Premium Only Content

Wall Street Cashes In As Inflation Wrecks Consumer Confidence, Inflation Fears Worst Since 2008

Subscribe to http://youtube.com/c/growathome

follow our backup channel

http://bit.ly/odyseesru

http://silverreportuncut.com

Subscribe to the SRU podcast

http://soundcloud.com/silverreport

http://silverreportuncut.podbean.com

Follow Us On Telegram http://t.me/silverreport & https://parler.com/profile/silverreport/posts

anyone can post on our public group http://t.me/silverreportforum

Ad revenue is down almost 70%, it's viewers like you who help keep the sru coming! you can donate via crypto at our website or consider supporting our work on

http://buymeacoffee.com/silverreport

https://www.patreon.com/silverreport

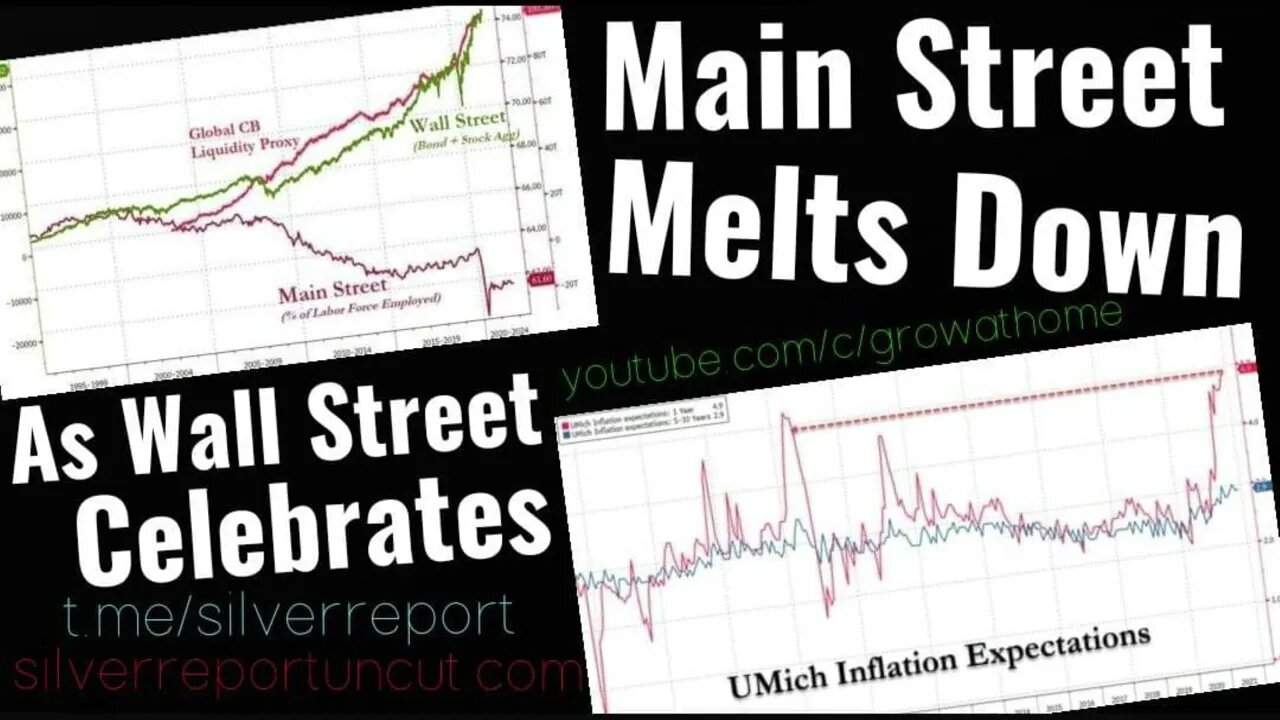

Since around the year 2000, Wall Street and Main Street have been decoupling. The Lehman crisis events and government response accelerated that divergence, and, most recently, policymakers' response to the crisis has driven the divided between Wall Street's success and Main Street's distress has never been wider.

This divergence was highlighted even more so today, when Americans' sentiment crashed to its lowest in 11 years (UMich) as stocks rebounded back towards record highs.

UMich headline sentiment plunged from 71.7 to 66.8 (way below the 72.5 expected) - that is the lowest since 2011. Both 'current conditions' and 'expectations' also plunged in preliminary November data.

UMich Director Richard Curtin notes, the plunge in sentiment is "due to an escalating inflation rate and the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation."

-

2:51

2:51

SRU

2 years ago $0.06 earnedThe housing market crash of 2022 no one saw coming, Home Showings Crash 24% And Buyers Evaporate

828 -

22:02

22:02

Mrgunsngear

15 hours ago $2.74 earnedHeckler & Koch Full Size VP9A1 F Review: The Best Striker Fired Duty Handgun?

4.09K13 -

17:14

17:14

JapaNomad - Video Tours

3 days agoNissan GT-R R35 2AM Tokyo Expressway Run | Pure Car ASMR | No Music | No Voice | 4K HDR

1.65K -

27:35

27:35

NordicVentures

7 days ago3 Days Solo on a Island: How to Build a Simple Beach Shelter!

8451 -

1:46:49

1:46:49

Survival Dispatch

6 days agoThe REAL Truth About Media's Terrorism Coverage vs Reality EP534

1.76K3 -

1:05:12

1:05:12

Greg Hunter's USAWatchdog.com

20 hours ago100% Chance of Nuclear War – Martin Armstrong

51.5K38 -

2:21:13

2:21:13

Tundra Tactical

15 hours ago $5.87 earned"The World's Okayest Gun Live Stream: Reloading Series Announcement & ATF Pistol Brace is Dead

41.8K3 -

45:12

45:12

TheCommonSenseShow

2 days agoCONTRIBUTE AND PROFIT FROM THE NEW DOMINANT MEDIA- SAM ANTHONY

1.46K -

1:23:15

1:23:15

Sports Wars

2 hours agoWNBA Players EMBARRASS Themselves At All Star Game, UFC 318, MLB All Star Game Heroics

20.7K3 -

9:43

9:43

MattMorseTV

1 day ago $90.37 earnedTulsi just DROPPED a BOMBSHELL.

175K356