The PhD Standard

As was the case with the original creation of the Federal Reserve, cutting the final connection to gold had little impact on the day-to-day life of the average American. The dollar did not change; the inflation that began to impact Americans in the mid-1960s continued.

It was foreign governments that were the most affected, as the collapse of the Bretton Woods system created a new era of uncertainty. The result was a new monetary system, with the American dollar—unbacked by gold—replacing gold as the global reserve currency.

Without hard money to back their currency, governments had to identify how to instill confidence in it. Some failed to do so, falling into the same mistake of relying on money printing to justify government spending. For example, Zimbabwe ended up printing 100-trillion-dollar bills as the result of the hyperinflation that resulted from reckless government policies.

Many smaller countries tied their currency to the dollar—which meant their monetary policy was dictated by the Federal Reserve. Europe—except for the United Kingdom—created a continental currency—the euro—and central bank, with the idea that no one country's government would be in a position to abuse the printing press. Other global governing institutions—like the World Bank and the International Monetary Fund—were also created to assist developing countries in this global economy.

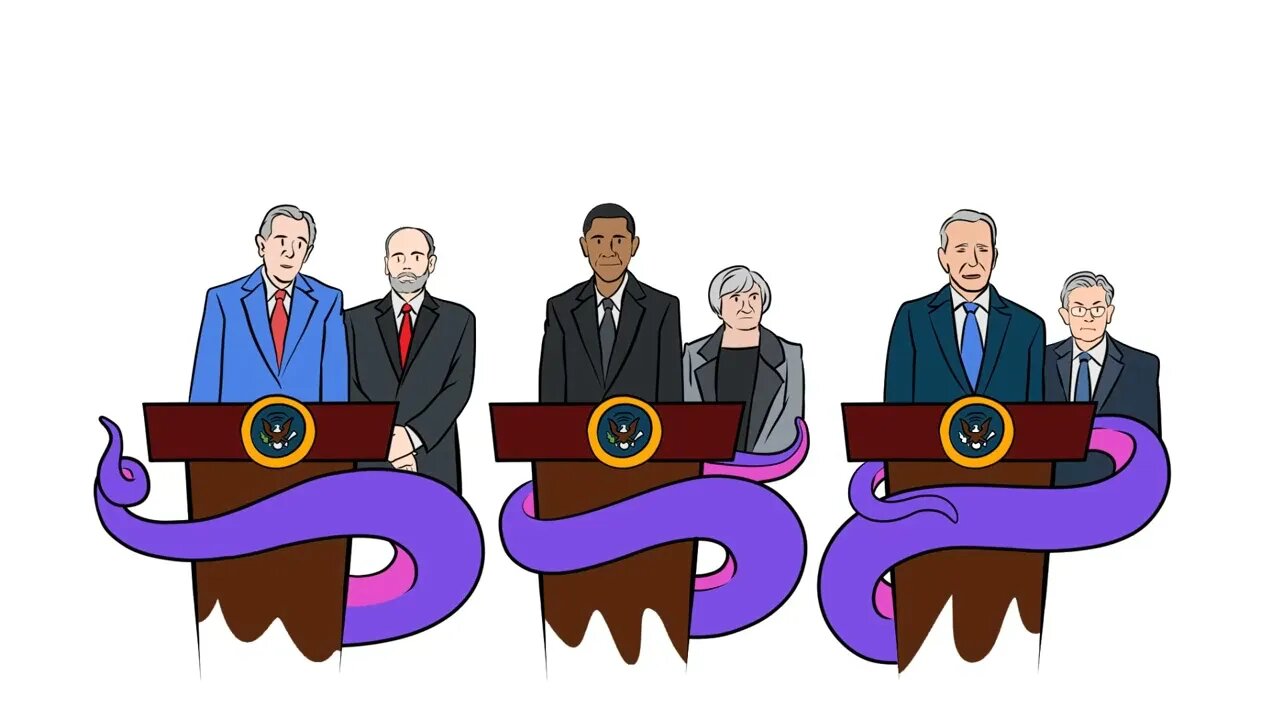

Ultimately, the international monetary system transformed from one backed by hard currency to one based on the whims of university-trained experts.

Of course, powerful bankers and government officials have always been the catalysts for the inflationary policies that have created the great economic crises of the past.

Governments are always the primary benefactors of inflationary monetary policy, and inflation is always an easier means of financing government spending than direct taxation. As long as money is controlled by the state, the incentive will be for central banks to expand the money supply at the expense of the rest of the population.

The result has been economic crises becoming larger and more global. The booms and busts of business cycles are created by the expansion of money and credit unbacked by real wealth. Without any tie to gold, governments, central banks, and large financial institutions have created more money and credit than ever before. From stagflation in the seventies to the financial crisis of 2008, central bank policy continues to sow the seeds of economic crises with increasing severity.

Another consequence of this has been normalizing consistent inflation. From 1792 to 1932, an ounce of gold consistently cost roughly $20. Between FDR's closing the gold window in the US and Nixon's doing so internationally, the price rose from $32 to $45. In 2021, an ounce of gold cost more than $1,800 dollars.

In our next video, we will look at the impact of this inflation.

________________________________________

This series was inspired by Murray Rothbard's classic introduction, What Has Government Done to Our Money?—available for free in PDF, ePub, HTML, and Audiobook at https://Mises.org/WHGD

To learn more about the operations of the Federal Reserve, check out Bob Murphy's book, Understanding Money Mechanics, available for free in PDF, ePub, and HTML at https://Mises.org/BobMoney

For more animated content, check out Economics for Beginners at https://BeginEconomics.org.

-

8:43

8:43

Mises Institute

16 days agoCalifornia Secession Would be Great for the Rest of America

1811 -

1:01:59

1:01:59

The White House

3 hours agoPress Secretary Karoline Leavitt Briefs Members of the Media, Feb. 20, 2025

51.2K30 -

59:58

59:58

Russell Brand

4 hours agoLive from Mar-a-Lago: The Globalist Empire’s Last Stand – SF541

117K83 -

35:23

35:23

CryptoWendyO

2 hours ago $1.35 earnedCrypto Chaos Unleashed: Trump Making USA The Bitcoin Capital Of The World

17K2 -

1:03:00

1:03:00

The Dan Bongino Show

6 hours agoTrump Keeps Delivering And The Libs Are Seething (Ep. 2427) - 02/20/2025

745K1.66K -

1:20:26

1:20:26

Nerdrotic

4 hours ago $4.43 earnedSuper Chat Square Up - Nerdrotic Nooner 466

66.9K2 -

2:05:00

2:05:00

Steven Crowder

7 hours agoTrump Slams Dictator Zelensky: Why He NOW Has a Point

476K294 -

2:58:22

2:58:22

LFA TV

19 hours agoKASH CONFIRMATION & PRESS BRIEFING! | LIVE FROM AMERICA 2.20.25 11AM

114K48 -

2:14:42

2:14:42

Matt Kohrs

15 hours agoIt's A Bull Trap, Partner! || The MK Show

100K3 -

40:25

40:25

BonginoReport

9 hours agoTrump Cancels Zelensky’s 'Gravy Train' (Ep.144) - 02/20/2025

153K166

0 Comments