Premium Only Content

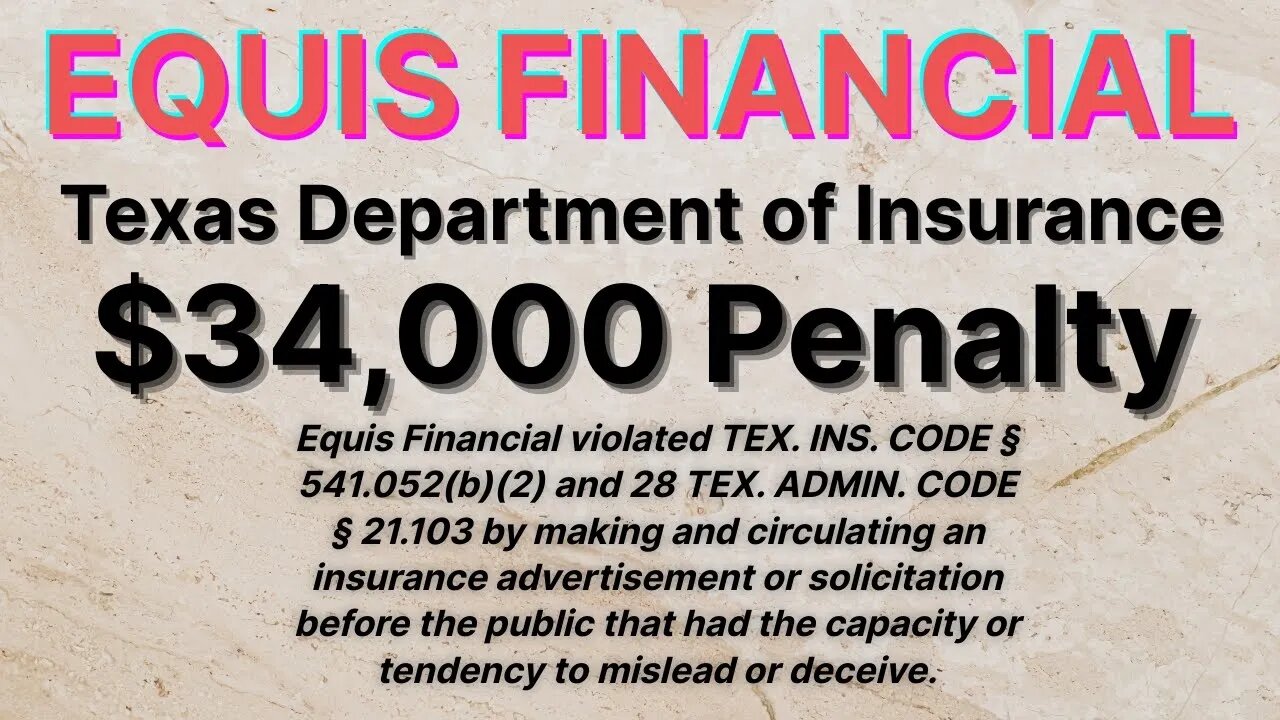

Equis Financial Fined $34,000 by Texas Department of Insurance

Equis Financial got slapped with a $34,000 fine from the Texas Department of Insurance (TDI).

1. TDI received a complaint from a reverse mortgage lender that Equis was mailing postcard advertisements to Texas residents containing words that had the tendency and capacity to mislead and deceive the recipient about the identity of the sender. The postcard included true data from public records, identifying the addressee’s home mortgage lender, the loan amount, closing date of the loan, and the mortgage identification number.

https://www.naaip.org/equis-financial-administrative-penalty.pdf

In your complaints to your State Attorney General and other government agencies, I suggest that you include a link to my playlist of interviews of the victims and whistle-blowers https://www.youtube.com/playlist?list=PLJVKYiW2lCj5oHUZkuMJJEIQAZzhWQisX

2. The postcard stated that the “The Mortgage Service Center” was attempting to contact the borrower related to protecting their new mortgage and provided a toll-free number for the borrower to call.

Data on new mortgage holders is public information. Anyone in the market of selling mortgage protection insurance should be accessing this list direct from the source. We discuss this on my 6-day per week video conference and on www.naaip.org/lead-services.

Buying leads from Family First Life or any of its sister companies is a foolish, a self-inflicted wound.

Integrity Marketing Group (IMG) and its subsidiaries which include Family First Life, Equis Financial, National Agents Alliance, PHP Agency and others are on the radar of the regulators. The more I learn about this operation, the more convinced I am that it is one big fraud.

The subject-matter of the Greg Birch Tyra Hamilton, Andrew Holland whistleblower were explosive, but the videos were lacking in basic editing and thumbnails. I am learning and have addressed these issues on existing videos.

Other videos by agent Mark Sias, Ronald Le Vine, Nate Fudala, Mario Herfy of Equis Financial, Mr. Mekika, Agent Kari, Agent Sheria, Agent Cris, Agent Lakeisha, Agent Alene, Agent Nicole, Agent Guy, Agent Sam, Jason Perry

of Equis Financial and others were just as consequential. YouTube showed me its analytics tools and I understand that low quality does not work.

I need you to encourage me in my journey. Please view all the videos on the Family First Life Class Action Lawsuit Witness List.

Like the video if you appreciate my work in helping America's new insurance agents.

In the future, I will only be uploading quality videos to YouTube. Proper editing, and dozens of hours of work can get any video to be Hollywoodesque.

I am willing and able to implement this task.

I need interview subjects, please call me to tell your story. Particularly if you have knowledge of frauds that Family First Life and friends have committed.

Please subscribe to this channel. As well, create your free forever insurance agent website at https://www.naaip.org.

Family First Life is being sued in a class-action lawsuit for lead fraud here: https://www.naaip.org/first-family-life-class-action-lawsuit-ffl.pdf

NAAIP's forum post that has the latest developments in the FFL's legal battles

https://www.naaip.org/community/topic/481-ffl-family-first-life-class-action-lawsuit/

Please join my 6 day per week video conference call to discuss.

NAAIP 6 Day Per Week Video Conference:

Monday to Thursday Noon, Saturday & Sunday 2pm ET

Dial (888)532-9320 or https://meetings.dialpad.com/naaip

-

12:07

12:07

TundraTactical

2 hours agoWhats The Deal With New Guns In 2025

4.44K -

LIVE

LIVE

Wayne Allyn Root | WAR Zone

6 hours agoWAR Zone LIVE | 12 SEPTEMBER 2025

255 watching -

1:05:02

1:05:02

vivafrei

5 hours agoCharlie Kirk Assassin ARRESTED! Universal Ostrich Farms UPDATE! And More!

119K182 -

1:44:36

1:44:36

Megyn Kelly

1 day agoRemembering Charlie Kirk, with Tucker Carlson, Donald Trump Jr., and Benny Johnson

65.4K129 -

9:40

9:40

Lara Logan

4 hours agoHonoring Charlie Kirk - Going Rogue with Lara Logan - LIVE

44.6K46 -

3:03:45

3:03:45

The Charlie Kirk Show

7 hours agoCharlie Kirk: A Life of Faith, A Legacy That Endures

471K429 -

3:58:08

3:58:08

The Rubin Report

8 hours agoCharlie Kirk’s Best Moments on The Rubin Report

82.1K27 -

UPCOMING

UPCOMING

FomoTV

19 hours ago🕯 Charlie Kick Assassinated — Radical Campus Rhetoric 🚨 Schools Should Be Held Accountable | Fomocast 09.12.25

26.9K3 -

3:08:36

3:08:36

Right Side Broadcasting Network

8 hours agoLIVE REPLAY: Latest News from the Trump White House - 9/12/25

83.4K24 -

LIVE

LIVE

Dr Disrespect

7 hours ago🔴LIVE - DR DISRESPECT DESTROYS BORDERLANDS 4 - INSANE LOOT, CHAOS & RAGE

904 watching