Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

trust

Overwatch1sentinal

- 44 / 200

1

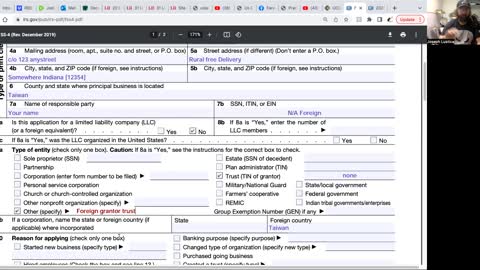

FinCen Beneficial Owner Reporting and More

We Are The NEWS

Smoking Baby and Derek Gonzalez break down the FinCen Reporting form and much more in this long long lesson. Fot those with eyes to see and ears to hear.

Don't forget to SUBSCRIBE and SHARE !!!

4.26K

views

18

comments

2

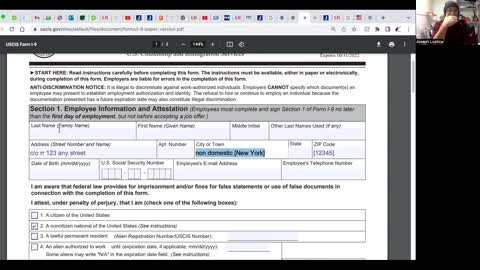

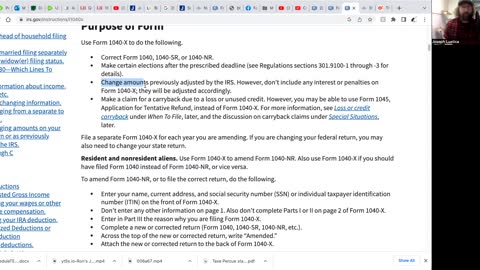

Patrick talks IRS Forms & More

KRISTINA WILSON PRIVATE BANK ESTATE & TRUST

Patrick talks IRS forms

Example 1099s can be found here:

https://kwestate.gumroad.com/l/tjpdq

7.69K

views

58

comments

3

4

5

6

7

Right to Pruvacy

KRISTINA WILSON PRIVATE BANK ESTATE & TRUST

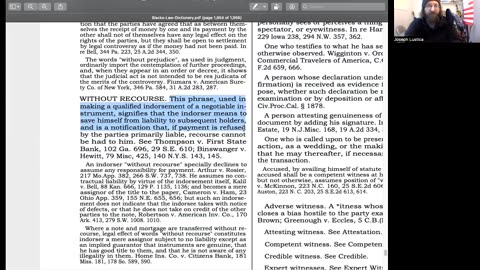

Listen to Patrick discuss Privacy, IRS forms and more.

2.66K

views

12

comments

8

9

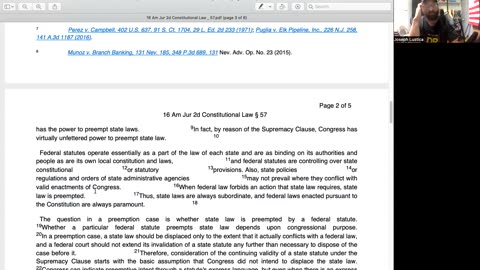

taxpayer and legal non-taxpayer

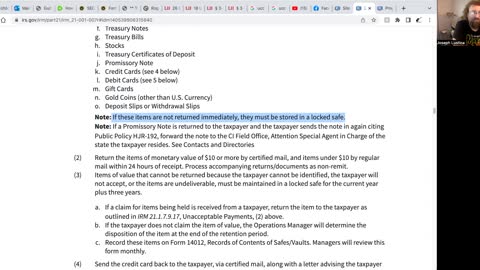

JoeLustica

The government recognizes taxpayers and legal non-taxpayers here's the proof: https://casetext.com/case/economy-plumbing-heating-v-united-states-2

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.44K

views

1

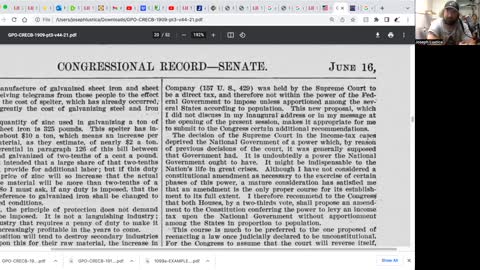

comment

10

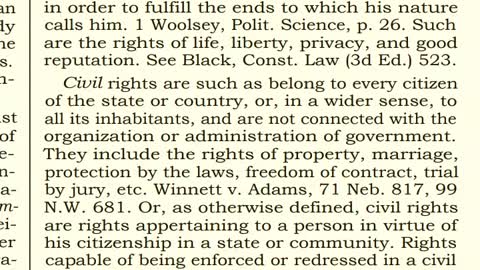

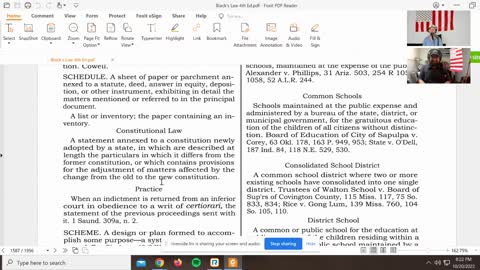

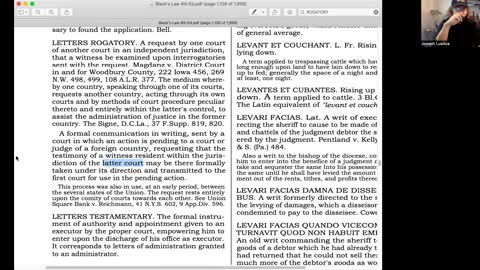

Natural rights versus civil rights

JoeLustica

Natural rights vs. Civil rights, which one is better and which would you prefer to be under?

This is found in Black Law's dictionary 4th edition under the definition of "Rights"

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.52K

views

11

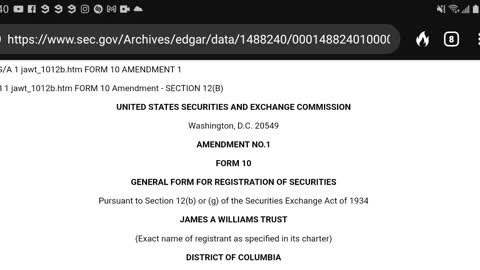

James A Williams Trust

JoeLustica

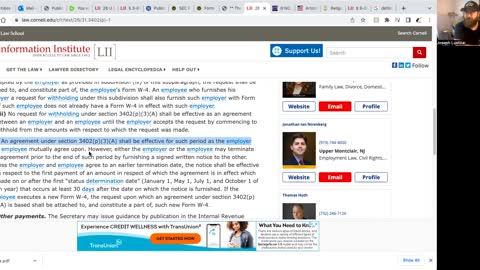

Why does a Trust Company the James a William trust own birth certificates? And did you know that you cannot pay off any debt legally?

Read it for yourself:

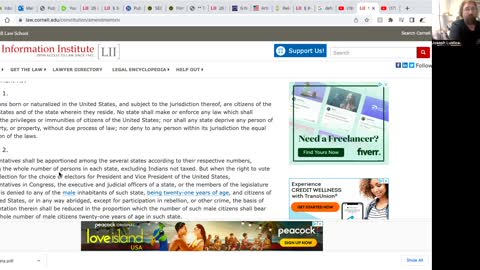

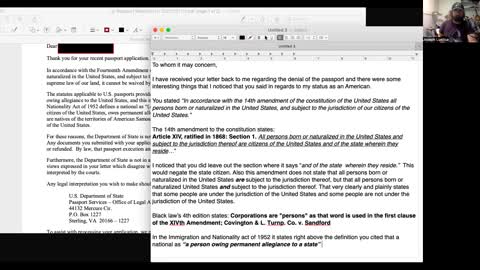

https://www.sec.gov/Archives/edgar/data/1488240/000148824010000004/jawt_1012b.htm

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

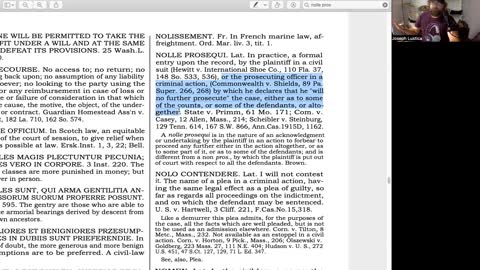

2.18K

views

9

comments

12

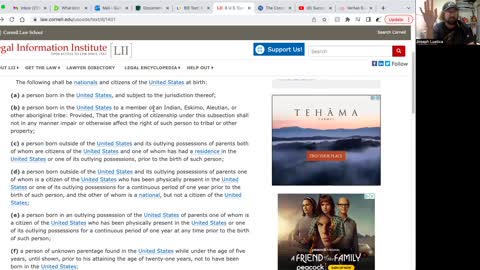

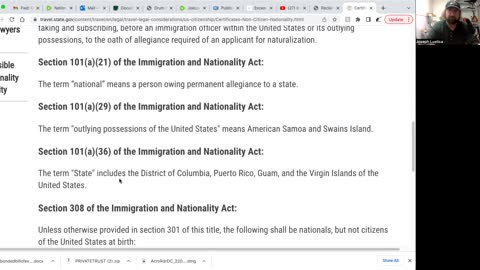

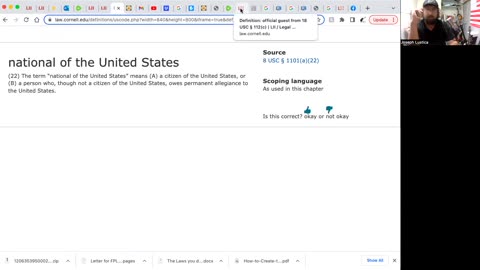

What is a national?

JoeLustica

In this video I gave you the legal definition of national and point out how they don't talk about it very much in the rest of the code.

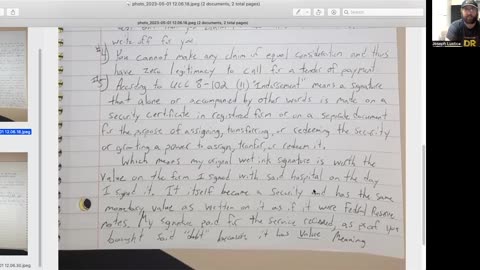

https://www.law.cornell.edu/uscode/text/8/1401

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1

comment

13

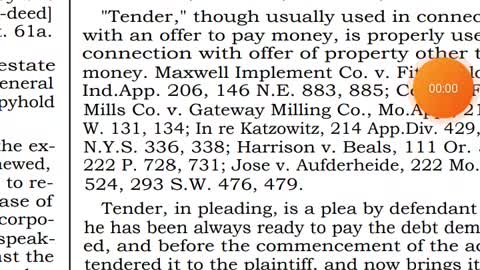

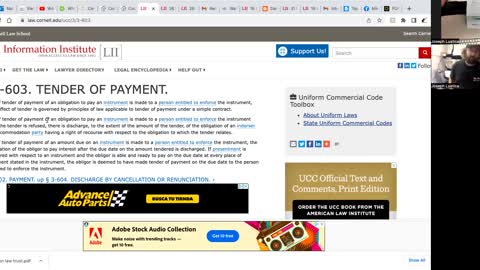

When a business refuses your payment

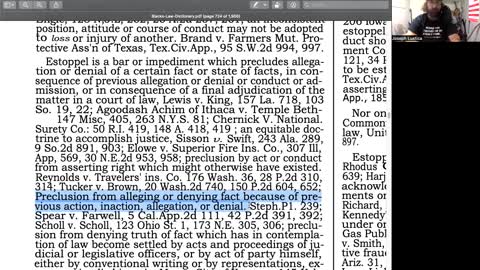

JoeLustica

In this video I show you legal recourse that you can use if you're trying to pay off a debt to someone or company and they are refusing what you were trying to pay them.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.04K

views

4

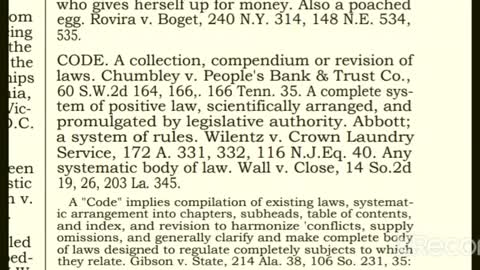

comments

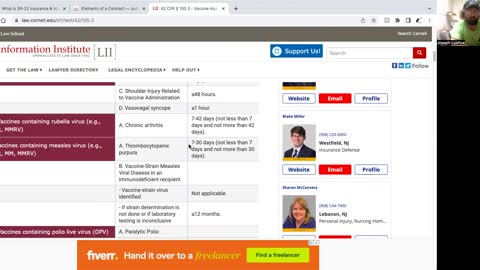

14

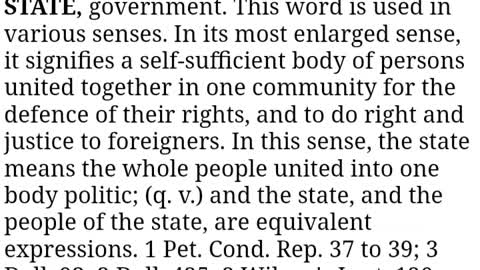

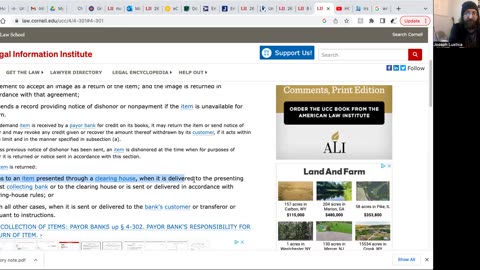

Definition of State part 2

JoeLustica

In this video I show you another definition for state. We also go into some of the definitions of the words in the definition in order to better clarify what state actually means.

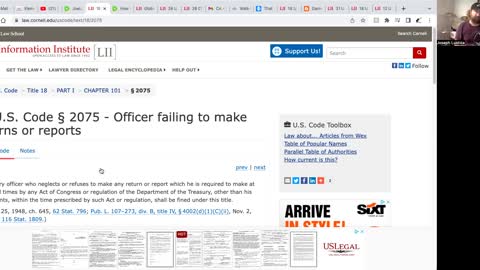

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.41K

views

1

comment

15

The section symbol (the weird symbol at the beginning of legal documents)

JoeLustica

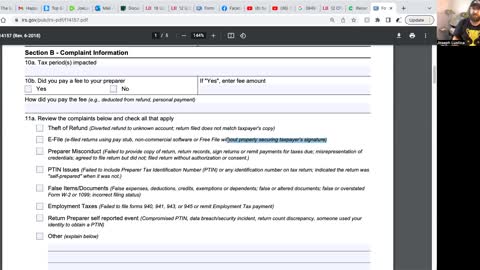

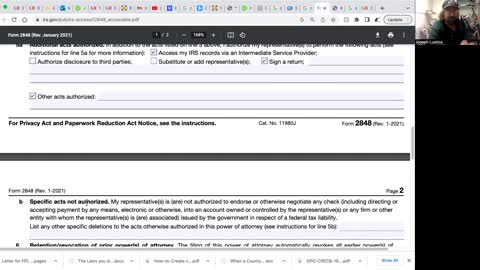

The section symbol (the weird symbol at the beginning of legal documents)

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

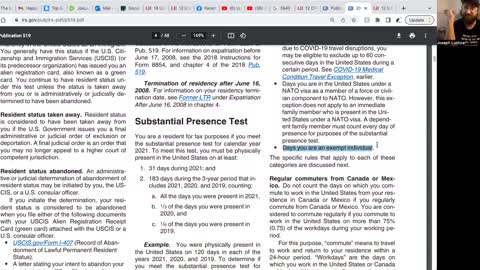

3

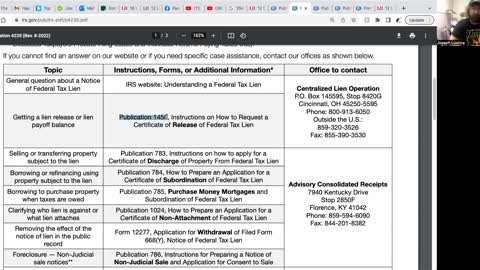

comments

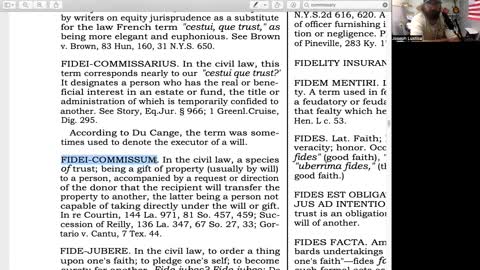

16

Definition of "State" capital S

JoeLustica

In this video I show you what the definition of "State" actually means. Here is the link so you can read it for yourself: https://www.law.cornell.edu/cfr/text/5/841.1002

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1

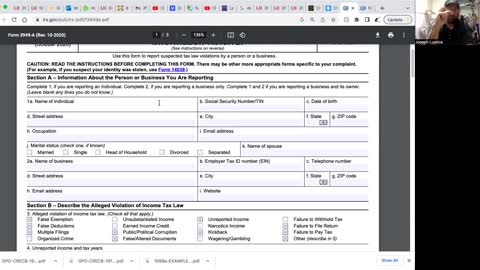

comment

17

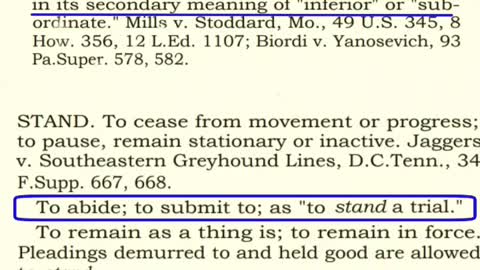

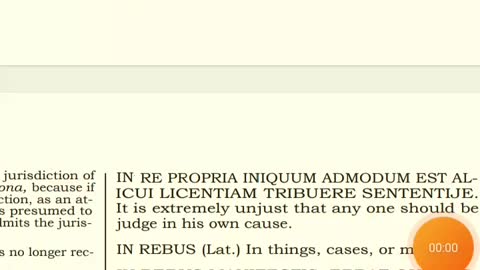

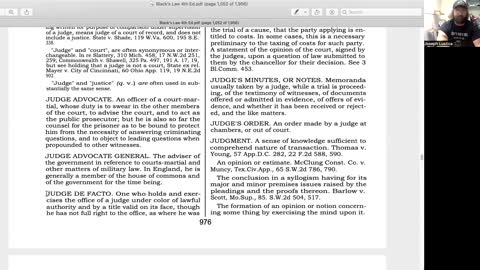

"Do you under stand me?" The real meaning

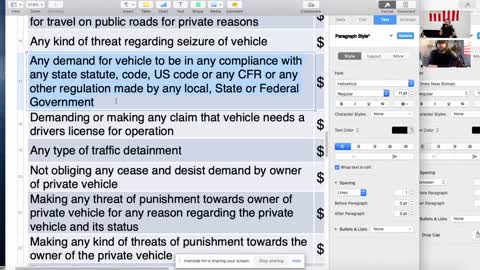

JoeLustica

This is from Black Law's dictionary 4th edition I place the definition together and then highlighted the important and pertinent parts of the definitions. So this is very interesting as police and courts do not use regular English when speaking to you they will use legalese such as this. It would behoove you to learn legalese.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.85K

views

1

comment

18

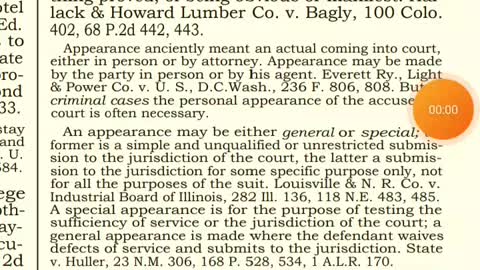

What is a special appearance in court?

JoeLustica

And this video I show you the definition of appearance and the different types of appearances you can make in court. Just note that a lawyer will not do this for you. Which I will explain in a different video

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.76K

views

3

comments

19

What an attorney actually is

JoeLustica

In this video I lay out exactly what an attorney really is per Black Law's dictionary 4th edition. I think you will find this very interesting and you may get some use out of this yourself but that is your own decision. I'm not offering any legal advice.

3

comments

20

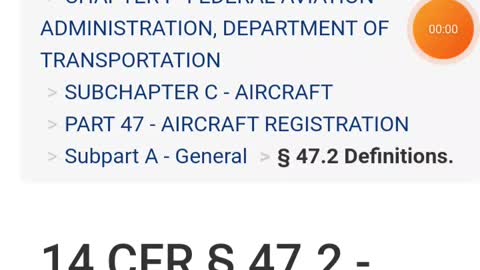

What is a United States Citizen?

JoeLustica

I found the legal text that explains what a United States citizen really is. You can read it for yourself here: https://www.law.cornell.edu/cfr/text/14/47.2

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.95K

views

1

comment

21

The "United States" is a corporation

JoeLustica

This is the actual US code that says that the United States is actually a corporation.

28 US code 3002

I suggest you go read it yourself.

https://www.law.cornell.edu/uscode/text/28/3002

1.84K

views

2

comments

22

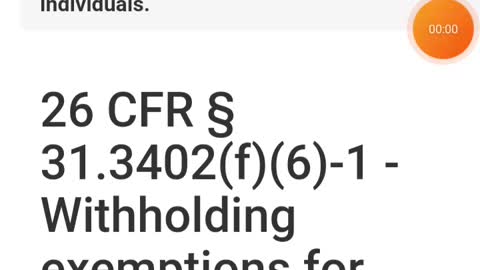

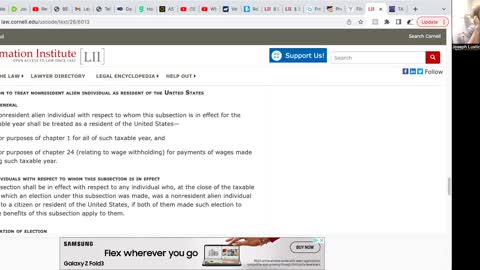

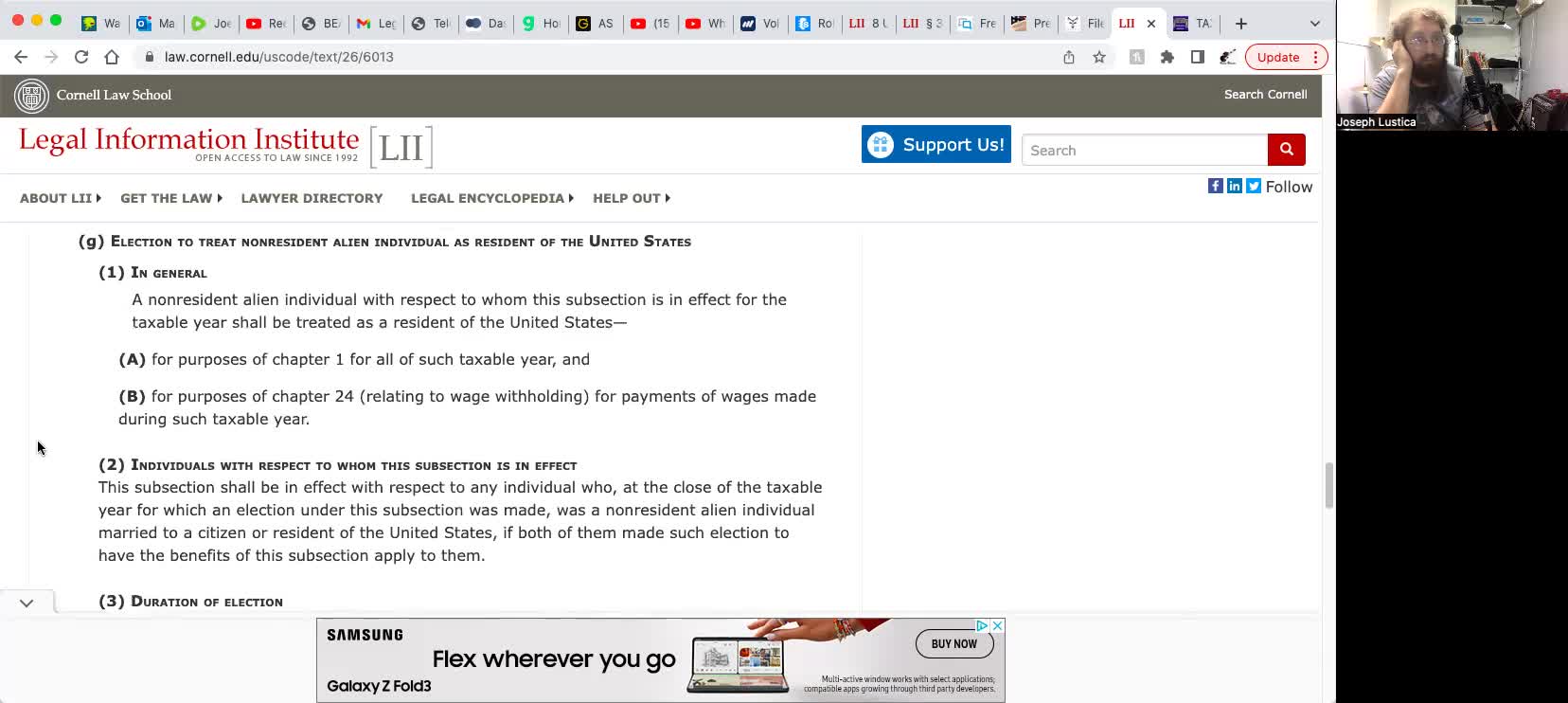

A Nonresident alien doesn't have to pay taxes.

JoeLustica

Who is a nonresident alien?

Definition: https://www.law.cornell.edu/cfr/text/43/426.8

Exemption code: https://www.law.cornell.edu/cfr/text/26/31.3402(f)(6)-1

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.37K

views

1

comment

23

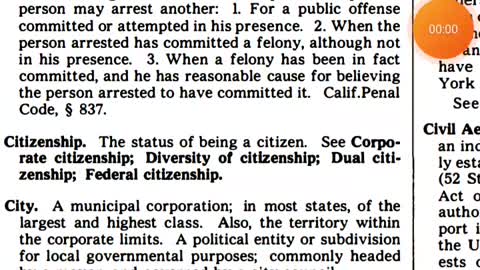

What is a citizen part 2

JoeLustica

What is a citizen? This definition comes from Black Law's dictionary 5th edition. I do not have a link for that unfortunately but you can try to order one online 5th edition or 4th edition or try to find a PDF file of the 4th edition or 5th edition somewhere. This is a vital tool in understanding

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1

comment

24

The United States corporation is taxed exempt!!!

JoeLustica

Here is the evidence that the United States is a tax exempt corporation.

This is a huge subchapter. Take your time and you'll find a treasure of tax exemptions. I'm sure you can find something that will fit your needs.

Link: https://www.law.cornell.edu/uscode/text/26/501

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2

comments

25

"Person" means corporation. Undeniable proof

JoeLustica

Yes "person" can mean corporation. I will make a video soon showing you how to tell the difference.

Read it for yourself: https://www.law.cornell.edu/uscode/text/28/3002

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

26

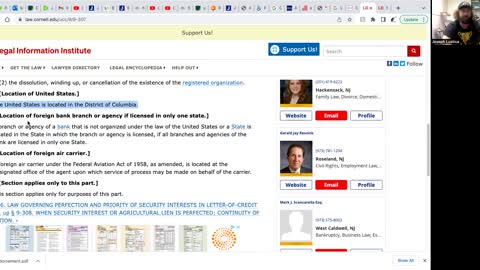

The location of the United States

JoeLustica

I'm showing you piece by piece the truth behind your imprisonment. Get yourself out of the bond.

Here is the link to the page. https://www.law.cornell.edu/ucc/9/9-307

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1

comment

27

Tax exemptions

JoeLustica

In this video I go over what things can be tax exempt. Read this for yourself. Be sure to do your own due diligence.

https://www.law.cornell.edu/uscode/text/31/3124

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.37K

views

2

comments

28

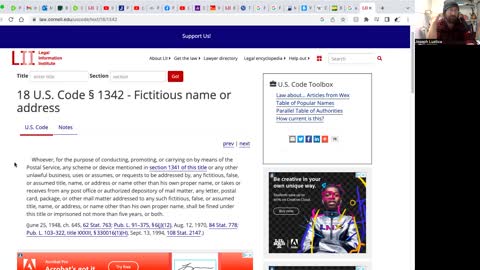

IRS code has no legality

JoeLustica

In this video I go over the IRS code that says specifically that it has no legal effect.

https://www.law.cornell.edu/uscode/text/26/7806

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.64K

views

8

comments

29

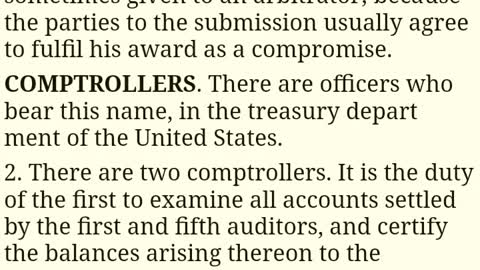

Definition of comptroller

JoeLustica

I read the definition of comptroller from the bouvier law dictionary there might be a lot of interesting legal stuff regarding debt and payment of debts so stay tuned for what may be coming in the future.

https://www.1215.org/lawnotes/bouvier/

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2

comments

30

Ens legis definition. Actual strawman word.

JoeLustica

In this video I show you the legal "strawman" word that is accepted by courts, lawyers and any other law officials or officers.

You can use this to identify yourself as a living person and show that your strawman is a separate identity from you. This comes from Black law's 4th edition.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.55K

views

2

comments

31

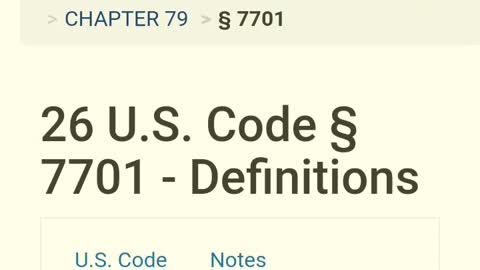

You are not a taxpayer and you didn't even know it

JoeLustica

In this video I break down exactly why you are not a taxpayer. Unless you want to pay taxes you can opt out of this.

Links: https://www.irs.gov/individuals/international-taxpayers/nonresident-spouse

https://www.law.cornell.edu/uscode/text/26/7701

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3

comments

32

"Without prejudice" definition

JoeLustica

In this video I go over the meaning of "without prejudice" and some of the ways you can use this in your life to reserve your rights

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.54K

views

4

comments

33

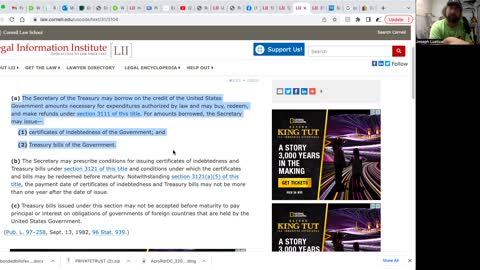

Who is responsible for paying debts

JoeLustica

In this video I show you who is responsible for paying debts. Especially public debt

https://www.law.cornell.edu/uscode/text/31/3123

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

4

comments

34

State national vs. Us national

JoeLustica

In this video I give you a breakdown of the two different statuses of State national and US national.

https://www.law.cornell.edu/uscode/text/8/1101

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.26K

views

5

comments

35

What commercial crimes are

JoeLustica

I give you a quick rundown on a lot of different types of commercial crimes. Very interesting how these crimes are considered to be commercial crimes.

https://www.law.cornell.edu/cfr/text/27/72.11

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

4

comments

36

How the government tricks you

JoeLustica

In this video I show you how the government will use codes to drag people around in an endless loop in order to confuse you and to hide things from you. This comes from Internal Revenue code of 1954

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1

comment

37

U.s. code books versus u.s. code online

JoeLustica

In this video I show you that there is a lawyers Edition to the u.s. code books. I found that there are some differences inside of them which I do not share in this video but I will in another. This is another part of the deception as only people who can buy these books will get all the information contained within while the online information has some of this data hidden or not put up on the websites.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.34K

views

2

comments

38

The only other tax a nonresident alien has to pay

JoeLustica

In this video I finally found the 871(b) code that says what taxes nonresident alien has to pay legally.

871(b) link: https://www.law.cornell.edu/uscode/text/26/871

26 CFR 1.1-1 link: https://www.law.cornell.edu/cfr/text/26/1.1-1

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3

comments

39

Definition of non-resident

JoeLustica

In this video I give you the definition of non-resident as it's being applied in virtually any IRS code where it's mentioned.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.37K

views

2

comments

40

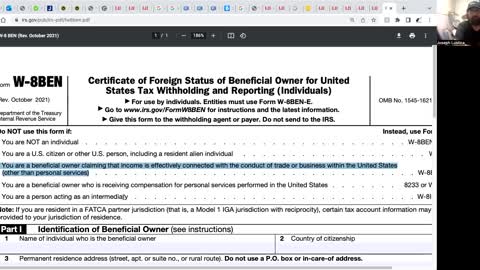

The IRS forms after the Revocation of Election

JoeLustica

In this video I show you the forms you need to do after you've sent in your ROE to the IRS. This is important because you must end the original contract with them regarding withholding your pay for taxes.

W4V: https://www.irs.gov/pub/irs-pdf/fw4v.pdf

W8 BEN: https://www.irs.gov/pub/irs-pdf/fw8ben.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

7.22K

views

16

comments

41

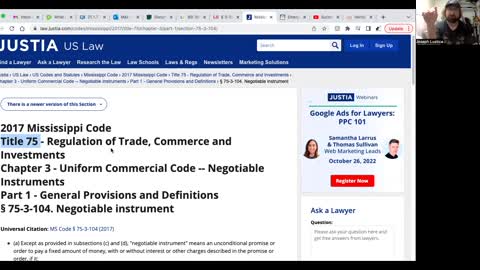

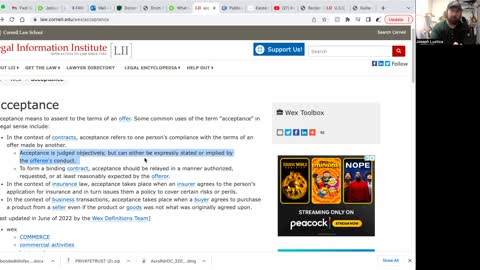

What is a negotiable instrument?

JoeLustica

In this video I give you the UCC meaning of negotiable instrument. This of course is not a simple subject to wrap your head around but I'm going to make a few videos regarding this and help you guys to make your own negotiable instruments.

https://www.law.cornell.edu/ucc/3/3-104#Note

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

42

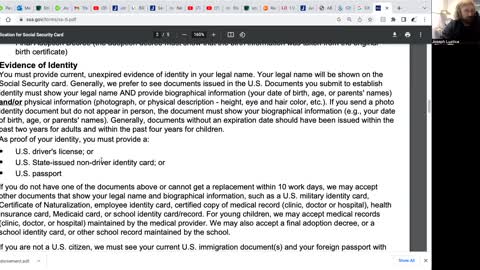

How to get the Certificate of Non-citizen National

JoeLustica

In this video I show you how to get the certificate of Non citizen national. Very simple process to do.

https://www.law.cornell.edu/uscode/text/8/1452

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.75K

views

10

comments

43

How to rescind a mortgage.

JoeLustica

In this video I show you how you can rescind a mortgage. There even is a way to keep the property if you can do it cleverly enough. But you'll have to figure that out on your own.

https://www.law.cornell.edu/uscode/text/15/1635

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.15K

views

2

comments

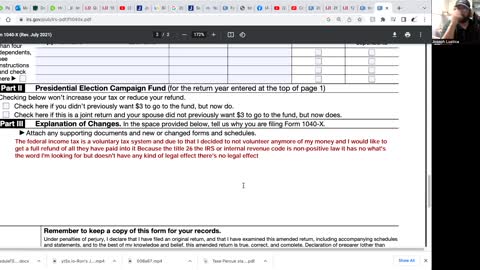

The law that says you do not have to pay taxes

JoeLustica

In this video I show you the US code that says that you do not have to pay taxes and how they trick you into paying taxes. Also once you revoke your taxpayer status you are no longer able to join back into the taxpayer status.

https://www.law.cornell.edu/uscode/text/26/6013

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.49K

views

5

comments

45

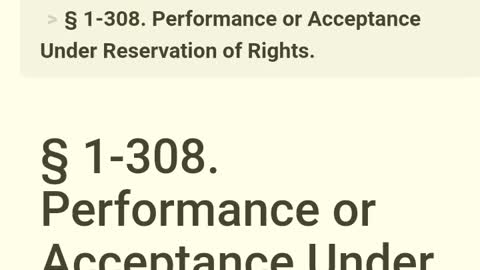

UCC 1-308

JoeLustica

In this video I show you the UCC 1-308 to reserve your rights. Probably one of the most important UCC.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

https://www.law.cornell.edu/ucc/1/1-308

46

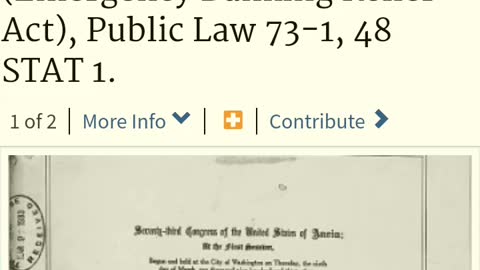

HJR 192 1933

JoeLustica

This is house joint resolution 192 of 1933. This is when Congress Took America off the gold standard and used fiat currency as the legal currency of the United States.

https://www.famguardian.org/Subjects/MoneyBanking/Money/1933-HJR192.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.46K

views

47

The United States government has to pay you?

JoeLustica

This is a well hidden public law that might be of interest to you. The law states that the United states government has an obligation to the promissory notes of individuals

https://catalog.archives.gov/id/299829

1.91K

views

6

comments

48

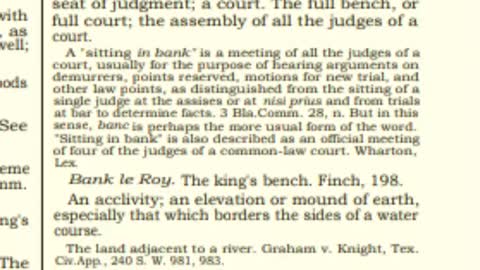

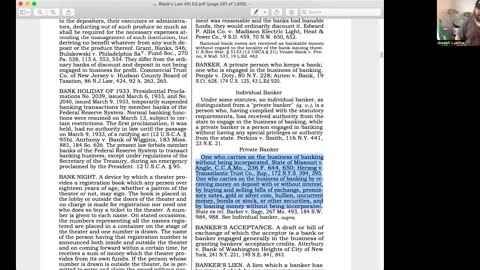

Definition of bank

JoeLustica

Did you know that every time you're going to court you're actually going to a bank? This comes from Black's law 4th edition

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3

comments

49

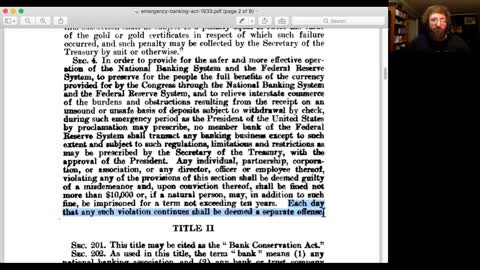

How the government stole the wealth from the American people. (Public Law 73-10 73d Congress)

JoeLustica

(Public Law 73-10 73d Congress, formally HJR 192)

This is a big one! I found the law that states exactly how the government robbed the people of their wealth and switched the banking system. Also because of the new currency not backed by gold they would allow debt to be discharged by the signature of the real and very secret creditor (you) and that the Unites States has an obligation to pay back all public debts (meaning all you spend) Very tricky with words and syntax.

This is also known as the "Emergency Banking Act of 1933"

https://fraser.stlouisfed.org/files/docs/historical/congressional/emergency-banking-act-1933.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.58K

views

7

comments

50

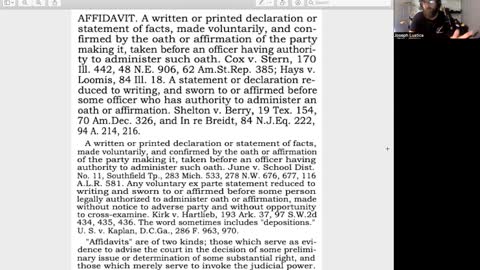

What is an affidavit? How to use one.

JoeLustica

In this video I go over the definition of affidavit in black laws fourth edition. I go over some ways of how are used it and how you can use it as well.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.46K

views

4

comments

51

What is an attorney-in-fact

JoeLustica

In this video I go over a new type of attorney that we haven't discussed yet this is from Andersen's Dictionary of law 1889

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.31K

views

5

comments

52

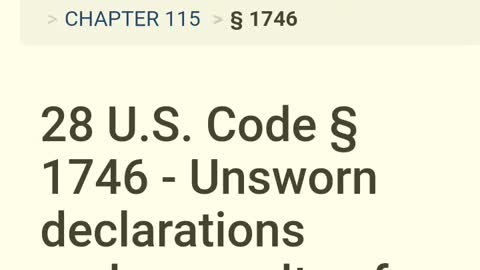

How to write an affidavit (part 1)

JoeLustica

This is a good way to begin your affidavit. I would suggest #1 as the way to go but you do you.

https://www.law.cornell.edu/uscode/text/28/1746

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.17K

views

1

comment

53

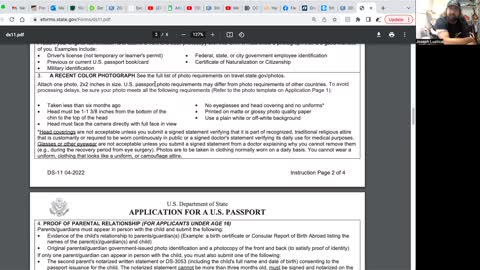

How to get a passport without a birth certificate

JoeLustica

In this video I give you the form that can be used instead of a birth certificate. Share this with someone who might need this.

https://www.us-passport-service-guide.com/support-files/birth_affidavit_ds-10.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.99K

views

4

comments

54

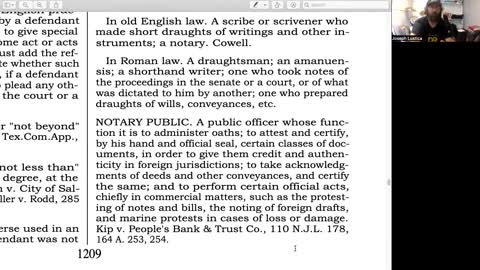

How to write an affidavit (part 2) Notary public

JoeLustica

In this video I go over another part of writing an affidavit I am why you need to get a notary to sign and seal your affidavit.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.82K

views

5

comments

55

Trust fund

JoeLustica

This video I go over the Social Security trust fund what a trustee is and what they're doing with your Social Security on the stock market.

https://www.ssa.gov/news/press/factsheets/WhatAreTheTrust.htm#:~:text=The%20Social%20Security%20trust%20funds,Trust%20Fund%20pays%20disability%20benefits.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.34K

views

3

comments

56

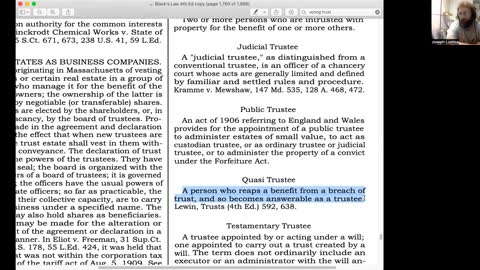

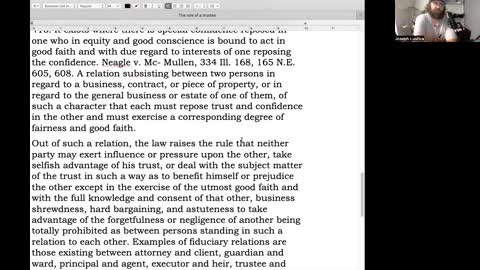

The role of a Trustee

JoeLustica

In this video I go over what some of the roles of a trustee are. These definitions come from Black law 4th and 5th edition

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.42K

views

4

comments

57

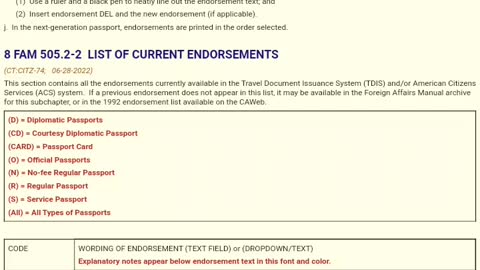

Passport card endorsements

JoeLustica

In this video I show you the passport endorsements. These I believe have more validity than the stars on the passport card. Check it out for yourself and make your own determination.

https://fam.state.gov/FAM/08FAM/08FAM050502.html

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

27

comments

58

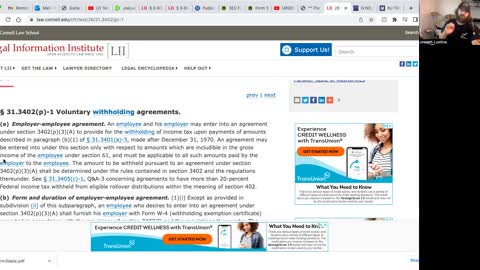

You volunteered to have your taxes taken from your paycheck

JoeLustica

In this video I show you the code of federal regulations that shows that you are voluntarily having your taxes withheld from your paycheck and that your employer is acting as an agent for the IRS to take money from you.

https://www.law.cornell.edu/cfr/text/26/31.3402(p)-1

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.66K

views

1

comment

59

How to peacefully end the W-4 agreement with your employer

JoeLustica

In this video I show you the code of federal regulations that says you can legally and the W-4 agreement with your employer and a form that you could use or at least borrow from in order to ease the tension of the employer feeling any kind of worry regarding the W-4 agreement ending.

https://www.law.cornell.edu/cfr/text/26/31.3402(p)-1

https://famguardian.org/TaxFreedom/Forms/Employers/w-4t.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.41K

views

6

comments

60

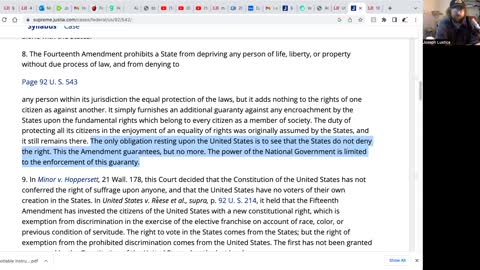

Why the 14th amendment doesn't apply to you

JoeLustica

In this video I go over the 14th Amendment and why it doesn't apply to you. I also show you that definitions of words mean a lot and are very important and vital to understanding and your freedom.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.69K

views

1

comment

61

Nationality, bluff letter, certificates and passports

JoeLustica

In this video I go over a number of things such as the bluff letters that people get and how to rebut them the certificates of non-citizen national or US national certificates and why they don't use them anymore and then the passports and why you have to get a passport instead of the certificate.

https://travel.state.gov/content/travel/en/legal/travel-legal-considerations/us-citizenship/Certificates-Non-Citizen-Nationality.html

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.02K

views

5

comments

62

What is a NOLLE PROSEQUI can I use this?

JoeLustica

In this video I give them definition of NOLLE PROSEQUI. Which you could use as a way to fight civil matter and criminal prosecution. This is from Black's Law 4th Edition. This video is just an introduction to the concept but later videos will dive more into how we can use this to advantage especially if you were innocent of criminal charges.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.25K

views

63

Don't cite HJR 192 when trying to pay taxes with a negotiable instrument

JoeLustica

In this video I show you that the IRS is well aware of HJR 192 and they do not like the fact that people are using it to pay their taxes.

https://www.irs.gov/irm/part21/irm_21-001-007r#idm140539908315840

https://www.irs.gov/compliance/criminal-investigation/program-and-emphasis-areas-for-irs-criminal-investigation

Here's the video that explains why they should be able to accept any of these forms of payment.

https://rumble.com/v13i9l3-when-a-business-refuses-your-payment.html

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.46K

views

6

comments

64

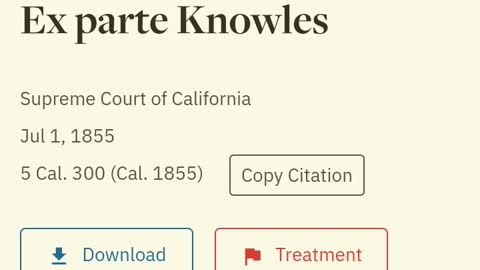

Court ruling: " there is no such thing as a citizen of the United States"

JoeLustica

In this video I show you a Court ruling that first off tells you that Congress does not have jurisdiction over the courts and then two shows by using the Constitution that there is no such thing as a citizen of the United States but only citizens of US state AKA State citizens

https://casetext.com/case/ex-parte-knowles-19

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

6

comments

65

W-8BEN not accepted by your job? Maybe this can help

JoeLustica

In this video I show you the code of federal regulations that shows who is a beneficial owner according to the W-8BEN and that they legally can't refuse it as it pertains to you. (If it does pertain to you) remember this is for people living in the private a.k.a. state nationals a.k.a. non-resident aliens.

Yes it's confusing.

Disclaimer: The IRS does not recognize any status other than the following three: US citizen, resident alien, non-resident alien. If you are to claim anything other than that with your job you will be rejected. (I forgot to mention that in the video)

https://www.law.cornell.edu/cfr/text/26/1.1471-6

https://www.law.cornell.edu/uscode/text/26/1471

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

5.78K

views

4

comments

66

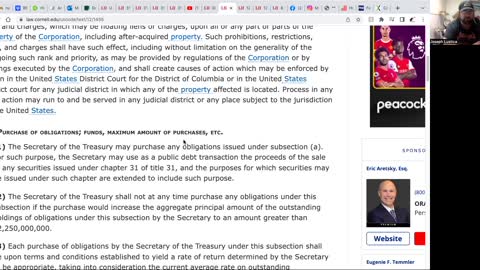

2 US codes that protect your rights against anyone

JoeLustica

In this video I show you the two US codes that will protect your rights from anyone that is trying to deprive you of them or conspiring against your rights. This is a vital part about being a national because this is how you protect your freedom. You must be an unwavering solid piece of steel in regard to your freedom and your rights. This is to empower you and you must retain that power.

https://www.law.cornell.edu/uscode/text/18/242

https://www.law.cornell.edu/uscode/text/18/241

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.83K

views

8

comments

67

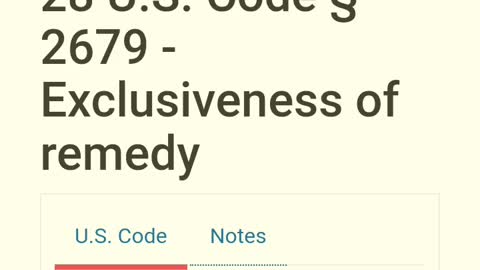

Government employees don't always have immunity

JoeLustica

In this video I show you how hard it actually is to remove the immunity from a government agent or employee.

https://www.law.cornell.edu/uscode/text/28/2679

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

68

What is governmental immunity?

JoeLustica

In this video I go over what governmental immunity is and a little bit into why they give themselves immunity. I know you're really shocked about that one.

https://www.law.cornell.edu/wex/governmental_immunity

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.15K

views

2

comments

69

How to write an affidavit of status (part 3)

JoeLustica

In this video I give you at length how to write your own affidavit of status that you can send them to the secretary of state of the United States in order to update your status to that of a state national rather than a 14th amendment US citizen.

No links in this one because we go through a lot of different stuff just use my rumble channel and any other information that you have outside of the videos I made in order to put together your own affidavit of status.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3.95K

views

13

comments

70

The power of your signature

JoeLustica

In this video I show you the power of your signature. I'm not even being hyperbolic just watch the video and see for yourself.

https://www.law.cornell.edu/ucc/8/8-102

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

4

comments

71

United States government debt obligations

JoeLustica

In this video I show you the law that states the United States government has an obligation to discharge debts from any person.

https://law.justia.com/codes/us/2000/title12/chap2/subchapiv/sec95a

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.43K

views

2

comments

72

Cestui que trust and taxes

JoeLustica

In this video I go over how the cestui que trust is the taxpayer. Not you. But I go over a few definitions as well to clarify what that really means.

https://cite.case.law/wis/148/456/

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.08K

views

5

comments

73

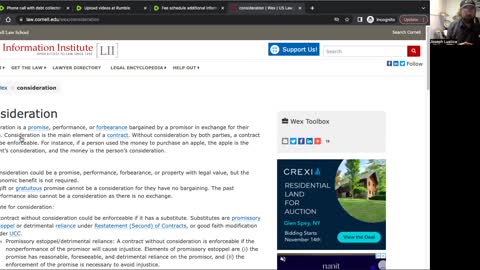

How to void a contract

JoeLustica

In this video I show you the legal remedy that you can use to void contracts and discharge debts and the contract itself.

https://www.law.cornell.edu/ucc/1/1-306

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.06K

views

2

comments

74

how to get all your mail prepaid

JoeLustica

In this video I show you how to get all your mail prepaid. I don't do it to save a buck I do it to show that I'm in the republic and not in the United States corporation.

I wouldn't download and use any of those prepaid stamps that people share in telegram groups personally but you can if you want to. I haven't tried them but I did notice that some were misspelled and don't know what that will do. you can still use 18 USC 1701 to get the mail through I'm sure.

EDIT: I have made my own stamps following this protocol and waited for the results and yes my stamps work they will be found on my telegram channel (ironic right?!)

Telegram: https://t.me/thefreedomfighter_1776

https://www.law.cornell.edu/uscode/text/18/1701

https://pe.usps.com/text/imm/immc7_011.htm

https://www.upu.int/UPU/media/upu/files/UPU/aboutUpu/acts/manualsInThreeVolumes/actInThreeVolumesManualOfConventionEn.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3.42K

views

11

comments

75

Treasury Decision

JoeLustica

In this video I show you a Treasury Decision (TD) that talks about a nonresident alien who is living in the USA. Evidence that the nonresident alien label has nothing to do with location but jurisdiction

http://www.supremelaw.org/td/Treasury.Decision.2313.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.8K

views

1

comment

76

Why sending the Affidavit of status is vital

JoeLustica

In this video I go over exactly why the affidavit of status being sent to the secretary of state of the United States is a vital and important first step in correct in your status as a state national. This court case which is been long forgotten is a vital piece of information and a clue to why affidavits are so powerful.

https://casetext.com/case/urtetiqui-v-darbel-and-others?q=Urtetiqui%20v.%20D%27Arcy&sort=relevance&p=1&type=case&resultsNav=false

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3.37K

views

8

comments

77

What does the IRS Criminal Investigation (CI) do?

JoeLustica

In this video I go over what the CI unit actually addresses. I know a lot of people are concerned and I honestly don't know what they are planning but I think that people are worried about nothing. But You never really know for sure.

https://www.irs.gov/compliance/criminal-investigation/program-and-emphasis-areas-for-irs-criminal-investigation

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.41K

views

1

comment

78

Extortion by officers or government employees

JoeLustica

In this video I show you the law that protects you against extortion from officers or government employees.

https://www.law.cornell.edu/uscode/text/18/872

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.54K

views

79

The right to use the highway

JoeLustica

In this video I show you that you have the right to use the highway and that a driver's license is only a privilege. If you are not a subject then you don't have to have a driver's license you can just use the roads to transport your property lawfully.

Definition of automobile from black laws 4th edition

https://ballentine.en-academic.com/33540/right_to_operate_automobile

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.83K

views

80

Why nationals have diplomatic immunity

JoeLustica

In this video I go over why nationals have diplomat community and citizens do not. Very simple and it has everything to do with residency and jurisdiction. This is why understanding the definitions of words is such a vital component to learning about anything. Without the proper definitions you cannot understand the subject you are studying plain and simple.

Make sure you do your own study on this: https://www.law.cornell.edu/uscode/text/28/part-IV/chapter-97

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.79K

views

11

comments

81

Admiralty and Maritime Jurisdiction

JoeLustica

In this video and show you the code that shows that the district courts have Admiralty and maritime jurisdiction. This has been used by people to shrug off the claims about maritime law and admiralty law being used in the courts as nothing more than a conspiracy theory.

https://www.law.cornell.edu/uscode/text/28/1333

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.34K

views

3

comments

82

Postive and non positive law

JoeLustica

In this video I show you what the difference between positive law and non positive law.

Definitions from black's law 4th edition

https://uscode.house.gov/codification/legislation.shtml

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.26K

views

1

comment

83

42 CFR 100.3

JoeLustica

In this video I go over 42 CFR section 100.3 I don't want to put too much information into this description as it may get people b@nned on social media for sharing this video. I want this video to be shared so I'm trying everything I can to protect people sharing it from getting b@nned on social media

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.15K

views

1

comment

84

A rejected payment is still a payment

JoeLustica

In this video I show you the UCC that states that a rejected payment is still a payment. Use this to your advantage! The banks are taking advantage of your ignorance! A negotiable instrument can be made and used by you! You've done it before, you just didn't know.

https://www.law.cornell.edu/ucc/3/3-603

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3.16K

views

9

comments

85

End the debt collector mailings

JoeLustica

In this video I show you the reality regarding debt collector sending you mail and what you can do about it.

https://www.law.cornell.edu/uscode/text/18/1341

https://about.usps.com/what-we-are-doing/current-initiatives/delivery-growth-management/section-611.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.74K

views

1

comment

86

Mail Fraud

JoeLustica

In this video I just show you exactly how I handle mail that could be fraudulent.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.5K

views

3

comments

87

Clerks must file what you give them

JoeLustica

In this video I show you the law that states that clerks must file whatever you give them. They are not to refuse anything you give them to file. Once they have the file they must file it. Yes this falls under the public school jurisdiction as well.

https://www.law.cornell.edu/uscode/text/18/part-I/chapter-101

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.05K

views

6

comments

88

Coupon payment not working? Try this!

JoeLustica

In this video I show you how those sneaky assholes have done it again. How they hide the UCC and refuse to enforce it. Look it up by STATE!!! Use the state codes instead of the UCC if that's the game they're playing. If you know they are using it then force them to abide by the laws!!!

https://www.law.cornell.edu/wex/table_ucc?fbclid=IwAR2CGneljbcmvg79nlD4cL-cSiRPMf7vpKxraWYPwUV7I2T8ynff-Zx9Iyk

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

9.62K

views

45

comments

89

You are a foreign government

JoeLustica

In this video I show you how nationals are each considered a foreign government and the group of nationals are also considered a foreign government. You gotta use this data to empower yourself.

https://www.law.cornell.edu/uscode/text/18/11

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.68K

views

6

comments

90

How to turn the payment voucher into a check

JoeLustica

Special note: this video is for entertainment and educational purposes only I am not offering any kind of legal or financial advice.

This video I show you how I use the coupon method to pay debts. You can follow these simple instructions to pay your own debts when you get these vouchers or coupons in the mail.

It is key that you write your own letter along with this explaining the laws of negotiable instruments that way they know that you know what you're talking about and if they do anything to your negotiable instrument or refuse it that the debt will still be discharged anyway.

I am linking the entire article 3 of the UCC because you should study the entire article 3 in order to have a full grasp and understanding of what a negotiable instrument is and the rights that you have.

https://www.law.cornell.edu/ucc/3

28.7K

views

127

comments

91

You are a private banker.

JoeLustica

In this video I show you how you are a private banker and you can use the IRS to pay out your debts using the coupons that you were sent from debt collectors, insurance companies, power companies etc.

This video is actually a lot more in depth than I expected it to be.

https://www.irs.gov/irm/part21/irm_21-001-007r#idm140539908315840

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

6.47K

views

39

comments

92

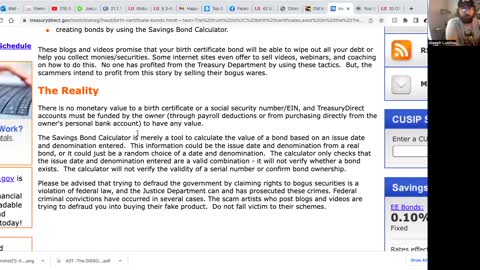

Birth Certificates and bonds

JoeLustica

In this video I show you that the Birth Certificate is a bond. Yet the powers that be want to hide it from you. And they straight up lie about it. They mix lies with facts in order to validate the falsehoods.

https://www.treasurydirect.gov/instit/statreg/fraud/birth-certificate-bonds.htm#:~:text=The%20truth%20is%2C%20birth%20certificates,exist%20in%20the%20Treasury%20system.

https://www.law.cornell.edu/cfr/text/20/422.402

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3.78K

views

8

comments

93

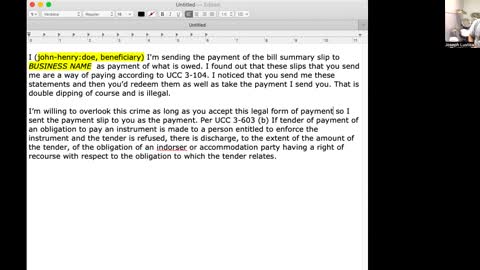

How to write the letter to the corporation for the coupon payment

JoeLustica

In this video I show you how I would write a letter to the corporation regarding a payment coupon. This letter is to let them know that you understand the legality of the negotiable instrument and how it works. You also informing them that even if they were to rejected that because it is a valid form of payment that they still have to discharge the debt. They do not have a choice in the matter if they want to stay in honor.

Here is a link to my Telegram group where I have the file that I wrote in this video: https://t.me/thefreedomfighter_1776

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

11.5K

views

50

comments

94

Why get a foreign EIN number?

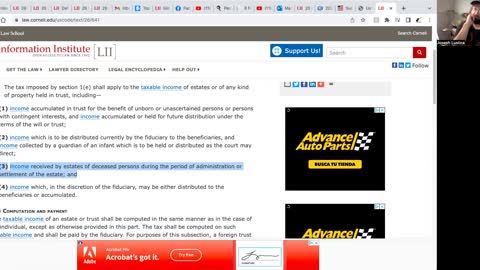

JoeLustica

In this video I show you a good reason why you should get a for an EIN number. Your decision you don't have to do it if you don't want to but it looks like a good reason.

https://www.law.cornell.edu/uscode/text/26/641

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3.08K

views

6

comments

95

Getting the W-8BEN accepted by your job

JoeLustica

In this video I show you the form that you can use to report the person who is refusing to file your W-8BEN. This form can do a lot of good for a lot of other people it's not just limited to the W8-BEN so please share this with other people so that way they can address their own issues with this form.

https://www.irs.gov/pub/irs-pdf/f14157.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

6.75K

views

3

comments

96

How to enforce the coupon payment

JoeLustica

In this video I show you how you can use the form 39 49–8 to enforce your payment using the coupon that they send you.

https://www.irs.gov/pub/irs-pdf/f3949a.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

15.1K

views

56

comments

97

Why your status change isn't retroactive for taxes

JoeLustica

In this video I show you an IRS publication that breaks down exactly what a non-resident alien actually is. Good news is you can fit the criteria of being a non-resident alien as long as you are a national and not a citizen of the United States.

https://www.irs.gov/pub/irs-pdf/p519.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.21K

views

11

comments

98

How to release a federal tax lien

JoeLustica

In this video I go over the process of how to release the United States government from redeeming property from its federal tax lien and getting rid of the lien completely. They will reject it if you have a tax liability still. I forgot to mention that in the video.

https://www.irs.gov/pub/irs-pdf/p487.pdf

https://www.irs.gov/pub/irs-pdf/p4235.pdf

https://www.irs.gov/pub/irs-pdf/p783.pdf

https://www.irs.gov/pub/irs-pdf/p1450.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.36K

views

14

comments

99

Fide-Commissary trust

JoeLustica

In this video I give you the updated and more modernized name for the cestui que trust. This definition comes from black's law fourth edition

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.97K

views

12

comments

100

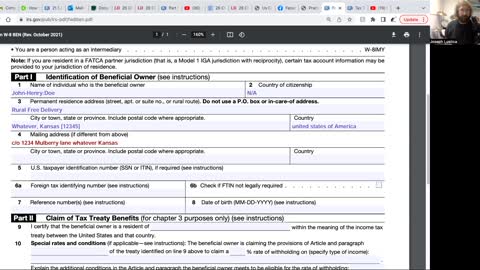

How to fill out the W-8BEN form

JoeLustica

In this video I show you how to fill out the W-8BEN form. you can fill it out right on the computer and then print it out after filling it out as such. sign it after you print it out.

https://www.irs.gov/pub/irs-pdf/fw8ben.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

8.6K

views

31

comments

101

Evidence of a common law marriage

JoeLustica

In this video I go over all the required evidence of a common law marriage. Very simple and keeps your marriage out of the jurisdiction of the government.

https://www.law.cornell.edu/cfr/text/20/404.726

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.64K

views

4

comments

102

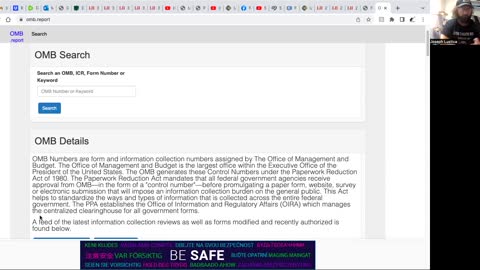

What is an OMB number?

JoeLustica

In this video I go over with an OMB number is. Since this is an executive office action that means that this is coming from the highest office held in the corporation. Anything with an OMB number is a valid form that can be accepted by any corporation or business anywhere in the United States.

https://omb.report/

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.92K

views

11

comments

103

Nationals are internationally protected people

JoeLustica

And this video and show you the code that says that nationals are internationally protected people and that infringing upon your liberties is a fineable and jail-able punishment.

https://www.law.cornell.edu/uscode/text/18/112

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.14K

views

5

comments

104

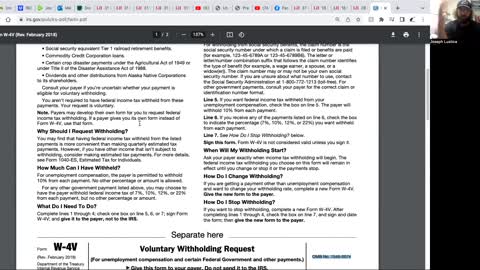

How to fill out the W-4V form

JoeLustica

In this video I show you how to fill out the W-4V form.

https://www.irs.gov/pub/irs-pdf/fw4v.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

5.5K

views

6

comments

105

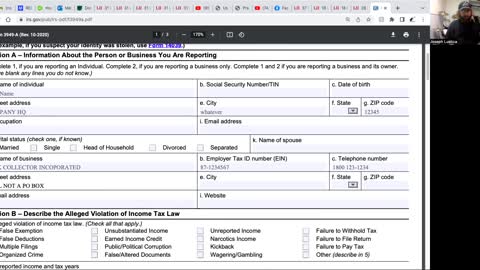

How to fill out the 3949a form

JoeLustica

In this video I show you how to fill out the 3949 form in order to report a business not claiming the income from the coupon payment that you sent them. As you'll see in this video is very important to keep track and records of what you are sending to companies..

https://www.irs.gov/pub/irs-pdf/f3949a.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

4.8K

views

21

comments

106

Your mortgage is a security for the public debt

JoeLustica

In this video I show you how the secretary of treasury is buying all the mortgage securities from the banks issuing securities and how they are using it to pay off the public debt. Which means that all loans and mortgages are completely fraudulent.

https://www.law.cornell.edu/uscode/text/12/1455

https://www.law.cornell.edu/uscode/text/15/78c

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.78K

views

8

comments

107

More on coupon payments

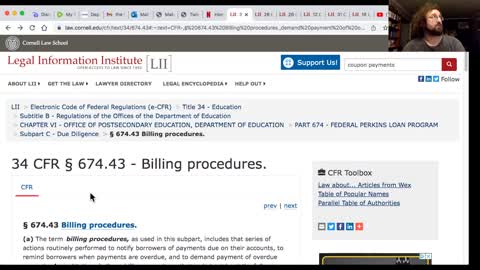

JoeLustica

In this video I go over a little more data about the coupon payments and even a company that processes them as deposits for the companies taking them as payments

https://www.law.cornell.edu/cfr/text/34/674.45

https://www.fiserv.com/

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

8.15K

views

15

comments

108

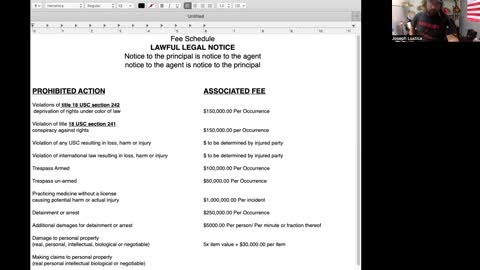

What is a fee schedule?

JoeLustica

In this video I go over the legal definitions of fee and schedule and then we put them together to create a document and put you in complete control of your rights and freedoms. Remember this works because state and federal governments are all corporations and operate under contract law. You can who is this notice on your front door on your car wherever you want I need to put it in order for agents and principles to see the notice.

telegram channel: https://t.me/thefreedomfighter_1776

telegram group: https://t.me/+nfvBqEzQqDA2ZjEx

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

7.87K

views

18

comments

109

Fee schedule additional information

JoeLustica

This video I go over some applications of the fee schedule and some additional things that I didn't put in the original one so I corrected that put the notary in and now you can put anyone you want on notice with this fee schedule now having the power of an affidavit.

If anyone is interested in the plates that I'm going to have made I don't have a price on them so no word on that yet but I should find out soon.

Telegram group: https://t.me/+nfvBqEzQqDA2ZjEx

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

4.62K

views

24

comments

110

What is the postal rule?

JoeLustica

In this video I go over with the postal rule is and how this is applied with contracts. This is contract law and is the epitome of how we can stay in control and remain in power against these corporate bullies.

https://www.law.cornell.edu/wex/mailbox_rule

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.95K

views

3

comments

111

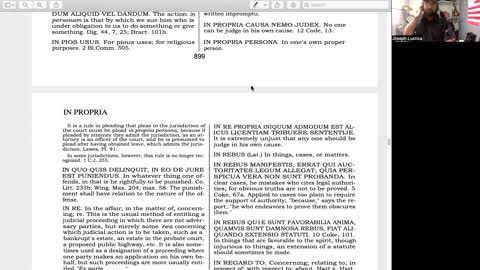

Sui Juris, In Propria Persona

JoeLustica

From Black's law 4th Edition. These phrases can be used in any situation that you feel it is necessary to ensure that people know that you were acting in your own capacity and that you are not in their jurisdiction and are testing it.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.03K

views

4

comments

112

Coupon payment method FAQ

JoeLustica

These are questions I get pretty frequently regarding the coupon payment so watch this video first.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

17K

views

70

comments

113

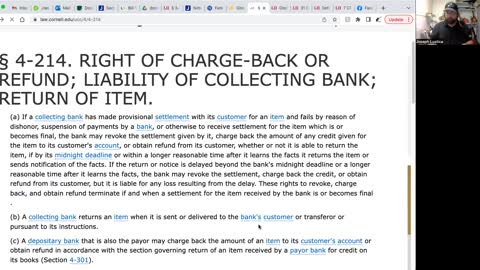

Coupon payment rejection validity

JoeLustica

In this video I go over the validity of a company to reject a coupon payment. There is some legality that they can use but once you know the rules and the guidelines if they cross any of those then they are liable and you can enforce that payment on them.

https://www.law.cornell.edu/ucc/4/4-214

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3.82K

views

14

comments

114

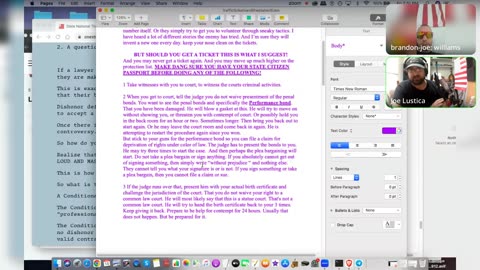

Fee Schedules, Public law 73-10 in the US codes, and so much more with brandon-joe-williams

JoeLustica

This hilarious video was originally recorded for Brandon's Podcast (the Power of Curiosity). We had a lot of fun in this episode and went over a lot of very interesting information regarding the public debt and obligations of the United States and even liquidating the Ens Legis (Legal Entity). There's literally so much more information regarding the public debt in the United States obligation to it that it wouldn't be able to be covered in one single video. But we had a lot of fun talking about this stuff and some new and hilarious ideas about how to use a fee schedule.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

4K

views

7

comments

115

Success with coupon payments with Felisha Beverly

JoeLustica

In this video Felisha and I have a chat regarding the coupon payments and successes with them. How to persevere through rejection, fight back to get them honored and more remedies.

Definitely go check out her youtube channel she has some great stuff for your freedom: https://www.youtube.com/watch?v=6MLyfY1bI0o&t=462s

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

6.75K

views

38

comments

116

US national, state national, US citizen, state citizen clarification

JoeLustica

In this video I go over the difference between the statuses and how they try to use the language to manipulate you into thinking one status is your only status and how to convince you to think that they have jurisdiction and authority over you when they actually do not as long as you voluntarily do not consent to giving them jurisdiction.

https://www.law.cornell.edu/uscode/text/8/1101

https://www.law.cornell.edu/uscode/text/8/1401

https://www.archives.gov/founding-docs/constitution-transcript

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3K

views

3

comments

117

How to find the UCC in the state statutes

JoeLustica

In this video I go over how to find the UCCs in the state statutes. It can be bothersome to go look for it but once you have that information you can just use it over and over again if this is a company you're dealing with regularly.

https://www.law.cornell.edu/ucc

https://www.law.cornell.edu/wex/table_ucc

https://www.law.cornell.edu/uscode/text/18/8

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.28K

views

2

comments

118

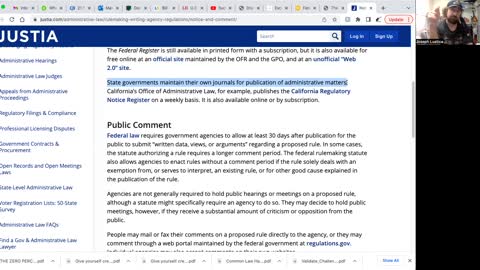

All the mandates were fraudulent (notice and comment)

JoeLustica

In this video I show you the definition of mandate in Black law's 4th edition and go over what noticing comment is. Putting all this together shows you the tremendous amount of evidence that the mask mandates and any other stupid mandates that were put in place during the Covid "pandemic" we're nothing more than tyrannical orders and not legal in anyway whatsoever. It was all fraudulent and done under the manipulation of the uninformed people.

My telegram channel: https://t.me/+nfvBqEzQqDA2ZjEx

https://www.justia.com/administrative-law/rulemaking-writing-agency-regulations/notice-and-comment/

https://www.federalregister.gov/uploads/2011/01/the_rulemaking_process.pdf

https://www.federalregister.gov/documents/current

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.44K

views

2

comments

119

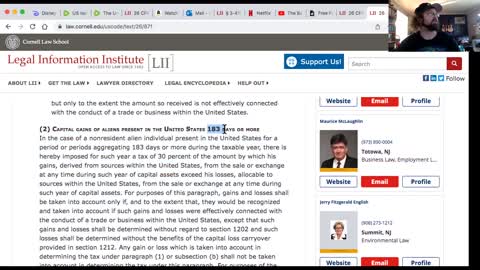

Tax liability for non-resident aliens

JoeLustica

In this video I go over all the taxes a non-resident alien has to pay on their income. Don't let them fool you. Do your research and do it throughly. They are manipulative and deceptive to the bone. All this is to confuse you and make you acquiesce to their apparent authority. They actually have none if you don't grant it.

https://www.law.cornell.edu/cfr/text/26/1.1-1

https://www.law.cornell.edu/uscode/text/26/871

https://www.law.cornell.edu/uscode/text/26/877

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3.64K

views

18

comments

120

What to do when the post office rejects your stamps

JoeLustica

In this video I show you the law that states that they can't ask for postage once you put the stamp on there that says postage paid or write postage paid on your envelope with your thumbprint as the stamp. By law it is considered prepaid and they have to accept it. If they send it back to you you can use this code to let them know that they're in violation of the law.

https://www.law.cornell.edu/uscode/text/18/1726

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.5K

views

10

comments

121

The reason people don't join the national movement

JoeLustica

In this video I break down the exact reason (not the only reason but probably the number one reason) why people don't get into this movement of freedom. Why they don't become nationals and change their status. Why they refuse to leave the tax system legally. And why they always say things like "i'll take a look at it some other time".

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.75K

views

10

comments

122

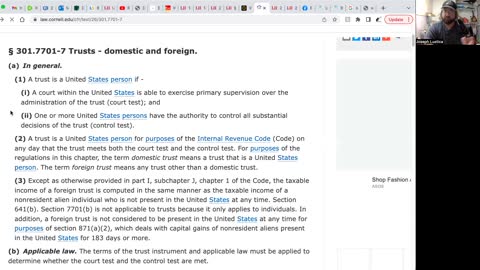

A Trust is a United States person

JoeLustica

In this video I break down how a trust falls into the jurisdiction of the United States government. That trust is the name on the drivers license and other such instruments that they use in order to gain jurisdiction over people. And by people I mean real people actually letting people not artificial persons or legal entities. When you go to court it is a trust that they are referring to as the person.

https://www.law.cornell.edu/cfr/text/26/301.7701-7

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.74K

views

1

comment

123

The difference ink colors and their usage

JoeLustica

In this video I go over a pretty brief version of this huge document and I have regarding in colors their usage and their purpose. I haven't found anything that explicitly states the meaning of the different colors of ink but their usage is important and gives us huge insight into the meaning of these colors. But really the only thing that actually matters is how to use them. And the only colors that are mentioned are blue, black and red.

Telegram group: https://t.me/+nfvBqEzQqDA2ZjEx

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.45K

views

7

comments

124

The first steps to becoming a national

JoeLustica

In this video I go over the first steps to becoming a national and why this is in my opinion the best way to start it off. One thing is that it is simple and I'll give you some basic information that you need in order to obtain and retain your rights in the future. This will prevent you from getting letters back from the department of state stating that you were a citizen and not a national. By doing this this will help you stay out of the court system. This is a preemptive strike to obtain your freedom. If you sit back and wait for them to strike first you will lose. That's why I say do the affidavit of status first.

Your affidavit is your freedom shield.

https://guitareducate.com/reclaim-your-freedom

https://travel.state.gov/content/travel/en/legal/travel-legal-considerations/us-citizenship/Certificates-Non-Citizen-Nationality.html

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

5.84K

views

43

comments

125

More on the postal rule

JoeLustica

In this video I go over more things about the postal rule and how you can use it to your advantage. But also where is that you cannot use it. So we go into more definitions and get a better understanding regarding how this rule actually works and how it's being used against you constantly.

https://www.law.cornell.edu/wex/mailbox_rule

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.24K

views

2

comments

126

National banks are Federal Reserve Banks

JoeLustica