Premium Only Content

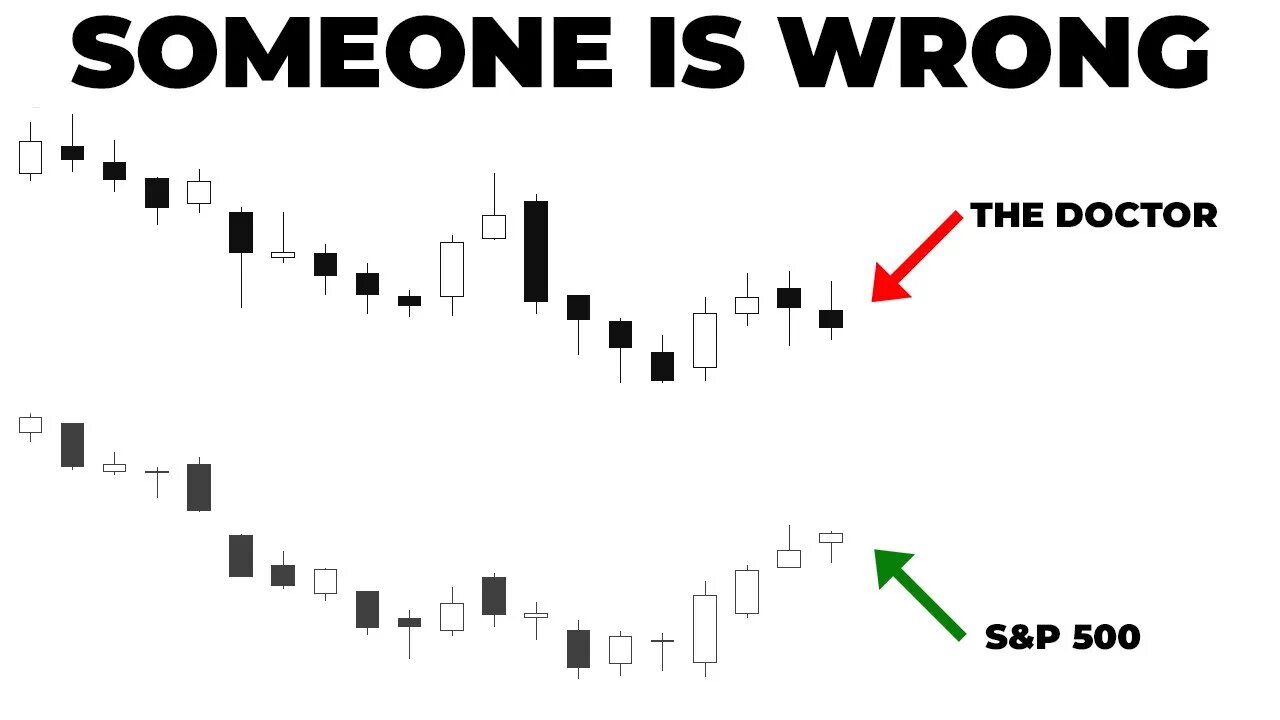

Momentum Slowing, Divergences Growing: What Does This Mean For The Markets?

🟢 TRADE IDEAS & DISCORD: https://www.patreon.com/figuringoutmoney

🟢 TRADE WITH IBKR: http://bit.ly/3mIUUfC

🟢 BOOKMAP DISCOUNT (PROMO CODE "BM20" for 20% off the monthly plans): https://bookmap.com/members/aff/go/figuringoutmoney?i=79

__________________________________________________________________________________________

Tonight's video delves into a comprehensive analysis of the financial markets, emphasizing the slowing momentum and building divergences. It begins by highlighting the release of the producer price inflation data, which surprisingly came in hotter than expected. Despite this revelation, the markets showcased a relatively flat performance. The volatility index (VIX) and the various sectors within the S&P 500 are discussed, shedding light on their recent movements. The narrative then shifts to the 10-year yield, which has been moving within a defined channel, and the TLT (a bond ETF) that has been navigating against declining moving averages. An intriguing aspect of the script is its focus on the divergences observed in the market. These divergences, especially between high yield and equity markets as well as between copper and the S&P 500, are flagged as potential warning signs. The movement of the dollar is also explored, emphasizing its correlation with the S&P 500. Other assets, including oil, gold, Bitcoin, and Ethereum, are touched upon, providing insights into their recent trajectories and the factors influencing them. Delving deeper into technical analysis, the script underscores the nuances of candlestick charting, particularly the diminishing momentum evident from the decreasing body sizes of consecutive green candles. The significance of expected move levels and potential resistance points in the market are also highlighted. Concluding the analysis, the script offers a short-term outlook for the markets, stressing the importance of the impending inflation data and its potential ramifications on market movements.

🔔 Subscribe now and never miss an update: https://www.youtube.com/c/figuringoutmoney?sub_confirmation=1

📧 For business inquiries or collaboration opportunities, please contact us at FiguringOutMoney@gmail.com

📈 Follow us on social media for more insights and updates:

🟢 Instagram: https://www.instagram.com/figuringoutmoney

🟢 Twitter: https://twitter.com/mikepsilva

______________________________________________________________________________________________

How To Predict How Far Stocks Can Go (EXPECTED MOVES):

○ https://youtu.be/JT32L89ZpEk

Saylor To Schiff Bitcoin Indicator:

○ https://youtu.be/zuG9Tjnud9k

Show Me The Money Scan:

○ https://youtu.be/dzRjEuUUb5g

Party Starter Scan:

○ https://youtu.be/zzaN91gcJOI

Bouncy Ball Scan:

○ https://youtu.be/7xKOo6vNaq8

Dark Money Scan:

○ https://youtu.be/ZUMuHaSg1ro

Sleepy Monster Scan:

○ https://youtu.be/C9EQkA7uVU8

High Volatility Scan:

○ https://youtu.be/VC327ko8DfE

______________________________________________________________________________________________

DISCLAIMER: I am not a professional investment advisor, nor do I claim to be. All my videos are for entertainment and educational purposes only. This is not trading advice. I am wrong all the time. Everything you watch on my channel is my opinion. Links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel :)

#Stockmarket #StockMarketAnalysis #DayTrading

-

11:07

11:07

Figuring Out Money

1 year agoGet A Closer Look At This Stock Market Rally!

71 -

1:02:18

1:02:18

Timcast

2 hours agoDemocrat States Ignore English Language Mandate For Truckers, DoT Vows Crackdown Amid Trucker Mayhem

117K36 -

1:57:04

1:57:04

Steven Crowder

5 hours agoAdios & Ni Hao: Trump Sends Abrego Garcia to Africa But Welcomes 600K Chinese to America

248K218 -

LIVE

LIVE

The White House

5 hours agoPresident Trump Participates in a Cabinet Meeting, Aug. 26, 2025

2,594 watching -

1:18:51

1:18:51

Rebel News

1 hour agoCarney's flawed LNG deal, Libs keep mass immigration, Poilievre's plan to fix it | Rebel Roundup

4.73K7 -

27:39

27:39

Crypto.com

5 hours ago2025 Live AMA with Kris Marszalek, Co-Founder & CEO of Crypto.com

54.2K4 -

TheAlecLaceShow

2 hours agoMAGA Pushback Against Flag Burning EO & 600K Chinese Students | Cashless Bail | The Alec Lace Show

6K -

1:09:18

1:09:18

SGT Report

17 hours agoBIOHACKING 101: MAKING BIG PHARMA IRRELEVANT -- Dr. Diane Kazer

27.1K20 -

4:58:31

4:58:31

JuicyJohns

6 hours ago $1.49 earned🟢#1 REBIRTH PLAYER 10.2+ KD🟢

47.6K -

1:42:52

1:42:52

The Mel K Show

3 hours agoMORNINGS WITH MEL K - The Future of the Constitutional Republic: Local Action for National Impact 8-26-25

25K14