Some Known Details About "How to Balance Risk and Reward in Your Retirement Savings Investments...

https://rebrand.ly/Goldco5

Get More Info Now

Some Known Details About "How to Balance Risk and Reward in Your Retirement Savings Investments" , retirement savings investment plan

Goldco aids customers secure their retired life cost savings by rolling over their existing IRA, 401(k), 403(b) or various other qualified pension to a Gold IRA. ... To learn exactly how safe house precious metals can help you build and also shield your riches, and also even secure your retired life phone call today retirement savings investment plan.

Goldco is just one of the premier Precious Metals IRA companies in the United States. Secure your wide range and income with physical precious metals like gold ...retirement savings investment plan.

Generating a varied retirement life profile is an crucial aspect of private financial strategy. A well-diversified profile along with a number of assets program may offer a secure earnings flow during retirement life, safeguard against market dryness, and ensure that you accomplish your long-term monetary objectives. In this post, we will look into the actions involved in developing a diversified retired life profile along with multiple assets program.

Step 1: Determine Your Threat Tolerance Amount

The very first step in creating a diversified retirement life collection is to analyze your danger tolerance degree. Danger tolerance refers to the degree of financial risk that an entrepreneur is eager to take. Various entrepreneurs possess various risk tolerance degrees located on their grow older, earnings, net worth, expenditure take in, and personal circumstances.

If you are young and have numerous years until retired life, you may be extra comfortable taking on higher-risk expenditures like stocks or common funds. On the various other palm, if you are closer to retired life age or have a reduced internet worth, you may wish to take into consideration low-risk investments like connects or CDs.

Measure 2: Identify Your Investment Goals

The 2nd measure in making a varied retirement life profile is to determine your financial investment objectives. Investment goals refer to the certain objectives that you wish your expenditures to accomplish. These objectives might consist of generating revenue during retirement, offering for your little ones's education and learning expenditures, or leaving funds for charitable reason.

Once you have recognized your investment goals, it are going to be easier to pick the best mix of investments for your collection. For instance, if generating income is one of your major goals during retirement, at that point investing in dividend-paying supplies or true property investment leaves (REITs) might be necessary.

Measure 3: Select Multiple Investment Program

After examining your threat resistance amount and pinpointing your investment objectives, it's opportunity to choose various investment plans for your varied retired life collection. A well-diversified collection must consist of a mix of property courses such as supplies, connects, genuine property financial investments depend on (REITs), exchange-traded funds (ETFs), and mutual funds.

Supplies: Stocks are an possession allotment in a company. Committing in supplies may deliver higher gains but also brings higher danger as the market value of the sell can differ commonly relying on market ailments.

Connects: Connects are financial obligation guitars that offer a dealt with passion cost for a specific period. Investing in connects can easily give stable money flow, but they deliver lesser yields than sells.

REITs: Real property expenditure leaves (REITs) commit in income-generating homes like apartment or condos, workplace buildings, and buying centers. They use a steady earnings stream and diversification perks.

ETFs: Exchange-traded funds (ETFs) are identical to reciprocal funds but trade like supplies on an substitution. ETFs provide variation benefits and reduced expenses.

Mutual Funds: Mutual funds pool money coming from multiple entrepreneurs to obtain safeties such as inventories, connections, or various other assets. Shared funds deliver professional management and variation advantages.

Measure 4: Designate Your Properties

Once you have decided on multiple assets program for your varied retirement life collection, it's opportunity to designate your assets one of them. Asset allocation recommends to the method of separating your investments one of different posses...

-

54:28

54:28

UnchartedX

11 hours agoHow Old Are These MEGALITHS? A Study of Erosion in Ancient Egyptian Architecture - UnchartedX

45.7K24 -

3:38:31

3:38:31

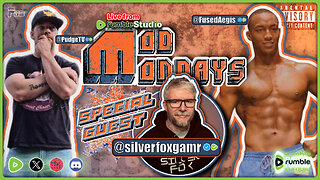

PudgeTV

14 hours ago🔵 Mod Mondays Ep 30 | SilverFoxGamr - How to Get HUGE! | Elden Ring Pre-Show & DLC

43.5K3 -

1:05:10

1:05:10

Donald Trump Jr.

15 hours agoThe American Dream is on the Ballot, Interview with Sean Davis | TRIGGERED Ep.148

133K140 -

2:02:31

2:02:31

Revenge of the Cis

12 hours agoEpisode 1342: You Fell For It

106K24 -

58:12

58:12

Savanah Hernandez

10 hours agoPropaganda goes into overdrive ahead of Thursday’s Presidential debate

77.9K62 -

1:04:25

1:04:25

Kimberly Guilfoyle

13 hours agoBiden Leaves White House Ahead of Debate, Plus Anti-Semitic LA Violence, Live with Mike Davis & Larry Elder | Ep. 136

101K87 -

1:03:55

1:03:55

In The Litter Box w/ Jewels & Catturd

1 day agoProvocation? | In the Litter Box w/ Jewels & Catturd – Ep. 593 – 6/24/2024

119K57 -

27:37

27:37

Stephen Gardner

11 hours ago🔴Trump DEFENDED by NYC Cuomo against Letitia James and Alvin Bragg

84.8K36 -

3:04

3:04

One Bite Pizza Reviews

3 days agoBarstool Pizza Review - Little Pops NY Pizzeria (Naperville, IL)

88.2K78 -

1:44:41

1:44:41

The Quartering

15 hours agoTrump Surges In Polls, AOC Flops, Biden's New CREEPY Hire, Trumps VP Pick Is In? w/ Styxhexenhammer

105K83