Roth Conversions Part I: What Is a Roth Conversion? (Plan For Retirement!)

Roth conversions can be a very powerful tool when it comes to successful retirement planning.

We will cover the two types of retirement money and explain what a Roth conversion is and how it will impact your taxes.

A Roth conversion is radical delayed gratification. Performing one is the ultimate extreme in sound financial planning. Why is this the case? Because whatever you convert will cost you in taxes NOW. You do a conversion because you know the prepayment of retirement taxes will be worth it in the future.

If you've ever thought about a Roth conversion, and want to know more--this is the stream for you!

Remember, Financial Freedom is found through Discipline 👏

01:56 – Stream starts

💸 Access Financial Freedom Resources: https://bit.ly/chisholmsubscribe

🚀 Join My FREE Retirement Planning Basics Course: https://bit.ly/chisholmretirementbasics

🗓️ Schedule a FREE Initial Consultation! : https://bit.ly/chisholmfinancialschedule

✅ Subscribe! : https://www.youtube.com/@chisholmfinancial

✅ My Instagram : https://bit.ly/ChisholmInsta

✅ My Twitter : https://bit.ly/ChisholmTwitter

✅ My Substack : https://bit.ly/ChisholmSubstack

Timestamps:

01:56 – Stream starts

03:41 – Roth vs. traditional retirement accounts

08:25 – How Roth conversions work

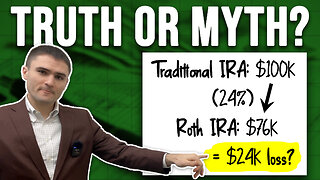

09:41 – Roth conversion example

13:08 – The benefit of a Roth conversion

17:45 – Why I recommend using a Roth IRA

20:21 – Next week sneak peak: How to minimize tax impacts of Roth conversions

#rothira #retirement #financialfreedom

-

20:30

20:30

Jenny Logan, CFP®

10 months agoRoth Conversions Part II: When is a Roth Conversion Worth It? (Retirement Planning!)

8 -

8:56

8:56

JazzWealth

3 months agoThe Benefits of Roth Conversions in Retirement Planning!

21 -

12:32

12:32

Ask Ralph Podcast: Mastering Your Finances with a Christian Perspective

2 months agoROTH IRA Conversions

61 -

3:11

3:11

Peak Retirement Planning, Inc.

1 year agoDo You Lose Money If You Do A Roth Conversion?

10 -

30:50

30:50

The Financial Mirror

6 months agoShould You Convert Your Retirement Account to Roth? | The Financial Mirror

17 -

7:36

7:36

Peak Retirement Planning, Inc.

1 year ago10 Reasons Why You SHOULD Roth Convert in 2023

3 -

12:24

12:24

Peak Retirement Planning, Inc.

10 months agoEverything You Need to Know About Roth Conversions

13 -

4:05

4:05

Peak Retirement Planning, Inc.

1 year ago3 Reasons Why You SHOULD NOT Roth Convert in 2023

19 -

7:09

7:09

JazzWealth

6 months agoTax Free Roth Conversion?!?

7 -

1:56

1:56

Peak Retirement Planning, Inc.

1 year agoThis Is Why You Should Roth Convert When The Stock Market Is Down

5