Premium Only Content

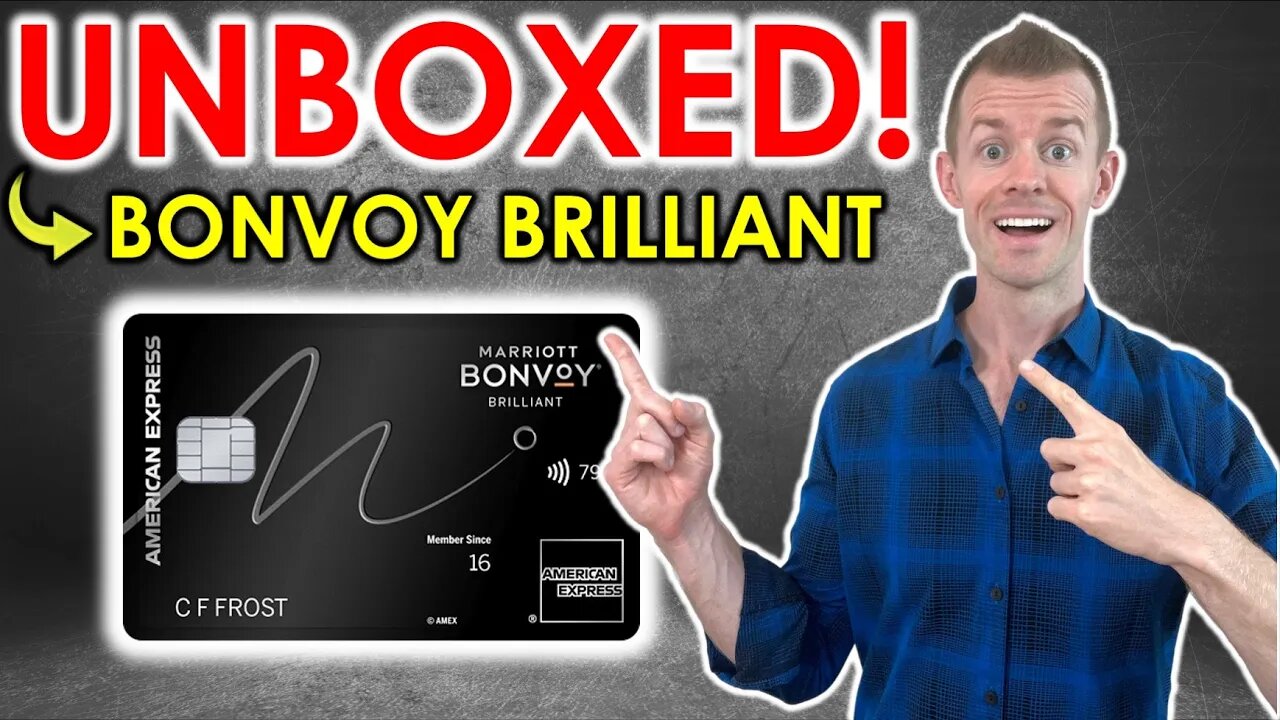

Marriott Bonvoy Brilliant Unboxing! (NEW DESIGN)

I received my new Marriott Bonvoy Brilliant Card in the mail and now it’s time for an unboxing! I’ll also compare it to the old design and talk about why I’m keeping it despite the higher $650 annual fee. Click “Show More” to see Ad Disclosure, links, and additional information below.

💳👉VIEW CREDIT CARD OFFERS!

http://markscreditcards.com/offers

🛍 RAKUTEN - Earn Cash Back!

http://markscreditcards.com/rakuten

📲 MAXREWARDS - Manage credit cards & rewards!

Get Gold level for free with PROMO CODE = markr

http://markscreditcards.com/maxrewards

🏦 SOFI CHECKING & SAVINGS – Get $25 FREE (or more w/ direct deposit)

http://markscreditcards.com/sofibanking

📈 GET FREE STOCKS FROM WEBULL when you open an account & make a deposit:

http://markscreditcards.com/webull

🥇 CHANNEL MEMBERSHIP - VIP PERKS!

http://markscreditcards.com/join

🔐 AURA – Identity Theft Protection & More!

Get Your 2-Week Free Trial: https://aura.com/markreese

I opened my Marriott Bonvoy Brilliant account back in Aug. 2018 (at that time it was the SPG Luxury Credit Card). More recently on Sep. 22, 2022, Marriott and American Express relaunched the card with a higher annual fee (originally $450, now $650) and a handful of improved benefits.

Here are the 4 Main Reasons why I’m keeping the Marriott Bonvoy Brilliant Card (at least for the foreseeable future):

1. $300 Dining Credit: This is issued as statement credits, up to $25/mo., and works at restaurants worldwide. I see this as a simple way to lower the effective annual fee to $350 as I already spend more than $25 per month at restaurants.

2. 85K Marriott Free Night Award: Each year you keep the card open and pay the annual fee, you’ll receive a Free Night certificate worth up to 85K points. This puts more Marriott luxury brands within reach, like Ritz-Carlton hotels, W hotels, JW Marriott hotels, St. Regis hotels, and more. Just be aware that this certificate only works for 1 night, so if you're staying at an expensive property for 2 nights or longer, then you'll need to have a lot of additional points or cash to pay for the remainder.

3. Complimentary Marriott Bonvoy Platinum Elite Status: As I see it, this is the sweet spot of the Marriott Bonvoy program. It offers a lot of really valuable benefits, including 50% more base points per stay, room upgrades including suites, a welcome amenity of points / breakfast benefit / other option, free premium Wi-Fi, lounge access, and more.

4. 25 Elite Night Credits Per Year: These act as if you had stayed an additional 25 nights each year. This is valuable for helping you achieve higher levels of elite status (e.g. Marriott Bonvoy Titanium) and also helps you work towards Marriott Lifetime Elite Status. I’m currently eyeing Marriott Lifetime Platinum, which requires being a Platinum Elite for 10 years and staying a total of 600 nights.

On the whole, I see this hotel credit card as a fantastic way to get more value out of Marriott hotel stays, though make sure it fits in with your travel habits prior to adding it to your wallet.

Disclosure: This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. The content in this video is accurate as of the posting date. Some of the offers mentioned may no longer be available. Mark Reese is not a financial advisor.

#marriott #marriottbonvoy #americanexpress

-

21:30

21:30

Mark Reese // Credit & Finance

9 months agoThese 9 Mistakes Will Make You HATE Amex (A Warning to Everyone)

53 -

9:07:53

9:07:53

Dr Disrespect

10 hours ago🔴LIVE - DR DISRESPECT - TOP 10 HOTTEST DEMOS OF 2025

148K12 -

LIVE

LIVE

I_Came_With_Fire_Podcast

8 hours agoCHINA TRADE | RUBIO VISA | SENATE SECRETS | DEPORT BAN

141 watching -

28:51

28:51

Scary Mysteries

13 hours agoDeath in Every Town - The Road Was His Hunting Ground

1541 -

LIVE

LIVE

megimu32

2 hours agoOFF THE SUBJECT: FAFO Friday - Bodycam Breakdown + Fortnite With the Boys

288 watching -

11:23

11:23

China Uncensored

2 hours agoChina’s Navy Has Done Something It’s NEVER Done Before

4.31K2 -

7:31

7:31

Millionaire Mentor

5 hours agoLiberals Lose It LIVE When Asked to House an Immigrant

3.35K3 -

1:21:15

1:21:15

Glenn Greenwald

7 hours agoLocals Mailbag: Glenn Answers Questions on Panic Over Zohran, SCOTUS Rulings, Israel/Iran War, & More | SYSTEM UPDATE #478

107K31 -

3:47:57

3:47:57

Nerdrotic

7 hours ago $9.16 earnedMarvel's IronSHART! Not Another Hollywood Bailout?! FNT Is Under ATTACK! | Friday Night Tights 360

61.1K10 -

2:51:17

2:51:17

Blabs Games

3 hours agoI'm Terrible At This. | Noob Plays

10.7K1