Premium Only Content

Don't Count On Gov Handouts For Retirement, We're A Few Short Years From A Social Security Crisis

Subscribe to grow at home http://youtube.com/c/growathome

and subscribe to our backup channel

http://bit.ly/backupchannellbry

http://silverreportuncut.com

Subscribe to the SRU podcast

http://soundcloud.com/silverreport

http://silverreportuncut.podbean.com

Follow Us On Telegram http://t.me/silverreport & https://parler.com/profile/silverreport/posts

anyone can post on our public group http://t.me/silverreportforum

Ad revenue is down almost 70%, it's viewers like you who help keep the sru coming! you can donate via crypto at our website or consider supporting our work on

http://buymeacoffee.com/silverreport

https://www.patreon.com/silverreport

Social Security provides the majority of income to most elderly Americans. The system provides at least 50 percent of incomes for about half of seniors. For roughly 1 in 4 seniors, it provides at least 90 percent of total incomes. But, that dependency ratio is directly tied to the financial insolvency of the vast majority of Americans. According to a CNBC report:

“Morning Consult found that nearly 18% of adults with an annual income of $50,000 or less have no savings, while some 34% have enough to cover just three months of expenses. Another 11% would deplete savings within six months. Only 10% of that income group has more than a year’s worth of cash.

Higher-income households are only somewhat better prepared, the survey found. Among those with annual incomes of $50,000 to $100,000, about 18% said they have between three months and six months of savings. About 25% said their cash would last less than three months, and 6% had set aside nothing at all. None of those questioned in that income group had more than a year’s worth of savings.”

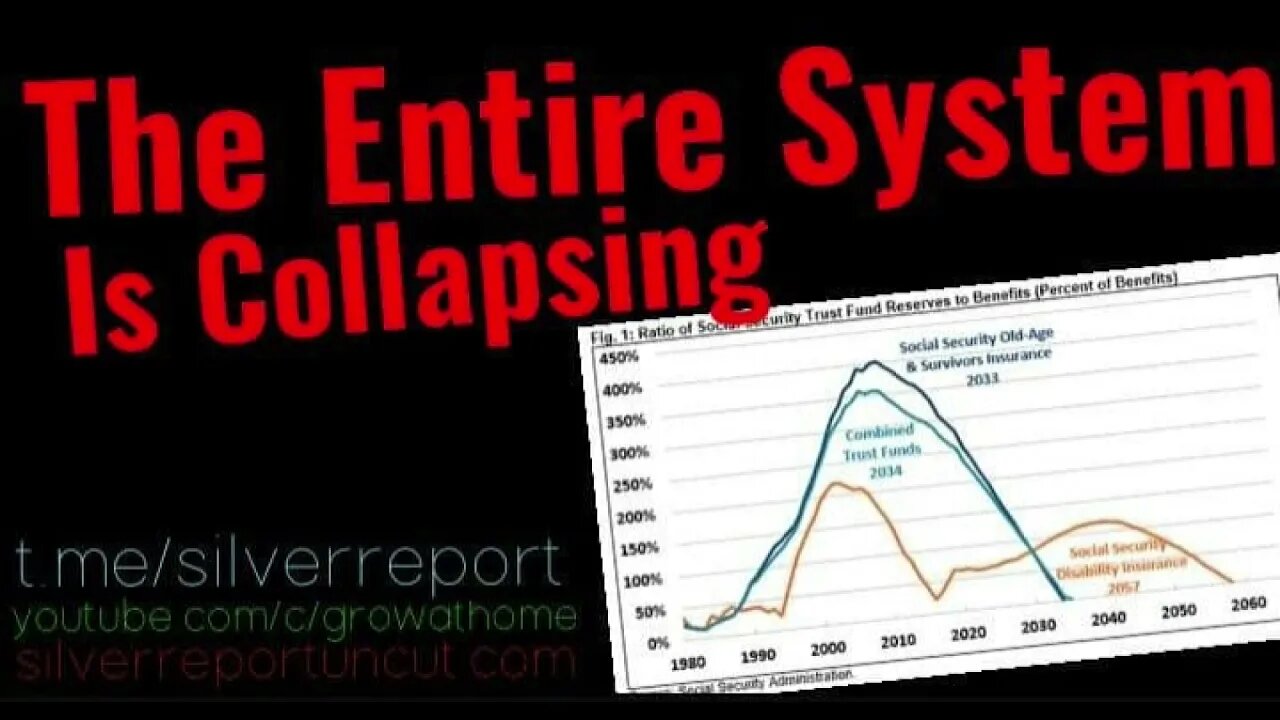

There's just one problem, Social Security is Only 13 Years from Insolvency. Social Security cannot guarantee full benefits to current retirees under current law. The Trustees project the Social Security Old-Age and Survivors Insurance (OASI) trust fund will deplete its reserves by 2033. The Social Security Disability Insurance (SSDI) trust fund will be insolvent by 2057. The theoretical combined trust funds will exhaust their reserves by 2034. Upon insolvency, all beneficiaries will face a 22% benefit cut.

-

16:33

16:33

SRU

3 years ago $0.06 earnedMy 5 Youtube Channels Stolen By Elon Worshipping Hacker Who Absorbed My Online Identity

7486 -

15:18

15:18

MetatronHistory

2 days agoThe REAL Origins of the SUMERIANS

7.78K2 -

22:43

22:43

Nikko Ortiz

14 hours agoGhost Of Tabor Is Like Fent...

12.5K2 -

17:44

17:44

The Pascal Show

14 hours ago $1.24 earnedNOW LAPD IS LYING?! TMZ Doubles Down On Source's "Celeste Rivas Was FROZEN" Claims

8.43K3 -

18:05

18:05

GritsGG

15 hours agoThis Duo Lobby Got a Little Spicy! We Have Over 20,000 Wins Combined!

9.43K -

LIVE

LIVE

Lofi Girl

3 years agolofi hip hop radio 📚 - beats to relax/study to

254 watching -

37:08

37:08

MetatronGaming

2 days agoWarhammer Shadow of The Horned Rat DOS Version is FANTASTIC! 1995

19.3K2 -

2:03:36

2:03:36

FreshandFit

13 hours agoAkaash Replies to FreshandFit w/ Girls

195K27 -

1:07:49

1:07:49

Man in America

13 hours agoBANNED TECH: The Tesla Secrets Rockefeller Crushed to Keep You Sick w/ Linda Olsen

46.8K7 -

4:40:43

4:40:43

Drew Hernandez

1 day agoCANDACE OWENS ASSASSINATION PLOT?

50.5K24