Premium Only Content

S&P 500 Dozing Off While Other Assets Signal Impending Wake-Up Call

🟢 BOOKMAP DISCOUNT: https://bit.ly/3F8qdGb

🟢 TRADE IDEAS & DISCORD: https://www.patreon.com/figuringoutmoney

🟢 TRADE WITH IBKR: http://bit.ly/3mIUUfC

______________________________________________________________________________________________

Welcome to another insightful daily stock market brief video. In today's discussion, we will cover a range of topics, including recent earnings reports, market volatility, and notable market trends. So let's dive right in and explore what's been happening in the financial world.

Earnings Reports: Retail Sector

This week, we've seen a flurry of earnings reports from the retail sector, offering valuable insights into consumer behavior and the overall health of the economy. Companies like Home Depot, Target, TJX, and Walmart have all shared their financial performance for the past quarter.

One notable report came from Home Depot, which revealed a 4% decline in sales compared to the previous year. This drop in revenues marked a significant decline, raising concerns about the sector's overall health. Despite the negative figures, Home Depot's stock only experienced a 2% decrease, indicating a potentially resilient market.

Market Movement and the S&P 500

While the S&P 500 has remained relatively stagnant, there are other assets showing movement that typically correlate with the index. Currently, the S&P 500 is trapped between the 4,200 and 4,100 levels, creating a coiled-up market waiting for a potential breakout in either direction.

Analyzing the 15-minute timeframe, we observe a break of the daily expected move, followed by a dip and subsequent rise. However, the S&P 500 couldn't sustain this momentum and encountered resistance at the week-to-date anchored VWAP, resulting in a downward move by the end of the day. This sets the stage for a potential gap fill and even a further downward move.

To have a more bullish outlook, it is crucial for the price to rise above the quarter-to-date anchored view, which currently indicates that the average investor, based on volume, is underwater for the quarter. A break above this level would open doors for a potential upward movement.

Volatility and Intermarket Analysis

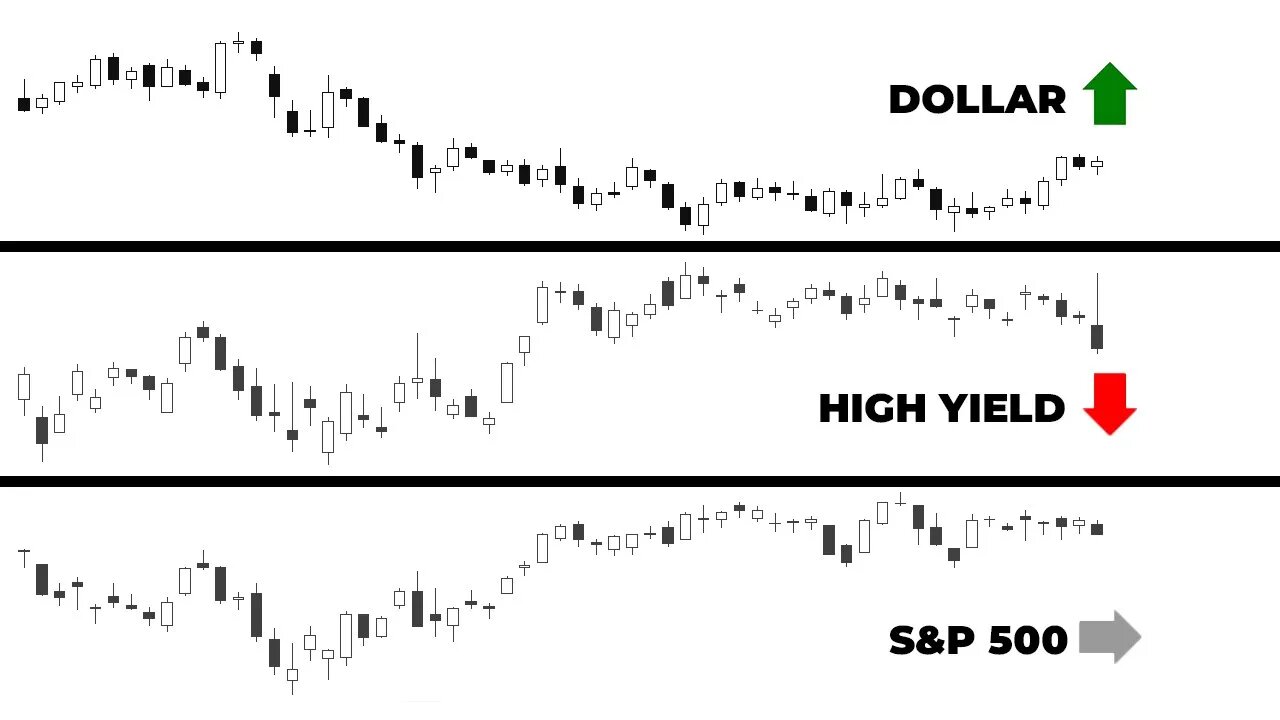

Volatility in the market is a critical factor to consider. We observe that both the dollar and high-yield bonds (HYG) are breaking out of their respective ranges. The dollar moving up could pose challenges for equity markets, while high-yield bond movements can influence various assets, including the equity market.

Notably, poor breadth can be observed in the NASDAQ composite, with low trading volumes and a flat advanced-decline cumulative line. This indicates a lack of support and a potential bear trap. However, some underlying equities are reaching the lower end of their zones, providing an opportunity for bounces, which may affect the broader market positively.

Conclusion

As we approach the end of the week, market participants should prepare for increased volatility. With various expiration dates and the anticipation of statements from Jerome Powell, it's essential to be mindful of potential market movements.

While earnings reports from the retail sector have presented mixed results, market trends suggest caution. The S&P 500's consolidation, coupled with intermarket analysis, highlights the need for a watchful eye on the dollar, high-yield bonds, and poor breadth indicators.

Remember, volatility can lead to both upward and downward movements, and it is crucial to remain vigilant and adaptable in response to market dynamics.

Thank you for joining us today, and we hope this overview has provided valuable insights into recent market developments. Stay tuned for more updates as the financial landscape continues to evolve.

🔔 Subscribe now and never miss an update: https://www.youtube.com/c/figuringoutmoney?sub_confirmation=1

📧 For business inquiries or collaboration opportunities, please contact us at [email protected]

📈 Follow us on social media for more insights and updates:

🟢 Instagram: https://www.instagram.com/figuringoutmoney

🟢 Twitter: https://twitter.com/mikepsilva

______________________________________________________________________________________________

______________________________________________________________________________________________

DISCLAIMER: I am not a professional investment advisor, nor do I claim to be. All my videos are for entertainment and educational purposes only. This is not trading advice. I am wrong all the time. Everything you watch on my channel is my opinion. Links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel :)

#stockmarket #sp500 #technicalanalysis

-

7:24

7:24

Figuring Out Money

2 years agoMomentum Slowing, Divergences Growing: What Does This Mean For The Markets?

52 -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

433 watching -

24:30

24:30

DeVory Darkins

16 hours agoMarjorie Taylor Greene RESIGNS as Minnesota dealt MAJOR BLOW after fraud scheme exposed

74.7K123 -

2:19:48

2:19:48

Badlands Media

1 day agoDevolution Power Hour Ep. 409: Panic in the Narrative — Epstein, Israel, and the Manufactured Meltdowns

167K59 -

1:52:38

1:52:38

Man in America

13 hours agoCommunists VS Zionists & the Collapse of the American Empire w/ Michael Yon

74.3K53 -

4:09:34

4:09:34

Akademiks

8 hours agoSheck Wes exposes Fake Industry. Future Not supportin his mans? D4VD had help w disposing his ex?

44.4K3 -

6:43:43

6:43:43

SpartakusLIVE

12 hours agoTeam BUNGULATORS || From HUGE WZ DUBS to TOXIC ARC BETRAYALS

117K3 -

2:44:56

2:44:56

BlackDiamondGunsandGear

8 hours agoAre You that guy? / Carrying a Pocket Pistol /After Hours Armory

28.4K1 -

5:41:59

5:41:59

Camhigby

8 hours agoLIVE - Riot Watch Portland, DC, NC

31.3K21 -

2:54:58

2:54:58

CAMELOT331

10 hours agoYouTube Just Told Me I OWE THOUSANDS $ TO THEM... update

36.1K13