Premium Only Content

Why Isn't The Gold Price Rising? Inflation Fears Persist Along With The Fed's Insane Money Printing

Gold. What’s wrong with it? From spiking inflation, falling real interest rates, and massive money printing, Visit our sponsor https://nevadaking.ca/

TSX-V: NKG I OTC: VKMTF

it seems logical that gold, a touted inflation hedge, should be rising. Yet, so far this year, gold has done little.

Another Compelling point is the relative performance of the gold mining stocks along with the gold price. With the latter soaring over the past five years you would think that the former would be outperforming and yet the miners’ performance has been absolutely pathetic compared to the S&P 500.

So, what’s wrong with this precious metal? nothing. one MUST buy low, when it feels the worst and when everything says NO, the courage must be to charge ahead and buy equities at bottoms, not tops.

Nevada King has staked 7,000 claims in Nevada's most prolific mineral belt, Battle Mountain, since its formation in 2015, at the depths of the bear market in gold, when little money and few investors were willing to engage in contrarianism and to risk time and funds on entrepreneurship.

Think about going from ZERO claims to over 7,000 in just a few years. It is excruciating work since every stake requires putting five poles in the ground, filing with the federal government, and maintaining the annual fee on all of them.

If you try to do this now, you'll soon find out that there are very few left. How potentially rewarding was this in monetary terms?

Nevada is the #1 gold-producing region on planet Earth. If it was its own country, it would be the 4th-largest producer!

The value proposition of this company is in the fact that if any large-cap, billion-dollar producer wants exposure to a wide range of exploration claims that are currently wholly-owned by Nevada King , they will probably have to essentially go through it.

The company states that 98% of its ground has been acquired via staking and as such, the company does not owe past owners royalty rights or JV agreements on the majority of its ground. We, the shareholders, are the legal claim holders!

This team, made up of Collin Kettel, Paul Matysek and Doug Foster are behind another gold company, whose market cap has appreciated by 300% in the past 6 months!

Paul Matysek is part of Lithium X, which soared 500% in 18 months and was sold at its peak price! This year, the biggest winner in the entire gold sector has been a company named New Found Gold. The same founders, same management team and same strategy that they've used to build a $1.6bn giant are executed with Nevada King right now, yet its market cap is only $80mn, so there's a 2,000% gap!

This video was conducted on behalf of Nevada King and was funded by Gold Standard Media LLC and/or affiliates. For our full disclaimer, please visit

https://www.goldstandardir.com/nevada-king-disclaimer-2/

-

14:19

14:19

SRU

2 years ago $0.02 earnedThe Dollar Is Once Again The World's Problem - Chinese State Urges De-Dollarization - A Rising Trend

184 -

1:32:08

1:32:08

Robert Gouveia

4 hours agoNew Year TERROR; Trump Speaks at Mar-a-Lago; Speaker Johnson FIGHT

35.4K28 -

22:21

22:21

Russell Brand

1 day agoVaccines Don't Cause Autism*

118K609 -

2:05:27

2:05:27

The Dilley Show

4 hours ago $14.79 earnedNew Years Agenda, New Orleans Terror Attack and More! w/Author Brenden Dilley 01/01/2025

56.3K18 -

25:45

25:45

Outdoor Boys

2 days ago3 Days in Arctic Survival Shelter - Solo Bushcraft Camping & Blacksmithing

44.6K18 -

2:59:05

2:59:05

Wendy Bell Radio

11 hours agoAmerica Is Back

95.6K107 -

1:45:57

1:45:57

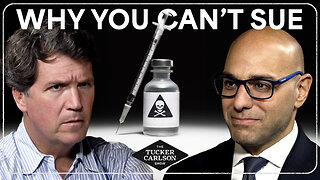

Tucker Carlson

5 days agoAaron Siri: Everything You Should Know About the Polio Vaccine, & Its Link to the Abortion Industry

131K176 -

1:46:38

1:46:38

Real Coffee With Scott Adams

6 hours agoEpisode 2707 CWSA 01/01/25

42.4K26 -

14:06

14:06

Stephen Gardner

6 hours ago🔥Trump FIGHTS BACK: Biden White House BUSTED in MAJOR SCANDAL!

50.6K170 -

6:08:13

6:08:13

MissesMaam

18 hours agoCelebrating New Years 2025 💚✨

90.4K18