Premium Only Content

Research Class

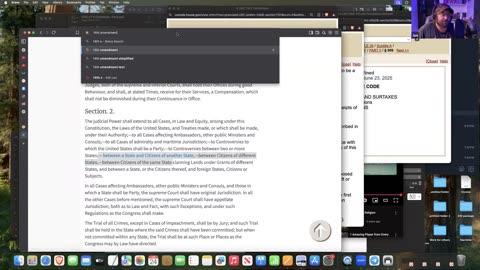

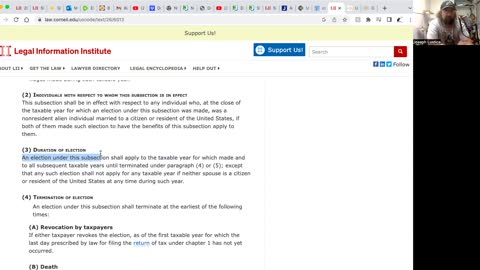

Revocation of Election: Can you REVOKE your election on your first 1040 to ALWAYS pay taxes?

Revocation of election (part 1)

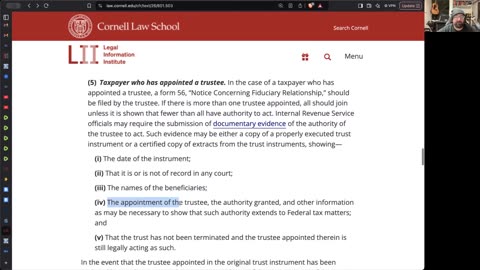

Understanding the form 56

Judge admits they have no discretion

Live telegram Q&A from April 2, 2024

Social Security scheme

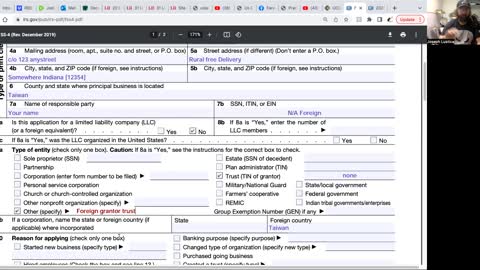

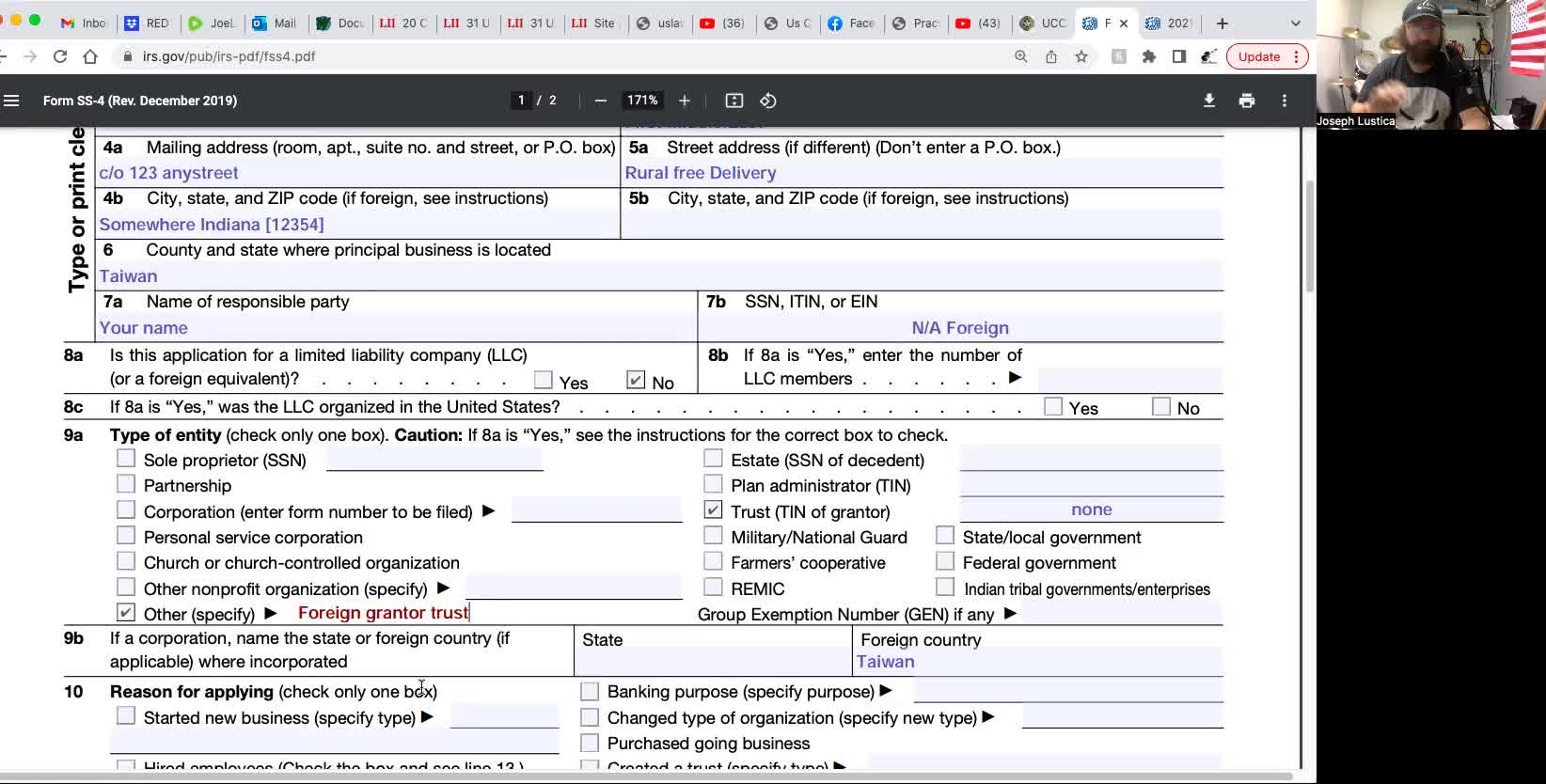

How to get the 98 EIN number (foreign grantor trust)

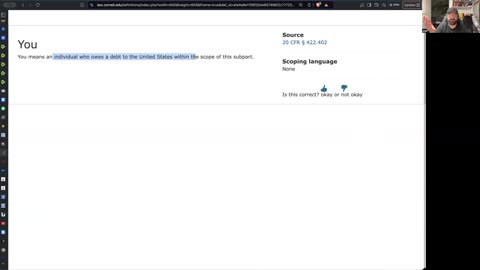

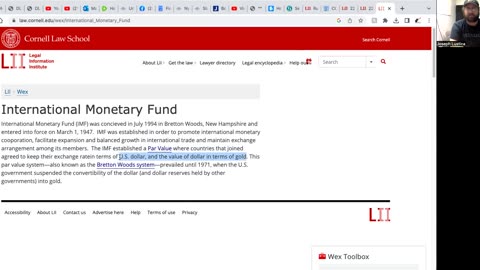

Who gets paid by the international monetary fund

Live telegram Q&A January 25, 2024

Coupon payment not working? Try this!

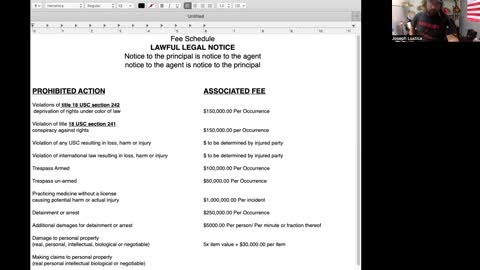

Fee schedule additional information

More on coupon payments

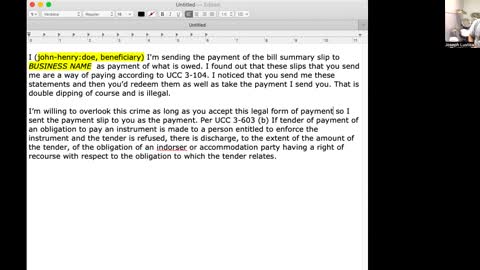

How to write the letter to the corporation for the coupon payment

How to turn the payment voucher into a check

What is a UCC financing statement and how to use one (W/Dave)

The purpose of the UCCs

Fee schedule for coupon

What is a fee schedule?

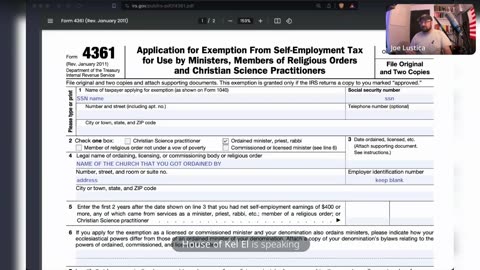

How to get the 98 EIN number (foreign grantor trust)

Yes I put it back up.This was in popular demand so, here it is, haters can exit please.

In this video I go over how to get the EIN number for the foreign grantor trust also called the 98 number. I called them and did the entire process over the phone but yes I did fill out the SS4 form before calling them. They did recommend that I fax it over but I never did. They gave me the number right over the phone the phone call was about five minutes just be professional and to the point with them.

Here is their number:

1-267-941-1099

https://www.irs.gov/pub/irs-pdf/fss4.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

-

38:44

38:44

The Why Files

4 days agoProject Ancient Arrow | The NSA's Secret War Against Our Future

59K73 -

2:36:06

2:36:06

Barry Cunningham

9 hours agoPRESIDENT TRUMP IS TRULY USHERING IN THE GOLDEN AGE OF AMERICA! CAN YOU FEEL IT?

109K44 -

3:47:25

3:47:25

SynthTrax & DJ Cheezus Livestreams

3 days agoFriday Night Synthwave 80s 90s Electronica and more DJ MIX Livestream 2K Celebration SPECIAL EDITION 530pm PST / 830pm EST

52K5 -

2:21:54

2:21:54

VapinGamers

6 hours ago $3.33 earnedDestiny 2 - Edge of Fate Legendary Run Part 3 - !rumbot !music

28.7K -

2:04:25

2:04:25

TimcastIRL

8 hours agoTrump DOJ Gives Ghislaine Maxwell Limited IMMUNITY As She Rats On 100+ People | Timcast IRL

238K175 -

1:09:09

1:09:09

Omar Elattar

10 hours agoThe Brain Experts: Your Brain Can Rewire Itself At Any Age & Here's How!

27.7K4 -

4:30:37

4:30:37

IcyFPS

7 hours agoLIVE - Wuchang Fallen Feathers x Borderlands w/ pope!

34.3K2 -

29:24

29:24

Afshin Rattansi's Going Underground

20 hours agoWas Epstein a Mossad Agent? Will Obama go to Prison? (Afshin Rattansi vs Alan Dershowitz)

34.9K28 -

4:26:54

4:26:54

Nerdrotic

13 hours ago $35.79 earnedFantastic Four Baby Steps V Superman's James Gunn, South Park Returns | Friday Night Tights 364

116K10 -

3:17:40

3:17:40

megimu32

7 hours agoOFF THE SUBJECT: FAFO Friday! Cops, Crash, Kombat & Chaos!

27.8K7