Accounting: Royal Lawncare Company produces and sells two packaged products—Weedban and

saxi753

Royal Lawncare Company produces and sells two packaged products—Weedban and Greengrow. Revenue and cost information relating to the products follow:

Product

Weedban Greengrow

Selling price per unit $ 9.00 $ 36.00

Variable expenses per unit $ 2.80 $ 13.00

Traceable fixed expenses per year $ 131,000 $ 32,000

Last year the company produced and sold 44,000 units of Weedban and 24,000 units of Greengrow. Its annual common fixed expenses are $98,000.

Required:

Prepare a contribution format income statement segmented by product lines.

#CostAccounting

#IncomeStatement

#Techniques

7

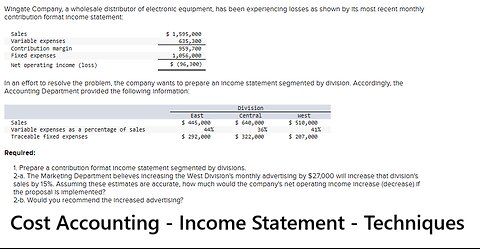

Cost Accounting: Wingate Company, a wholesale distributor of electronic equipment, has been

saxi753

Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses as shown by its most recent monthly contribution format income statement:

Sales $ 1,595,000

Variable expenses 635,300

Contribution margin 959,700

Fixed expenses 1,056,000

Net operating income (loss) $ (96,300)

In an effort to resolve the problem, the company wants to prepare an income statement segmented by division. Accordingly, the Accounting Department provided the following information:

Division

East Central West

Sales $ 445,000 $ 640,000 $ 510,000

Variable expenses as a percentage of sales 44% 36% 41%

Traceable fixed expenses $ 292,000 $ 322,000 $ 207,000

Required:

1. Prepare a contribution format income statement segmented by divisions.

2-a. The Marketing Department believes increasing the West Division's monthly advertising by $27,000 will increase that division's sales by 15%. Assuming these estimates are accurate, how much would the company's net operating income increase (decrease) if the proposal is implemented?

2-b. Would you recommend the increased advertising?

#CostAccounting

#Accounting

#IncomeStatement

8

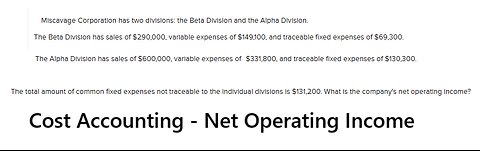

Cost Accounting: Miscavage Corporation has two divisions: the Beta Division and the Alpha Division

saxi753

Miscavage Corporation has two divisions: the Beta Division and the Alpha Division. The Beta Division has sales of $290,000, variable expenses of $149,100, and traceable fixed expenses of $69,300. The Alpha Division has sales of $600,000, variable expenses of $331,800, and traceable fixed expenses of $130,300. The total amount of common fixed expenses not traceable to the individual divisions is $131,200. What is the company's net operating income?

Multiple Choice

$209,500

$78,300

$268,200

$409,100

#CostAccounting

#Accounting

#NetOperatingIncome

9

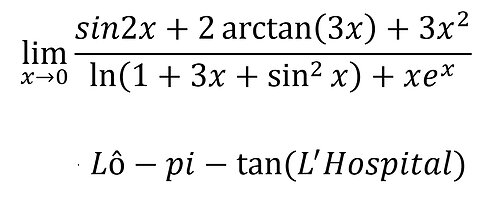

Toán Cao Cấp: lim (x→0) (sin2x+2 arctan(3x)+3x^2)/(ln(1+3x+sin^2x )+xe^x ) (L'Hospital)

saxi753

lim (x→0) (sin2x+2 arctan(3x)+3x^2)/(ln(1+3x+sin^2x )+xe^x )

0/0→Lô-pi-tan (L^' Hospital)

#CachGiai

#ToanCaoCap

#ChuongTrinhMoi

10

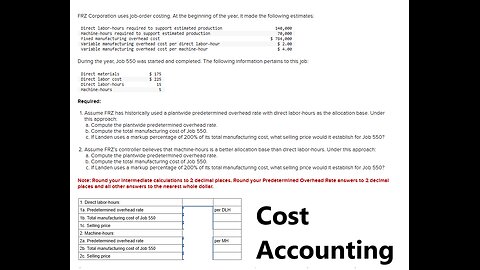

Cost Accounting: FRZ Corporation uses job-order costing. At the beginning of the year, it made the

saxi753

FRZ Corporation uses job-order costing. At the beginning of the year, it made the following estimates:

Direct labor-hours required to support estimated production 140,000

Machine-hours required to support estimated production 70,000

Fixed manufacturing overhead cost $ 784,000

Variable manufacturing overhead cost per direct labor-hour $ 2.00

Variable manufacturing overhead cost per machine-hour $ 4.00

During the year, Job 550 was started and completed. The following information pertains to this job:

Direct materials $ 175

Direct labor cost $ 225

Direct labor-hours 15

Machine-hours 5

Required:

Assume FRZ has historically used a plantwide predetermined overhead rate with direct labor-hours as the allocation base. Under this approach:

Compute the plantwide predetermined overhead rate.

Compute the total manufacturing cost of Job 550.

If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550?

Assume FRZ’s controller believes that machine-hours is a better allocation base than direct labor-hours. Under this approach:

Compute the plantwide predetermined overhead rate.

Compute the total manufacturing cost of Job 550.

If Landen uses a markup percentage of 200% of its total manufacturing cost, what selling price would it establish for Job 550?

Note: Round your intermediate calculations to 2 decimal places. Round your Predetermined Overhead Rate answers to 2 decimal places and all other answers to the nearest whole dollar.

#CostAccounting

#Accounting

#Techniques

11

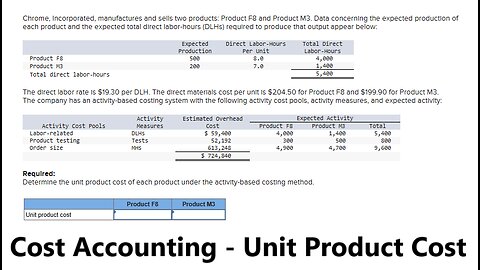

Chrome, Incorporated, manufactures and sells two products: Product F8 and Product M3

saxi753

Chrome, Incorporated, manufactures and sells two products: Product F8 and Product M3. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:

Expected Production Direct Labor-Hours Per Unit Total Direct Labor-Hours

Product F8 500 8.0 4,000

Product M3 200 7.0 1,400

Total direct labor-hours 5,400

The direct labor rate is $19.30 per DLH. The direct materials cost per unit is $204.50 for Product F8 and $199.90 for Product M3.

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

Activity Cost Pools Activity Measures Estimated Overhead Cost Expected Activity

Product F8 Product M3 Total

Labor-related DLHs $ 59,400 4,000 1,400 5,400

Product testing Tests 52,192 300 500 800

Order size MHs 613,248 4,900 4,700 9,600

$ 724,840

Required:

Determine the unit product cost of each product under the activity-based costing method.

#CostAccounting

#Accounting

#Techniques

12

Cost Accounting: Which of the following journal entries would be used to record direct labor costs

saxi753

Which of the following journal entries would be used to record direct labor costs in a company having two processing departments (Department A and Department B)?

Multiple Choice

Debit Credit

Salaries and Wages Expense XXX

Salaries and Wages Payable XXX

Debit Credit

Work in Process-Department A XXX

Work in Process-Department B XXX

Salaries and Wages Payable XXX

Debit Credit

Salaries and Wages Payable XXX

Work in Process XXX

Debit Credit

Work in Process XXX

Salaries and Wages Payable XXX

13

Cost Accounting: Hettrick International Corporation's only product sells for $120.00 per unit and

saxi753

Hettrick International Corporation's only product sells for $120.00 per unit and its variable expense is $52.80. The company's monthly fixed expense is $396,480 per month. The unit sales to attain the company's monthly target profit of $13,000 is closest to:

Note: Round your intermediate calculations to 2 decimal places.

Multiple Choice

6,093

3,412

7,755

5,753

#CostAccounting

#Accounting

#Techniques

14

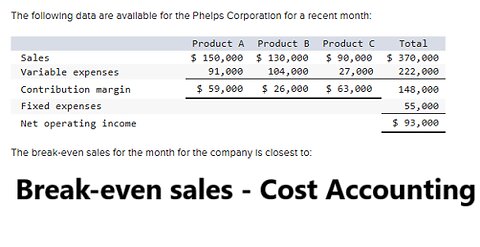

Cost Accounting: The following data are available for the Phelps Corporation for a recent month:

saxi753

The following data are available for the Phelps Corporation for a recent month:

Product A Product B Product C Total

Sales $ 150,000 $ 130,000 $ 90,000 $ 370,000

Variable expenses 91,000 104,000 27,000 222,000

Contribution margin $ 59,000 $ 26,000 $ 63,000 148,000

Fixed expenses 55,000

Net operating income $ 93,000

The break-even sales for the month for the company is closest to:

Multiple Choice

$203,000

$91,667

$137,500

$148,000

#CostAccounting

#BreakEvenSales

15

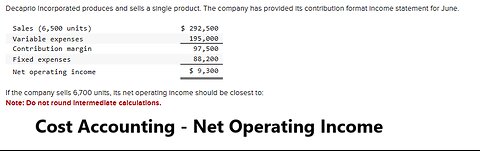

Cost Accounting: Decaprio Incorporated produces and sells a single product. The company has provided

saxi753

Decaprio Incorporated produces and sells a single product. The company has provided its contribution format income statement for June.

Sales (6,500 units) $ 292,500

Variable expenses 195,000

Contribution margin 97,500

Fixed expenses 88,200

Net operating income $ 9,300

If the company sells 6,700 units, its net operating income should be closest to:

Note: Do not round intermediate calculations.

Multiple Choice

$9,586

$9,300

$18,300

$12,300

#CostAccounting

#Accounting

#NetOperatingIncome

#Solutions

16

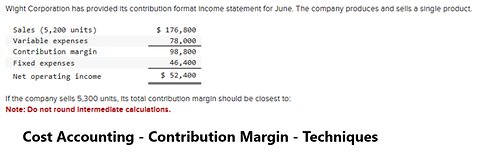

Cost Accounting: Wight Corporation has provided its contribution format income statement for June.

saxi753

Wight Corporation has provided its contribution format income statement for June. The company produces and sells a single product.

Sales (5,200 units) $ 176,800

Variable expenses 78,000

Contribution margin 98,800

Fixed expenses 46,400

Net operating income $ 52,400

If the company sells 5,300 units, its total contribution margin should be closest to:

Note: Do not round intermediate calculations.

Multiple Choice

$98,800

$53,408

$100,700

$102,200

#CostAccounting

#Accounting

#Techniques

17

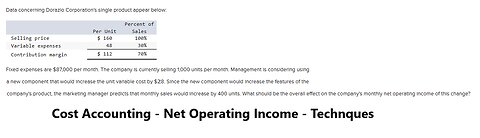

Cost Accounting: Data concerning Dorazio Corporation's single product appear below:

saxi753

Data concerning Dorazio Corporation's single product appear below:

Per Unit Percent of Sales

Selling price $ 160 100%

Variable expenses 48 30%

Contribution margin $ 112 70%

Fixed expenses are $87,000 per month.

The company is currently selling 1,000 units per month. Management is considering using a new component that would increase the unit variable cost by $28. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

Multiple Choice

increase of $5,600

increase of $33,600

decrease of $5,600

decrease of $33,600

#CostAccounting

#NetOperatingIncome

18

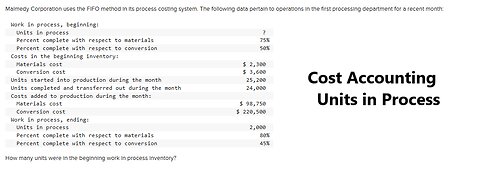

Cost Accounting: Malmedy Corporation uses the FIFO method in its process costing system. The

saxi753

Malmedy Corporation uses the FIFO method in its process costing system. The following data pertain to operations in the first processing department for a recent month:

Work in process, beginning:

Units in process ?question mark

Percent complete with respect to materials 75%

Percent complete with respect to conversion 50%

Costs in the beginning inventory:

Materials cost $ 2,300

Conversion cost $ 3,600

Units started into production during the month 25,200

Units completed and transferred out during the month 24,000

Costs added to production during the month:

Materials cost $ 98,750

Conversion cost $ 220,500

Work in process, ending:

Units in process 2,000

Percent complete with respect to materials 80%

Percent complete with respect to conversion 45%

How many units were in the beginning work in process inventory?

#CostAccounting

#WorkInProcess

#TransferredOut

#AccountingHelp

19

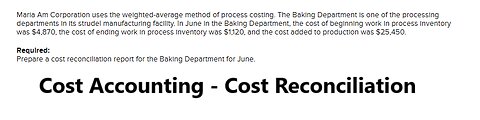

Maria Am Corporation uses the weighted-average method of process costing. The Baking

saxi753

Maria Am Corporation uses the weighted-average method of process costing. The Baking Department is one of the processing departments in its strudel manufacturing facility. In June in the Baking Department, the cost of beginning work in process inventory was $4,870, the cost of ending work in process inventory was $1,120, and the cost added to production was $25,450.

Required:

Prepare a cost reconciliation report for the Baking Department for June.

#CostAccounting

20

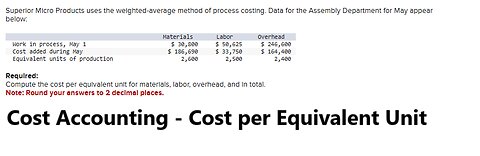

Cost Accounting: Superior Micro Products uses the weighted-average method of process costing.

saxi753

Superior Micro Products uses the weighted-average method of process costing. Data for the Assembly Department for May appear below:

Materials Labor Overhead

Work in process, May 1 $ 30,800 $ 50,625 $ 246,600

Cost added during May $ 186,690 $ 33,750 $ 164,400

Equivalent units of production 2,600 2,500 2,400

Required:

Compute the cost per equivalent unit for materials, labor, overhead, and in total.

Note: Round your answers to 2 decimal places.

#CostAccounting

#Accounting

#Techniques

#Solutions

21

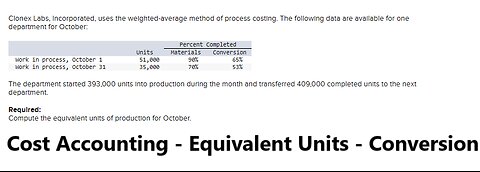

Cost Accounting: Clonex Labs, Incorporated, uses the weighted-average method of process costing

saxi753

Clonex Labs, Incorporated, uses the weighted-average method of process costing. The following data are available for one department for October:

Units Percent Completed

Materials Conversion

Work in process, October 1 51,000 90% 65%

Work in process, October 31 35,000 70% 53%

The department started 393,000 units into production during the month and transferred 409,000 completed units to the next department.

Required:

Compute the equivalent units of production for October.

#CostAccounting

#Techniques

#Accounting

22

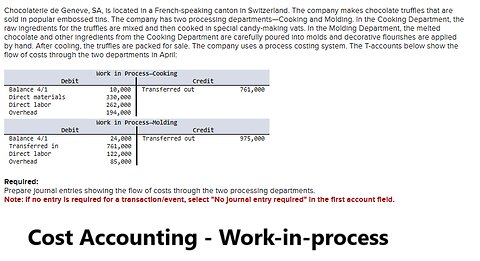

Cost Accounting: Chocolaterie de Geneve, SA, is located in a French-speaking canton in Switzerland

saxi753

Chocolaterie de Geneve, SA, is located in a French-speaking canton in Switzerland. The company makes chocolate truffles that are sold in popular embossed tins. The company has two processing departments—Cooking and Molding. In the Cooking Department, the raw ingredients for the truffles are mixed and then cooked in special candy-making vats. In the Molding Department, the melted chocolate and other ingredients from the Cooking Department are carefully poured into molds and decorative flourishes are applied by hand. After cooling, the truffles are packed for sale. The company uses a process costing system. The T-accounts below show the flow of costs through the two departments in April:

Work in Process—Cooking

Debit Credit

Balance 4/1 10,000 Transferred out 761,000

Direct materials 330,000

Direct labor 262,000

Overhead 194,000

Work in Process—Molding

Debit Credit

Balance 4/1 24,000 Transferred out 975,000

Transferred in 761,000

Direct labor 122,000

Overhead 85,000

Required:

Prepare journal entries showing the flow of costs through the two processing departments.

#CostAccounting

#Accounting

#Techniques

23

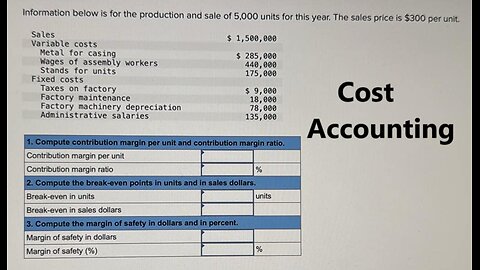

Cost Accounting: Information below is for the production and sale of 5,000 units for this year. The

saxi753

Information below is for the production and sale of 5,000 units for this year. The sales price is $300 per unit.

Sales

Variable costs

$ 1,500,000

$285,000

Metal for casing

Wages of assembly workers

Stands for units

Fixed costs

Taxes on factory

Factory maintenance

Factory machinery depreciation

Administrative salaries

440,000 175,000

$ 9,000

18,000

78,000

135,000

1. Compute contribution margin per unit and contribution margin ratio.

Contribution margin per unit

Contribution margin ratio

%

2. Compute the break-even points in units and in sales dollars.

Break-even in units

units

Break-even in sales dollars

3. Compute the margin of safety in dollars and in percent.

Margin of safety in dollars

Margin of safety (%)

%

#CostAccounting

#Accounting

24

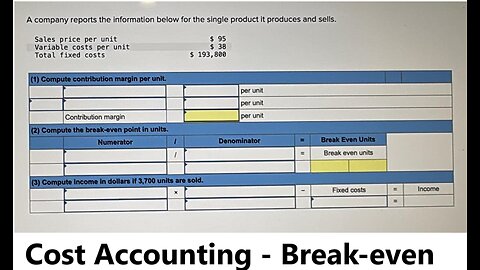

Cost Accounting: A company reports the information below for the single product it produces and

saxi753

A company reports the information below for the single product it produces and sells.

Sales price per unit Variable costs per unit Total fixed costs

(1) Compute contribution margin per unit.

$95 $38

$193,800

Contribution margin

(2) Compute the break-even point in units.

Numerator

per unit

per unit

per unit

1

Denominator

1

(3) Compute income in dollars if 3,700 units are sold.

X

=

Break Even Units

=

Break even units

Fixed costs

=

Income

=

#CostAccounting

#Accounting

#Techniques

25

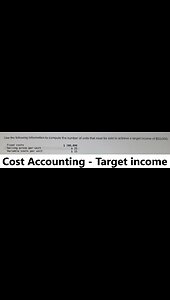

Cost Accounting: Use the following information to compute the number of units

saxi753

Use the following information to compute the number of units that must be sold to achieve a target income of $50,000.

Fixed costs

Selling price per unit

Variable costs per unit

$ 200,000 $ 25

$15

#CostAccounting

#Accounting

#TargetIncome

26

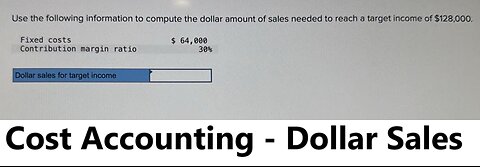

Use the following information to compute the dollar amount of sales needed to reach a target

saxi753

Use the following information to compute the dollar amount of sales needed to reach a target income of $128,000

#CostAccounting

#TargetIncome

#FixedCosts

27

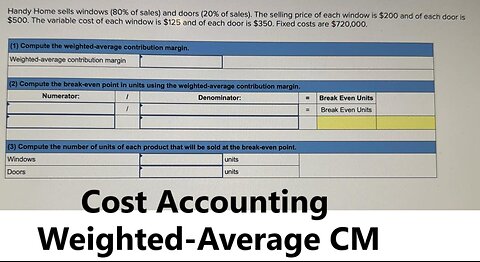

Cost Accounting: Handy Home sells windows (80% of sales) and doors (20% of sales). The selling

saxi753

Handy Home sells windows (80% of sales) and doors (20% of sales). The selling price of each window is $200 and of each door is $500. The variable cost of each window is $125 and of each door is $350. Fixed costs are $720,000.

(1) Compute the weighted-average contribution margin. Weighted-average contribution margin

(2) Compute the break-even point in units using the weighted-average contribution margin.

Numerator:

1 /

Denominator:

=

Break Even Units

=

#CostAccounting

#BreakEvenPoint

#Accounting

28

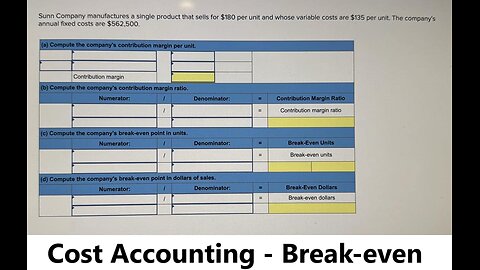

Cost Accounting: Sunn Company manufactures a single product that sells for $180 per unit and whose

saxi753

Sunn Company manufactures a single product that sells for $180 per unit and whose variable costs are $135 per unit. The company's annual fixed costs are $562,500.

(a) Compute the company's contribution margin per unit.

Contribution margin

(b) Compute the company's contribution margin ratio.

Numerator:

(c) Compute the company's break-even point in units.

Numerator:

Denominator:

=

=

Contribution Margin Ratio

Contribution margin ratio

Denominator:

=

Break-Even Units

=

Break-even units

(d) Compute the company's break-even point in dollars of sales.

Numerator:

Denominator:

=

Break-Even Dollars

=

Break-even dollars

#BreakEvenPoint

#BreakEven

#CostAccounting

#Accounting

29

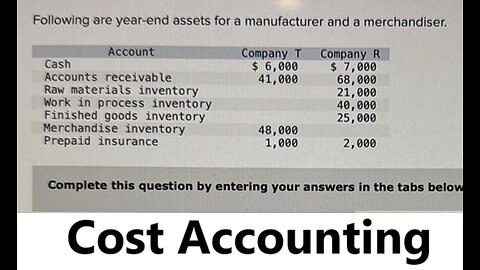

Cost Accounting: Following are year-end assets for a manufacturer and a merchandiser.

saxi753

Following are year-end assets for a manufacturer and a merchandiser.

Account

Cash

Accounts receivable

Raw materials inventory

Work in process inventory

Finished goods inventory

Merchandise inventory Prepaid insurance

Company T

Company R

$ 6,000

$ 7,000

41,000

68,000

21,000

40,000

25,000

48,000

1,000

2,000

#CostAccounting

#Accounting

30

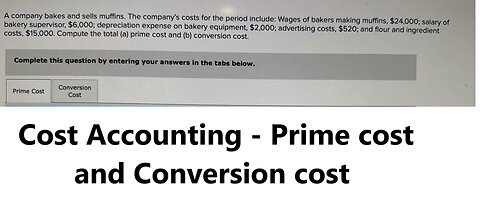

Cost Accounting: A company bakes and sells muffins. The company's costs for the period include

saxi753

A company bakes and sells muffins. The company's costs for the period include: Wages of bakers making muffins, $24,000; salary of bakery supervisor, $6,000; depreciation expense on bakery equipment, $2,000; advertising costs, $520; and flour and ingredient costs, $15,000. Compute the total (a) prime cost and (b) conversion cost.

Complete this question by entering your answers in the tabs below.

Prime Cost

Conversion Cost

#CostAccounting

#Accounting

#Techniques

#Solutions

31

Listed here are the costs associated with the production of 1,000 drum sets manufactured by

saxi753

[The following information applies to the questions displayed below.]

Listed here are the costs associated with the production of 1,000 drum sets manufactured by TrueBeat.

1. Plastic for casing-$17,000

Costs

2. Wages of assembly workers-$82,000

3. Property taxes on factory-$5,000

4. Office accounting salaries-$35,000

5. Drum stands-$26,000

6. Rent cost of office for accountants-$10,000

7. Office management salaries-$125,000

8. Annual fee for factory maintenance-$10,000

9. Sales commissions-$15,000

10. Factory machinery depreciation, straight-line-$40,000

Required:

1. Classify each cost and its amount as either product or period. The first cost is completed as an example.

#CostAccounting

#Accounting

#PeriodCost

#ProductCost

32

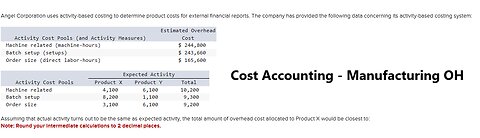

Cost Accounting: Angel Corporation uses activity-based costing to determine product costs for

saxi753

Angel Corporation uses activity-based costing to determine product costs for external financial reports. The company has provided the following data concerning its activity-based costing system:

Activity Cost Pools (and Activity Measures) Estimated Overhead Cost

Machine related (machine-hours) $ 244,800

Batch setup (setups) $ 243,660

Order size (direct labor-hours) $ 165,600

Activity Cost Pools Expected Activity

Product X Product Y Total

Machine related 4,100 6,100 10,200

Batch setup 8,200 1,100 9,300

Order size 3,100 6,100 9,200

Assuming that actual activity turns out to be the same as expected activity, the total amount of overhead cost allocated to Product X would be closest to:

Note: Round your intermediate calculations to 2 decimal places.

#CostAccounting

#Accounting

#Techniques

33

Cost Accounting: Privott, Incorporated, manufactures and sells two products: Product Z9 and Product

saxi753

Privott, Incorporated, manufactures and sells two products: Product Z9 and Product N0. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

Activity Cost Pools Activity Measures Estimated Overhead Cost Expected Activity

Product Z9 Product N0 Total

Labor-related DLHs $ 343,018 8,300 4,900 13,200

Product testing tests 55,247 1,350 1,450 2,800

Order size MHs 480,608 5,900 6,200 12,100

$ 878,873

The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:

#costaccounting #Accounting

#Solutions

#ManufacturingOverhead

34

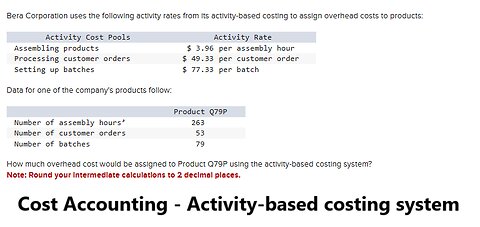

Cost Accounting: Bera Corporation uses the following activity rates from its activity-based costing

saxi753

Bera Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:

Activity Cost Pools Activity Rate

Assembling products $ 3.96 per assembly hour

Processing customer orders $ 49.33 per customer order

Setting up batches $ 77.33 per batch

Data for one of the company's products follow:

Product Q79P

Number of assembly hours’ 263

Number of customer orders 53

Number of batches 79

How much overhead cost would be assigned to Product Q79P using the activity-based costing system?

Note: Round your intermediate calculations to 2 decimal places.

#CostAccounting

#ActivityBasedCostSystem

#CostSystem

#AccountingHelp

35

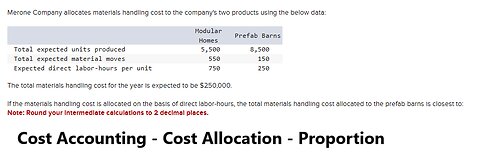

Merone Company allocates materials handling cost to the company's two products using the

saxi753

Merone Company allocates materials handling cost to the company's two products using the below data:

Modular Homes Prefab Barns

Total expected units produced 5,500 8,500

Total expected material moves 550 150

Expected direct labor-hours per unit 750 250

The total materials handling cost for the year is expected to be $250,000.

If the materials handling cost is allocated on the basis of direct labor-hours, the total materials handling cost allocated to the prefab barns is closest to:

Note: Round your intermediate calculations to 2 decimal places.

#CostAccounting

#CostAllocation

#Accounting

36

Cost Accounting: Spates, Incorporated, manufactures and sells two products: Product H2 and Product

saxi753

Spates, Incorporated, manufactures and sells two products: Product H2 and Product E0. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:

Expected Production Direct Labor-Hours Per Unit Total Direct Labor-Hours

Product H2 100 6.0 600

Product E0 100 5.0 500

Total direct labor-hours 1,100

The company’s expected total manufacturing overhead is $266,468.

If the company allocates all of its overhead based on direct labor-hours, the overhead assigned to each unit of Product H2 would be closest to:

Note: Round your intermediate calculations to 2 decimal places.

#CostAccounting

#Accounting

37

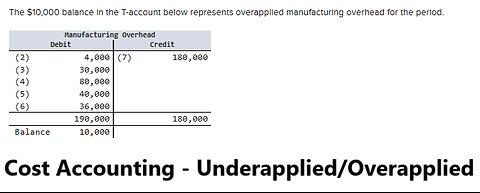

Cost Accounting: The $10,000 balance in the T-account below represents overapplied manufacturing

saxi753

The $10,000 balance in the T-account below represents overapplied manufacturing overhead for the period.

Manufacturing Overhead

Debit Credit

(2) 4,000 (7) 180,000

(3) 30,000

(4) 80,000

(5) 40,000

(6) 36,000

190,000 180,000

Balance 10,000

#CostAccounting

#Accounting

#Techniques

38

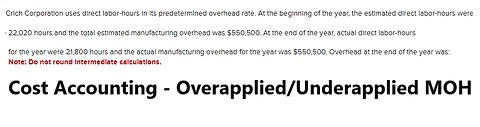

Cost Accounting: Crich Corporation uses direct labor-hours in its predetermined overhead rate.

saxi753

Crich Corporation uses direct labor-hours in its predetermined overhead rate. At the beginning of the year, the estimated direct labor-hours were 22,020 hours and the total estimated manufacturing overhead was $550,500. At the end of the year, actual direct labor-hours for the year were 21,800 hours and the actual manufacturing overhead for the year was $550,500. Overhead at the end of the year was:

#CostAccounting

#Accounting

#Techniques

39

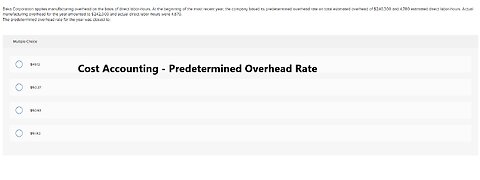

Cost Accounting: Baka Corporation applies manufacturing overhead on the basis of direct labor-hours

saxi753

Baka Corporation applies manufacturing overhead on the basis of direct labor-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $240,300 and 4,780 estimated direct labor-hours. Actual manufacturing overhead for the year amounted to $242,000 and actual direct labor-hours were 4,670.

The predetermined overhead rate for the year was closest to:

#CostAccounting

#Accounting

#Techniques

40

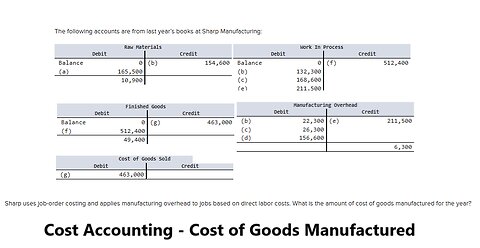

Cost Accounting: The following accounts are from last year’s books at Sharp Manufacturing:

saxi753

The following accounts are from last year’s books at Sharp Manufacturing:

Raw Materials

Debit Credit

Balance 0 (b) 154,600

(a) 165,500

10,900

Work In Process

Debit Credit

Balance 0 (f) 512,400

(b) 132,300

(c) 168,600

(e) 211,500

0

Finished Goods

Debit Credit

Balance 0 (g) 463,000

(f) 512,400

49,400

Manufacturing Overhead

Debit Credit

(b) 22,300 (e) 211,500

(c) 26,300

(d) 156,600

6,300

Cost of Goods Sold

Debit Credit

(g) 463,000

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. What is the amount of cost of goods manufactured for the year?

#CostAccounting

#Accounting

#Techniques

41

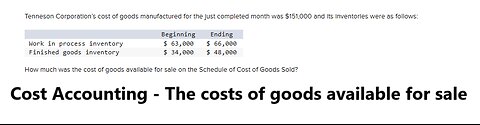

Cost Accounting: Tenneson Corporation’s cost of goods manufactured for the just completed month was

saxi753

Tenneson Corporation’s cost of goods manufactured for the just completed month was $151,000 and its inventories were as follows:

Beginning Ending

Work in process inventory $ 63,000 $ 66,000

Finished goods inventory $ 34,000 $ 48,000

How much was the cost of goods available for sale on the Schedule of Cost of Goods Sold?

#CostAccounting

#Accounting

#CostOfGoodsSales

42

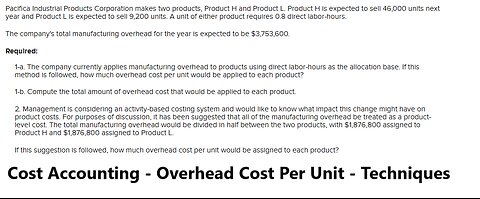

Pacifica Industrial Products Corporation makes two products, Product H and Product

saxi753

Pacifica Industrial Products Corporation makes two products, Product H and Product L. Product H is expected to sell 46,000 units next year and Product L is expected to sell 9,200 units. A unit of either product requires 0.8 direct labor-hours.

The company's total manufacturing overhead for the year is expected to be $3,753,600.

Required:

1-a. The company currently applies manufacturing overhead to products using direct labor-hours as the allocation base. If this method is followed, how much overhead cost per unit would be applied to each product?

1-b. Compute the total amount of overhead cost that would be applied to each product.

2. Management is considering an activity-based costing system and would like to know what impact this change might have on product costs. For purposes of discussion, it has been suggested that all of the manufacturing overhead be treated as a product-level cost. The total manufacturing overhead would be divided in half between the two products, with $1,876,800 assigned to Product H and $1,876,800 assigned to Product L.

If this suggestion is followed, how much overhead cost per unit would be assigned to each product?

#CostAccounting

#Accounting

#Techniques

43

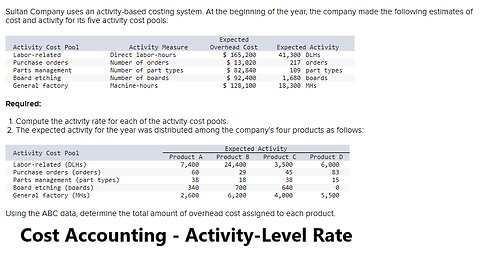

Cost Accounting: Sultan Company uses an activity-based costing system. At the beginning of the year

saxi753

Sultan Company uses an activity-based costing system. At the beginning of the year, the company made the following estimates of cost and activity for its five activity cost pools:

Activity Cost Pool Activity Measure Expected Overhead Cost Expected Activity

Labor-related Direct labor-hours $ 165,200 41,300 DLHs

Purchase orders Number of orders $ 13,020 217 orders

Parts management Number of part types $ 82,840 109 part types

Board etching Number of boards $ 92,400 1,680 boards

General factory Machine-hours $ 128,100 18,300 MHs

Required:

Compute the activity rate for each of the activity cost pools.

The expected activity for the year was distributed among the company’s four products as follows:

Activity Cost Pool Expected Activity

Product A Product B Product C Product D

Labor-related (DLHs) 7,400 24,400 3,500 6,000

Purchase orders (orders) 60 29 45 83

Parts management (part types) 38 18 38 15

Board etching (boards) 340 700 640 0

General factory (MHs) 2,600 6,200 4,000 5,500

Using the ABC data, determine the total amount of overhead cost assigned to each product.

#CostAccounting

#Accounting

#Cost

#ActivityLevel

44

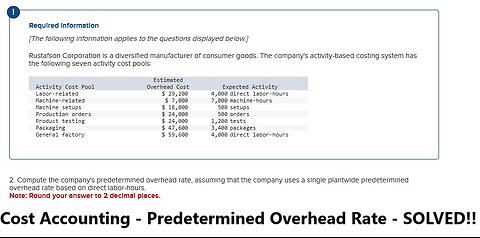

Cost Accounting: Rustafson Corporation is a diversified manufacturer of consumer goods. The company'

saxi753

Rustafson Corporation is a diversified manufacturer of consumer goods. The company's activity-based costing system has the following seven activity cost pools:

Activity Cost Pool Estimated Overhead Cost Expected Activity

Labor-related $ 29,200 4,000 direct labor-hours

Machine-related $ 7,000 7,000 machine-hours

Machine setups $ 18,000 500 setups

Production orders $ 24,000 500 orders

Product testing $ 24,000 1,200 tests

Packaging $ 47,600 3,400 packages

General factory $ 59,600 4,000 direct labor-hours

2. Compute the company's predetermined overhead rate, assuming that the company uses a single plantwide predetermined overhead rate based on direct labor-hours.

#CostAccounting

#Accounting

#Techniques

#PredeterminedOverheadRate

45

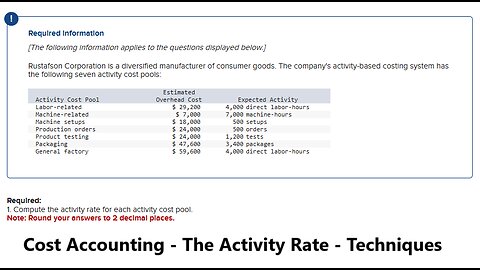

Cost Accounting: Rustafson Corporation is a diversified manufacturer of consumer goods. The company

saxi753

Rustafson Corporation is a diversified manufacturer of consumer goods. The company's activity-based costing system has the following seven activity cost pools:

Activity Cost Pool Estimated Overhead Cost Expected Activity

Labor-related $ 29,200 4,000 direct labor-hours

Machine-related $ 7,000 7,000 machine-hours

Machine setups $ 18,000 500 setups

Production orders $ 24,000 500 orders

Product testing $ 24,000 1,200 tests

Packaging $ 47,600 3,400 packages

General factory $ 59,600 4,000 direct labor-hours

Required:

1. Compute the activity rate for each activity cost pool.

#ActivityCost

#ActivityRate

46

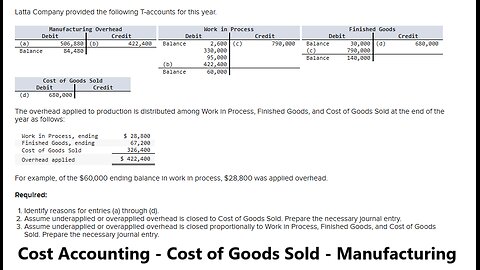

Cost Accounting: Latta Company provided the following T-accounts for this year.

saxi753

Latta Company provided the following T-accounts for this year.

Manufacturing Overhead

Debit Credit

(a) 506,880 (b) 422,400

Balance 84,480

Work in Process

Debit Credit

Balance 2,600 (c) 790,000

330,000

95,000

(b) 422,400

Balance 60,000

Finished Goods

Debit Credit

Balance 30,000 (d) 680,000

(c) 790,000

Balance 140,000

Cost of Goods Sold

Debit Credit

(d) 680,000

The overhead applied to production is distributed among Work in Process, Finished Goods, and Cost of Goods Sold at the end of the year as follows:

Work in Process, ending $ 28,800

Finished Goods, ending 67,200

Cost of Goods Sold 326,400

Overhead applied $ 422,400

For example, of the $60,000 ending balance in work in process, $28,800 was applied overhead.

Required:

Identify reasons for entries (a) through (d).

Assume underapplied or overapplied overhead is closed to Cost of Goods Sold. Prepare the necessary journal entry.

Assume underapplied or overapplied overhead is closed proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the necessary journal entry.

#CostAccounting

#Accounting

#Manufacturing

#AccountingHelp

47

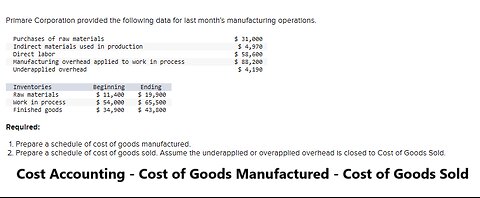

Primare Corporation provided the following data for last month’s manufacturing operations.

saxi753

Primare Corporation provided the following data for last month’s manufacturing operations.

Purchases of raw materials $ 31,000

Indirect materials used in production $ 4,970

Direct labor $ 58,600

Manufacturing overhead applied to work in process $ 88,200

Underapplied overhead $ 4,190

Inventories Beginning Ending

Raw materials $ 11,400 $ 19,900

Work in process $ 54,000 $ 65,500

Finished goods $ 34,900 $ 43,800

Required:

Prepare a schedule of cost of goods manufactured.

Prepare a schedule of cost of goods sold. Assume the underapplied or overapplied overhead is closed to Cost of Goods Sold.

#CostAccounting

#ManagerialAccounting

#Accounting

#Techniques

48

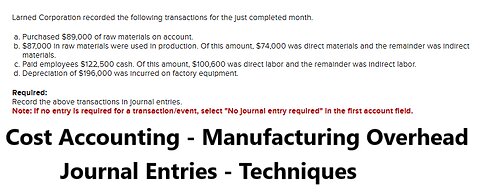

Cost Accounting: Larned Corporation recorded the following transactions for the just completed month

saxi753

Larned Corporation recorded the following transactions for the just completed month.

Purchased $89,000 of raw materials on account.

$87,000 in raw materials were used in production. Of this amount, $74,000 was direct materials and the remainder was indirect materials.

Paid employees $122,500 cash. Of this amount, $100,600 was direct labor and the remainder was indirect labor.

Depreciation of $196,000 was incurred on factory equipment.

Required:

Record the above transactions in journal entries.

#CostAccounting

#Accounting

#JournalEntries

#manufacturingoverhead

49

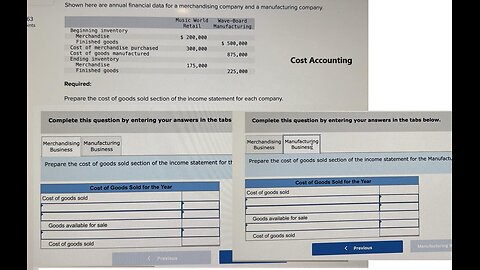

Shown here are annual financial data for a merchandising company and a manufacturing company.

saxi753

Shown here are annual financial data for a merchandising company and a manufacturing company.

Music World Retail

Beginning inventory

Merchandise

Finished goods

Cost of merchandise purchased

Cost of goods manufactured

Ending inventory

Merchandise

Finished goods

Required:

Wave-Board Manufacturing

$ 200,000

$ 500,000

300,000

875,000

175,000

225,000

Prepare the cost of goods sold section of the income statement for each company.

Complete this question by entering your answers in the tabs below.

Merchandising Manufacturing Business

Business

Prepare the cost of goods sold section of the income statement for the Merchandising Business.

Cost of goods sold

Cost of Goods Sold for the Year

Goods available for sale

Cost of goods sold

#CostAccounting

#Accounting

#MerchandiseInventory

50

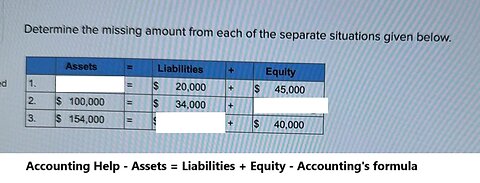

Cost Accounting: Determine the missing amount from each of the separate situations given below

saxi753

Cost Accounting: Determine the missing amount from each of the separate situations given below

#AccountingFormula

#Accounting

#Techniques

51

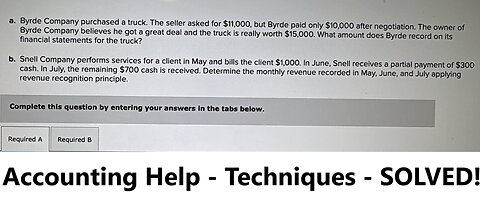

Accounting Help: Byrde Company purchased a truck. The seller asked for $11,000, but Byrde paid only

saxi753

Byrde Company purchased a truck. The seller asked for $11,000, but Byrde paid only $10,000 after negotiation. The owner of Byrde Company believes he got a great deal and the truck is really worth $15,000. What amount does Byrde record on its financial statements for the truck?

Snell Company performs services for a client in May and bills the client $1,000. In June, Snell receives a partial payment of $300 cash. In July, the remaining $700 cash is received. Determine the monthly revenue recorded in May applying revenue recognition principle.

#accounting

#AccountingHelp

#Techniques

52

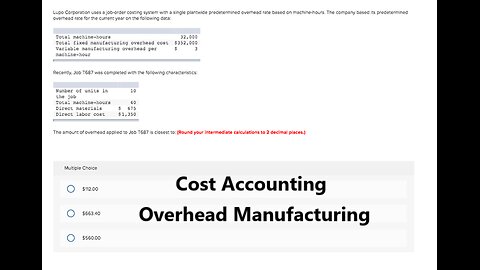

Lupo Corporation uses a job-order costing system with a single plantwide predetermined

saxi753

Lupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data Total machine-hours Total fixed manufacturing overhead cost $352,000 Variable manufacturing overhead per machine-hour 32,000 Recently, Job T687 was completed with the following characteristics: Number of units in the job Total machine-hours Direct materials $ 675 Direct labor cost $1,350 10 40 The amount of overhead applied to Job T687 is closest to: (Round your Intermediate calculations to 2 decimal places.) Multiple Choice S112.00 $663.40 S560.00 S352.00

#PredeterminedOverheadRate

#CostAccounting

#Accounting

#Techniques

53

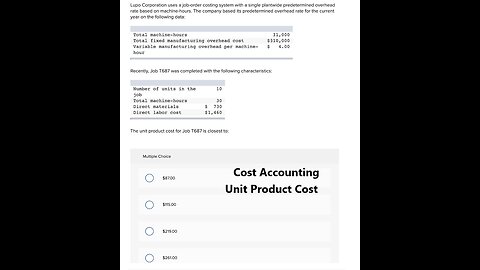

Lupo Corporation uses a job-order costing Lupo Corporation uses a job-order costing system

saxi753

Lupo Corporation uses a job-order costing Lupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data: Total machine-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine- 31,000 $310,000 4.00 hour Recently, Job T687 was completed with the following characteristics: 10 Number of units in the job Total machine-hours Direct materials Direct labor cost 30 $ 730 $1,460 The unit product cost for Job T687 is closest to Multiple Choice $8700 $115.00 $219.00 $261.00

#CostAccounting

#Accounting

#Techniques

54

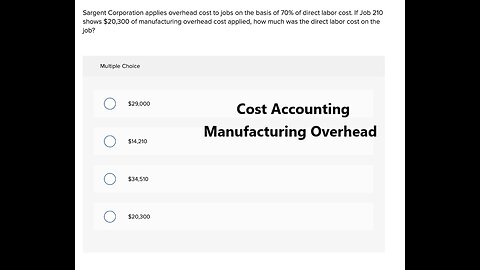

Sargent Corporation applies overhead cost to jobs on the basis of 70% of direct labor cost.

saxi753

Sargent Corporation applies overhead cost to jobs on the basis of 70% of direct labor cost. If Job 210 shows $20,300 of manufacturing overhead cost applied, how much was the direct labor cost on the job? Multiple Choice $29,000 51.210 $14,210 $34,510 O O $20,300

#CostAccounting

#Accounting

#OverheadRate

#ManufacturingOverheadCost

55

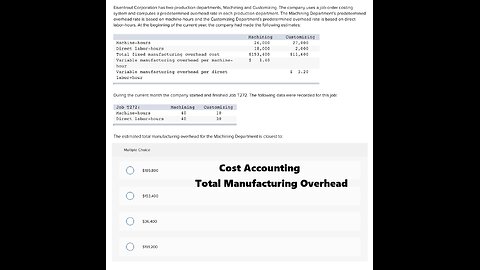

Cost Accounting: Eisentrout Corporation has two production departments, Machining and Customizing

saxi753

Eisentrout Corporation has two production departments, Machining and Customizing. The company uses ajob-order costing system and computes a predetermined overhead rate in each production department. The Machining Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning ofthe current year, the company had made the following estimates: Machining Customizing 27,000 Machine-hours 26,000 Direct labor-hours 18,000 2,000 $153,400 $11,600 Total fixed manufacturing overhead cost variable manufacturing overhead per machine- 1.40 hour Variable manufacturing overhead per direct 3.20 labor-hour During the current month the company started and finished Job T272. The following data were recorded for this job: Job T272 Customizing Machining Machine-hour 40 10 Direct labor-hours 30 40 The estimated total manufacturing overhead for the Machining Department is closest to:

#costaccounting

#Accounting

#MachiningDepartment

#PredeterminedOverheadRate

56

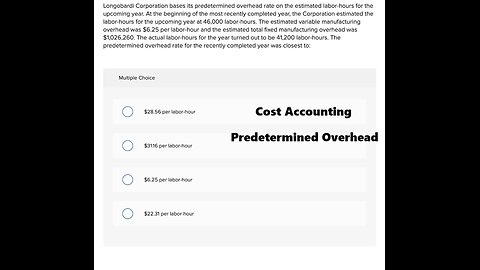

Cost Accounting: Longobardi Corporation bases its predetermined overhead rate on the estimated

saxi753

Longobardi Corporation bases its predetermined overhead rate on the estimated labor-hours for the upcoming year. At the beginning of the most recently completed year, the Corporation estimated the labor-hours for the upcoming year at 46,000 labor-hours. The estimated variable manufacturing overhead was $6.25 per labor-hour and the estimated total fixed manufacturing overhead was $1,026,260. The actual labor-hours for the year turned out to be 41,200 labor-hours. The predetermined overhead rate for the recently completed year was closest to: Multiple Choice $28.56 per labor-hour $31.16 per labor-hour $6.25 per labor-hour $22.31 per labor-hour

#costaccounting

#Accounting

#Techniques

#PredeterminedOverheadRate

57

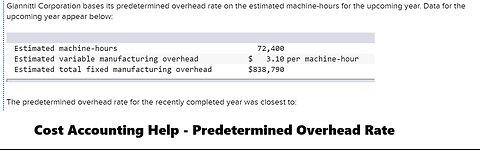

Cost Accounting: Giannitti Corporation bases its predetermined overhead rate on the estimated

saxi753

Giannitti Corporation bases its predetermined overhead rate on the estimated machine-hours for the upcoming year. Data for the upcoming year appear below: Estimated machine-hours Estimated variable manufacturing overhead Estimated total fixed manufacturing overhead 72,400 $ 3.10 per machine-hour $838,790 The predetermined overhead rate for the recently completed year was closest to:

#CostAccounting

#Accounting

#Techniques

#Cost

58

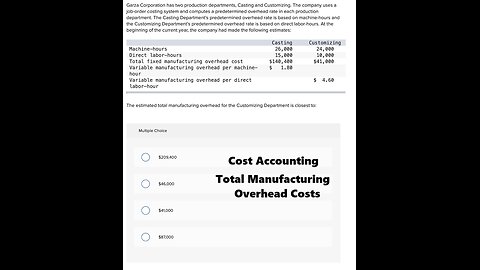

Garza Corporation has two production departments, Casting and Customizing

saxi753

Garza Corporation has two production departments, Casting and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates: Casting 26,000 15,000 $140,400 $ 1.80 Customizing 24,000 10,000 $41,000 Machine-hours Direct labor-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine- hour Variable manufacturing overhead per direct labor-hour $ 4.60 The estimated total manufacturing overhead for the Customizing Department is closest to: Multiple Choice $209,400 $46,000 $41,000 O O $87,000

#AccountingHelp

#CostAccountingHelp

#Solutions

59

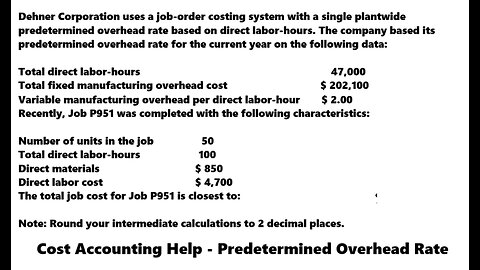

Dehner Corporation uses a job-order costing system with a single plantwide predetermined

saxi753

Dehner Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:

Total direct labor-hours 47,000

Total fixed manufacturing overhead cost $ 202,100

Variable manufacturing overhead per direct labor-hour $ 2.00

Recently, Job P951 was completed with the following characteristics:

Number of units in the job 50

Total direct labor-hours 100

Direct materials $ 850

Direct labor cost $ 4,700

The total job cost for Job P951 is closest to:

Note: Round your intermediate calculations to 2 decimal places.

Multiple Choice

$6,180

$1,480

$5,550

$5,330

#CostAccounting

#Accounting

#Techniques

#Answered

60

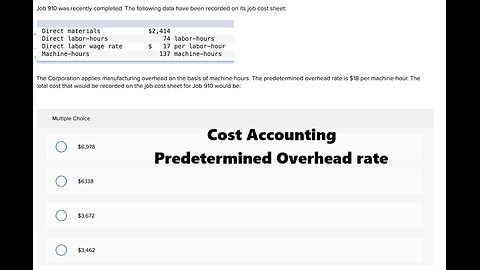

Cost Accounting Help: Job 910 was recently completed. The following data have been recorded on its

saxi753

Job 910 was recently completed. The following data have been recorded on its job cost sheet: Direct materials Direct labor-hours Direct labor wage rate Machine-hours $2,414 74 labor-hours $ 17 per labor-hour 137 machine-hours The Corporation applies manufacturing overhead on the basis of machine-hours. The predetermined overhead rate is $18 per machine-hour. The total cost that would be recorded on the job cost sheet for Job 910 would be: Multiple Choice $6,978 $6,138 $3,672 $3,462

#CostAccountingHelp

#CostAccounting

#Techniques

#Solutions

61

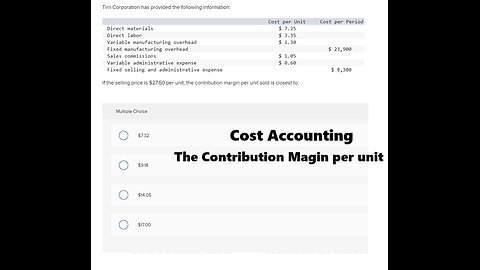

Tirri Corporation has provided the following information: Cost per Period Cost

saxi753

Tirri Corporation has provided the following information: Cost per Period Cost per Unit $ 7.25 $ 3.35 $ 1.30 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions Variable administrative expense Fixed selling and administrative expense $ 23,900 $ 1.05 $ 0.60 $ 8,300 If the selling price is $27.60 per unit, the contribution margin per unit sold is closest to: Multiple Choice O $7.32 $9.18 0 $14.05 $17.00

#CostAccounting

#Accounting

#Techniques

#Solutions

62

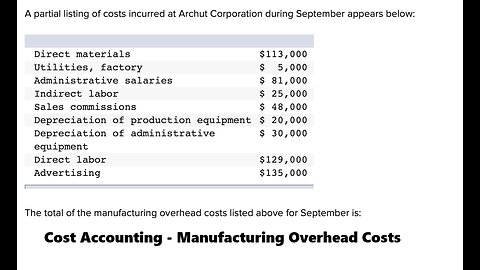

Cost Accounting Help: A partial listing of costs incurred at Archut Corporation during September

saxi753

A partial listing of costs incurred at Archut Corporation during September appears below: Direct materials $113,000 Utilities, factory $ 5,000 Administrative salaries $ 81,000 Indirect labor $ 25,000 Sales commissions $ 48,000 Depreciation of production equipment $ 20,000 Depreciation of administrative $ 30,000 equipment Direct labor $ 129,000 Advertising $135,000 The total of the manufacturing overhead costs listed above for September is:

#CostAccountingHelp

#costaccounting

#Solutions

#Answered

63

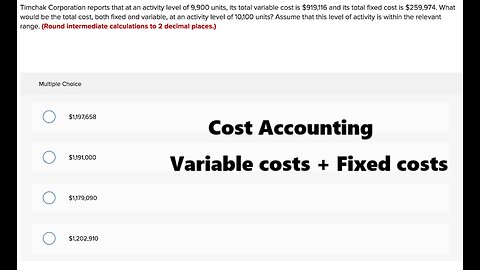

Cost Accounting Help: Timchak Corporation reports that at an activity level of 9,900 units, its

saxi753

Timchak Corporation reports that at an activity level of 9,900 units, its total variable cost is $919,116 and its total fixed cost is $259,974. What would be the total cost, both fixed and variable, at an activity level of 10,100 units? Assume that this level of activity is within the relevant range. (Round intermediate calculations to 2 decimal places.) Multiple Choice $1,197,658 $1,191,000 $1,179,090 $1,202,910

#CostAccountingHelp

#Techniques

#Solutions

#VariableCost

#FIxedCosts

64

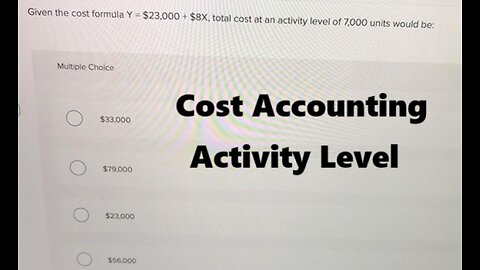

Cost Accounting Help: Given the cost formula Y = $23,000 + $8X, total cost at an activity level of

saxi753

Cost Accounting Help: Given the cost formula Y = $23,000 + $8X, total cost at an activity level of

#CostAccounting

#AccountingHelp

#Techniques

65

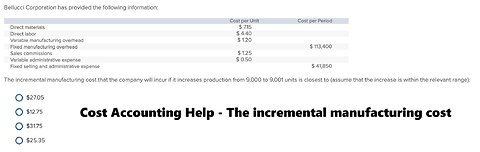

Cost Accounting Help: Bellucci Corporation has provided the following information: Cost per Period

saxi753

Bellucci Corporation has provided the following information: Cost per Period Cost per Unit $ 7.15 $ 4.40 $ 1.20 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions Variable administrative expense Fixed selling and administrative expense $ 113,400 $ 1.25 $ 0.50 $ 41,850 The incremental manufacturing cost that the company will incur if it increases production from 9,000 to 9,001 units is closest to (assume that the increase is within the relevant range): $27.05 $12.75 $31.75 O $25.35

#CostAccountingHelp

#CostAccounting

#Techniques

#Solutions

66

Cost Accounting Help: The following costs were incurred in May: Direct materials Direct labor

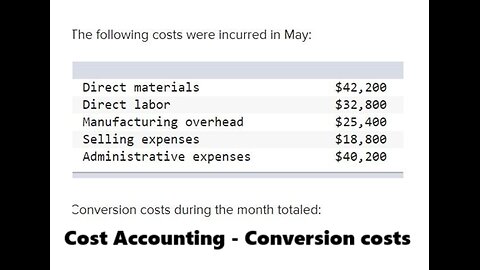

saxi753

The following costs were incurred in May: Direct materials Direct labor Manufacturing overhead Selling expenses Administrative expenses $42,200 $32,800 $25,400 $18,800 $40,200 Conversion costs during the month totaled: Multiple Choice $58,200 O $67,600

#CostAccountingHelp

#Techniques

#CostAccounting

67

Haack Inc. is a merchandising company. Last month the company's cost of goods sold was

saxi753

Haack Inc. is a merchandising company. Last month the company's cost of goods sold was $69,200. The company's beginning merchandise inventory was $15,600 and its ending merchandise inventory was $28,800. What was the total amount of the company's merchandise purchases for the month? Multiple Choice Ο $69,200 Ο $56,000 Ο $82.400 Ο $113,600

#CostAccountingHelp

#Accounting

#Techniques

68

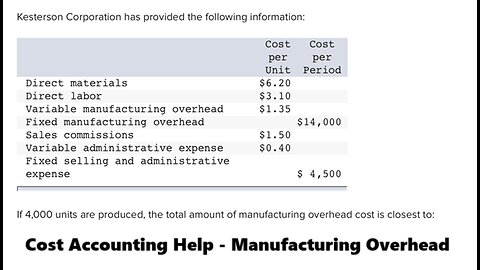

Cost Accounting: Kesterson Corporation has provided the following information: Cost

saxi753

Kesterson Corporation has provided the following information: Cost Cost per Unit Period per Direct materials $6.20 $3.10 Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions $1.35 $14,000 $1.50 Variable administrative expense $0.40 Fixed selling and administrative $4,500 expense If 4,000 units are produced, the total amount of manufacturing overhead cost is closest to: Multiple Choice $25,600 $13,200 $19,400 $16,300

#CostAccountingHelp

#AccountingHelp

#ManufacturingOverhead

#Solutions

69

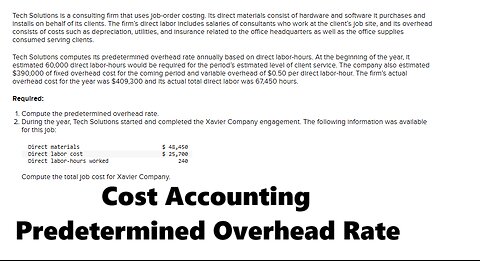

Tech Solutions is a consulting firm that uses job-order costing. Its direct materials

saxi753

Tech Solutions is a consulting firm that uses job-order costing. Its direct materials consist of hardware and software it purchases and installs on behalf of its clients. The firm’s direct labor includes salaries of consultants who work at the client’s job site, and its overhead consists of costs such as depreciation, utilities, and insurance related to the office headquarters as well as the office supplies consumed serving clients.

Tech Solutions computes its predetermined overhead rate annually based on direct labor-hours. At the beginning of the year, it estimated 60,000 direct labor-hours would be required for the period’s estimated level of client service. The company also estimated $390,000 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor-hour. The firm’s actual overhead cost for the year was $409,300 and its actual total direct labor was 67,450 hours.

Required:

Compute the predetermined overhead rate.

During the year, Tech Solutions started and completed the Xavier Company engagement. The following information was available for this job:

Direct materials $ 48,450

Direct labor cost $ 25,700

Direct labor-hours worked 240

Compute the total job cost for Xavier Company.

#Accounting

#CostAccounting

#PredeterminedOverheadRate

#Techniques

#ManagerialAccounting

70

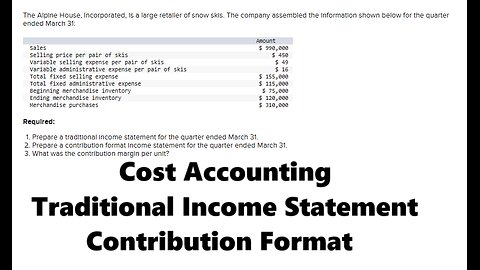

The Alpine House, Incorporated, is a large retailer of snow skis. The company assembled

saxi753

The Alpine House, Incorporated, is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31:

Amount

Sales $ 990,000

Selling price per pair of skis $ 450

Variable selling expense per pair of skis $ 49

Variable administrative expense per pair of skis $ 16

Total fixed selling expense $ 155,000

Total fixed administrative expense $ 115,000

Beginning merchandise inventory $ 75,000

Ending merchandise inventory $ 120,000

Merchandise purchases $ 310,000

Required:

Prepare a traditional income statement for the quarter ended March 31.

Prepare a contribution format income statement for the quarter ended March 31.

What was the contribution margin per unit?

#CostAccounting

#TraditionalIncomeStatement

#ContributionFormatIncomeStatement

71

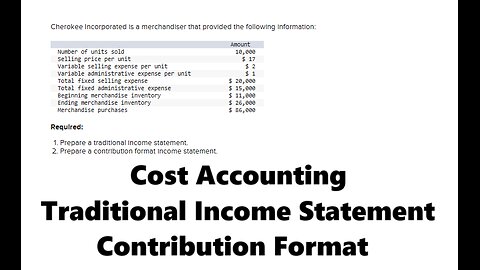

Cherokee Incorporated is a merchandiser that provided the following information:

saxi753

Cherokee Incorporated is a merchandiser that provided the following information:

Amount

Number of units sold 10,000

Selling price per unit $ 17

Variable selling expense per unit $ 2

Variable administrative expense per unit $ 1

Total fixed selling expense $ 20,000

Total fixed administrative expense $ 15,000

Beginning merchandise inventory $ 11,000

Ending merchandise inventory $ 26,000

Merchandise purchases $ 86,000

Required:

Prepare a traditional income statement.

Prepare a contribution format income statement.

#CostAccounting

#ManagerialAccounting

#TraditionalIncomeStatement

#ContributionFormatIncomeStatement

#Accounting

72

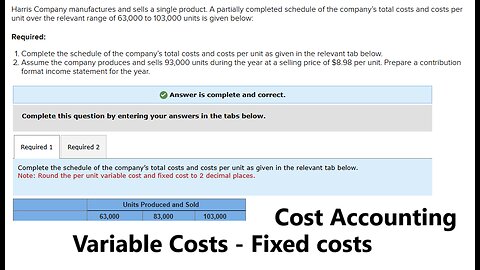

Accounting Help: Harris Company manufactures and sells a single product. A partially completed

saxi753

Harris Company manufactures and sells a single product. A partially completed schedule of the company’s total costs and costs per unit over the relevant range of 63,000 to 103,000 units is given below:

Required:

Complete the schedule of the company’s total costs and costs per unit as given in the relevant tab below.

Assume the company produces and sells 93,000 units during the year at a selling price of $8.98 per unit. Prepare a contribution format income statement for the year.

#FixedCost

#VariableCost

#ManufacturingCosts

#OperatingExpense

#ManagerialAccounting

73

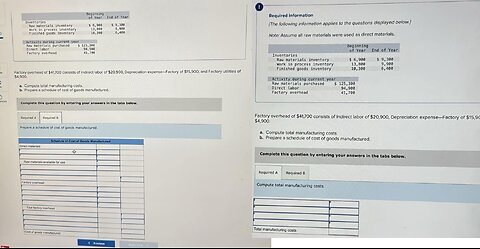

Accounting Help: Factory overhead of $41,700 consists of Indirect labor of $20,900, Depreciatio n

saxi753

Factory overhead of $41,700 consists of Indirect labor of $20,900, Depreciation expense-Factory of $15,900, and Factory utilities of $4,900

a) Compute the manufacturing costs

b) Prepare a schedule of costs of goods manufacturing

#CostManufacturing

#Manufactuirng

#CostAccounting

74

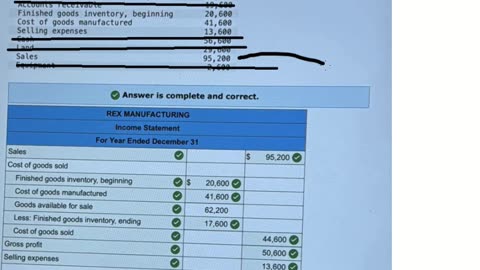

Accounting Help: Prepare an income statement for Rex Manufacturing for the year ended December 31

saxi753

Accounting Help: Prepare an income statement for Rex Manufacturing for the year ended December 31

#IncomeStatement

#AccountingHelp

#Manufacturing

75

Accouting Help: Alpha Company issued 1,000 shares of $10 par value common stock to stockholders, in

saxi753

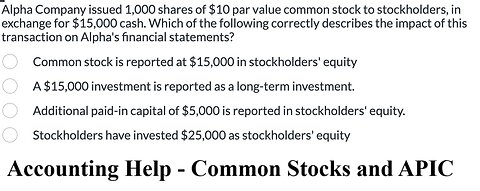

Alpha Company issued 1,000 shares of $10 par value common stock to stockholders, in exchange for $15,000 cash. Which of the following correctly describes the impact of this transaction on Alpha's financial statements?

Common stock is reported at $15,000 in stockholders' equity

A $15,000 investment is reported as a long-term investment.

Additional paid-in capital of $5,000 is reported in stockholders' equity.

Stockholders have invested $25,000 as stockholders' equity

#AccountingHelp

#CommonStock

#JournalEntries

#Stocks

76

Diaz Company owns a machine that cost $ 126,000 and has accumulated depreciation of $ 93,200

saxi753

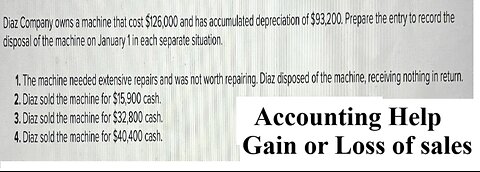

Diaz Company owns a machine that cost $ 126,000 and has accumulated depreciation of $ 93,200 . Prepare the entry to record the disposal of the machine on January 1 in each separate situation. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return. Diaz sold the machine for $ 15,900 cash. Diaz sold the machine for $ 32,800 cash. Diaz sold the machine for $ 40,400 cash.

#AccountingHelp

#Accounting

#GainOrLoss

#JournalEntries

Accounting Help: Trane Company purchases a delivery van by paying $5,000 cash and by signing a

saxi753

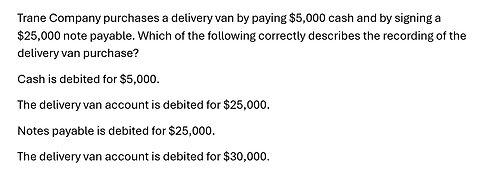

Trane Company purchases a delivery van by paying $5,000 cash and by signing a $25,000 note payable. Which of the following correctly describes the recording of the delivery van purchase?

Cash is debited for $5,000.

The delivery van account is debited for $25,000.

Notes payable is debited for $25,000.

The delivery van account is debited for $30,000.

#AccountingHelp

#Accounting

#Credit

#Debit

78

Accounting Help: JM Co has recorded the following distribution costs during the last three months.

saxi753

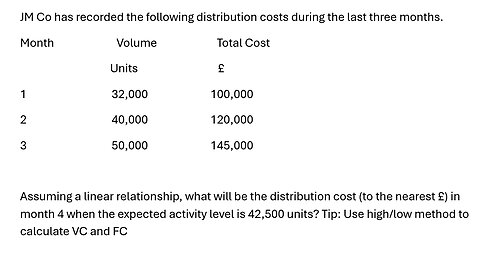

JM Co has recorded the following distribution costs during the last three months.

Month Volume Total Cost

Units £

1 32,000 100,000

2 40,000 120,000

3 50,000 145,000

Assuming a linear relationship, what will be the distribution cost (to the nearest £) in month 4 when the expected activity level is 42,500 units? Tip: Use high/low method to calculate VC and FC

#HighLow

#AccountingHelp

#Accounting

#Finance

#VariableCosts

#FixedCosts

79

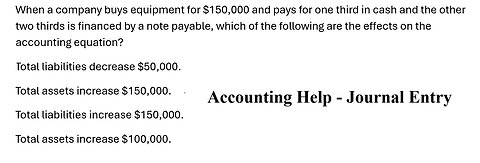

Accounting Help: When a company buys equipment for $150,000 and pays for one third in cash and the

saxi753

When a company buys equipment for $150,000 and pays for one third in cash and the other two thirds is financed by a note payable, which of the following are the effects on the accounting equation?

Total liabilities decrease $50,000.

Total assets increase $150,000.

Total liabilities increase $150,000.

Total assets increase $100,000.

#Asset

#Liability

#Equity

#AccountingHelp

80

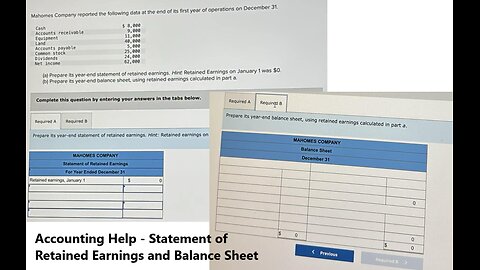

Accounting Help: Mahomes Company reported the following data at the end of its first year of

saxi753

Mahomes Company reported the following data at the end of its first year of operations on December 31

#AccountingHelp

#BalanceSheet

#RetainedEarnings

81

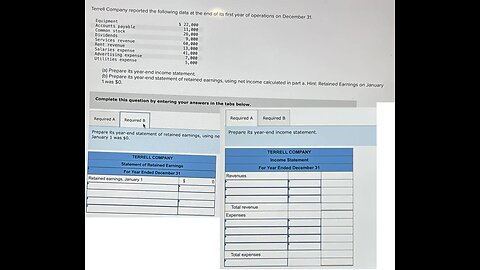

Accounting: Terrell Company reported the following data at the end of its first year of operations

saxi753

Accounting: Terrell Company reported the following data at the end of its first year of operations

#AccountingHelp

#Accounting

#IncomeStatements

#RetainedEarnings

82

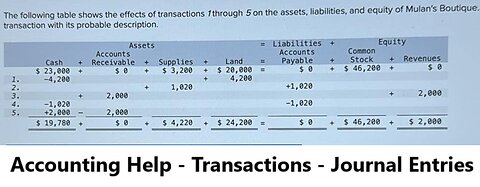

Accounting Help: The following table shows the effects of transactions 1 through 5 on the assets

saxi753

Accounting Help: The following table shows the effects of transactions 1 through 5 on the assets, liabilities, and equity of Mulan's Boutique. Match the transaction with its probable description

#AccountingHelp

#Transactions

#JournalEntries

83

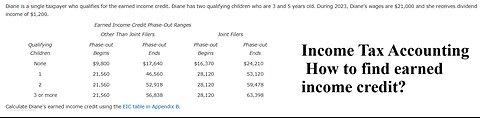

Tax Accounting: Diane is a single taxpayer who qualifies for the earned income credit. Diane has

saxi753

Diane is a single taxpayer who qualifies for the earned income credit. Diane has two qualifying children who are 3 and 5 years old. During 2023, Diane's wages are $21,000 and she receives dividend income of $1,200.

Earned Income Credit Phase-Out Ranges

Other Than Joint Filers Joint Filers

Qualifying

Children Phase-out

Begins Phase-out

Ends Phase-out

Begins Phase-out

Ends

None $9,800 $17,640 $16,370 $24,210

1 21,560 46,560 28,120 53,120

2 21,560 52,918 28,120 59,478

3 or more 21,560 56,838 28,120 63,398

Calculate Diane's earned income credit using the EIC table in Appendix B.

#TaxAccounting

#Accounting

#EarnedCredit

Accounting Help: Trane Company purchases a delivery van by paying $5,000 cash and by signing a

5 months ago

17

Trane Company purchases a delivery van by paying $5,000 cash and by signing a $25,000 note payable. Which of the following correctly describes the recording of the delivery van purchase?

Cash is debited for $5,000.

The delivery van account is debited for $25,000.

Notes payable is debited for $25,000.

The delivery van account is debited for $30,000.

#AccountingHelp

#Accounting

#Credit

#Debit

Loading comments...

-

LIVE

LIVE

The Rubin Report

1 hour agoWhy I’m Taking a Break

1,573 watching -

LIVE

LIVE

Benny Johnson

2 hours ago🚨CIA Whistleblower SPEAKS! Tulsi Gabbard Joins LIVE to Expose New Obama-Gate BOMBSHELL: 'Burn Bags'

9,140 watching -

LIVE

LIVE

LFA TV

13 hours agoLFA TV ALL DAY STREAM - THURSDAY 7/31/25

4,681 watching -

LIVE

LIVE

JuicyJohns

3 hours ago $1.57 earned🟢#1 REBIRTH PLAYER 10.2+ KD🟢$500 GIVEAWAY SATURDAY!

127 watching -

43:09

43:09

VINCE

2 hours agoSPECIAL: "Obamagate" DEEP-DIVE with Gen. Mike Flynn, Mike Benz and Paul Sperry

87.1K60 -

LIVE

LIVE

The Big Mig™

3 hours agoFBI Burn Bags, Hidden SCIF’s & Truth About Mar-A-Lago Raid

5,114 watching -

1:50:11

1:50:11

Dear America

3 hours agoFBI Discovers THOUSANDS Russia Hoax Docs In “Burn Bags”!! + Pelosi EXPOSED For Insider Trading!!

103K76 -

1:27:12

1:27:12

Tucker Carlson

3 hours agoTony Aguilar Details the War Crimes He’s Witnessing in Gaza

71.6K115 -

LIVE

LIVE

Badlands Media

6 hours agoBadlands Daily: July 31, 2025

4,207 watching -

2:16:31

2:16:31

Matt Kohrs

12 hours agoHUGE Earnings Beat, Inflation Data & New Record Highs || Live Trading Options & Futures

28.7K2