Premium Only Content

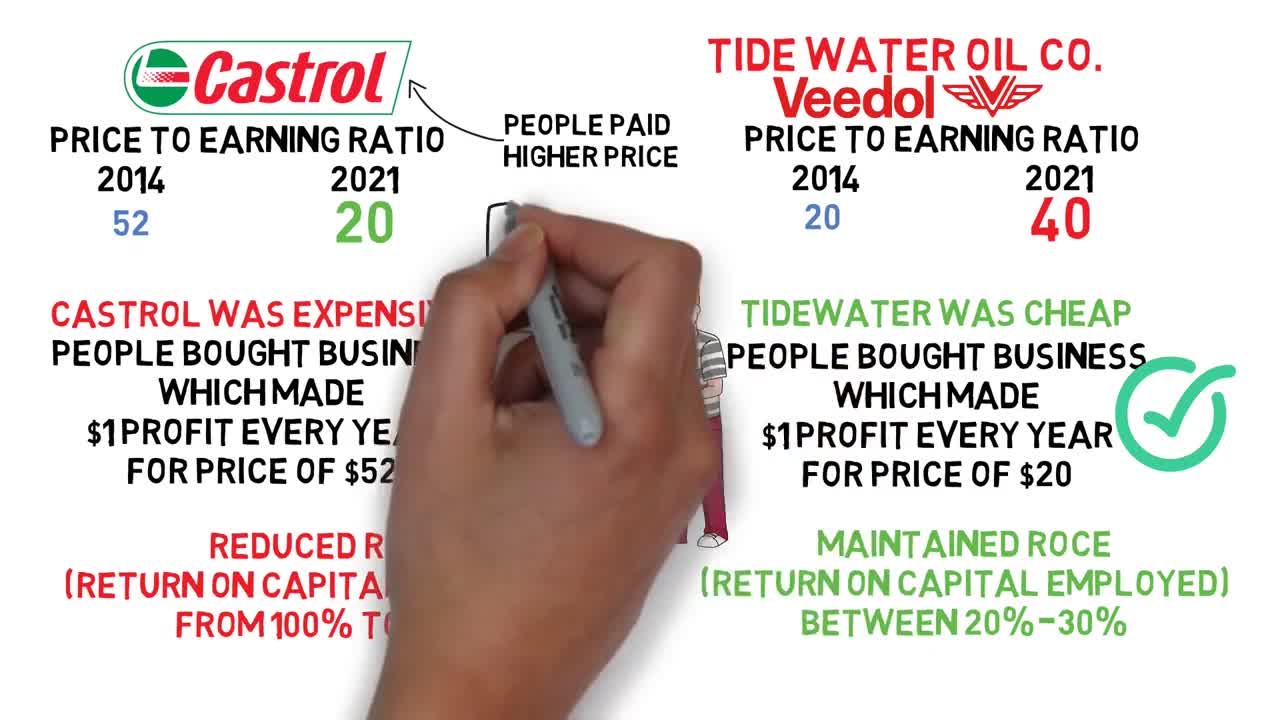

How not to invest (Value Investing and behavioral finance by Parag Parikh)

Parag Parikh in this book explains how our biases and mental heuristics affect our investment decisions. "When others are greedy be fearful and when others are fearful be greedy" - ill-timed bouts of greed and fear among investors make stock markets volatile. Rational and successful investing is all about restraining and channelizing these emotions and understanding behavioral finance, not market sentiments, crowd behavior or company performances. At a time when market upheavals are eroding investors' confidence, dooming life's earnings and corporate fortunes, and whipping up mass hysteria-Value Investing and Behavioral Finance comes as an antidote to investor anxiety and a guide to sane and safe investment decisions. Using investing trends in Indian capital markets over the last three decades, it shows how collective behavioral biases affect investment decisions, returns and market vagaries. As a corrective, it spells out long-term value and contrarian investing strategies based on the principles of behavioral finance. Further, it advises on how to spot investment opportunities and pitfalls in commodity stocks, growth stocks, PSUs, IPOs, sectors and index stocks. It also alerts the reader to a 'bubble' or crisis situation, and ways to identify and insure against it.

-

35:18

35:18

The Quiet Part

2 hours agoMAID Is Coming for the Mentally Ill — But This Could Change Everything

67 -

LIVE

LIVE

LFA TV

14 hours agoLFA TV ALL DAY STREAM - MONDAY 8/25/25

5,079 watching -

LIVE

LIVE

Surviving The Survivor: #BestGuests in True Crime

1 hour agoLIVE Court: Wendi Adelson Testifies Against Mom, Donna Adelson, in Dan Markel's Murder Trial

259 watching -

LIVE

LIVE

JuicyJohns

1 hour ago $0.05 earned🟢#1 REBIRTH PLAYER 10.2+ KD🟢

109 watching -

1:14:57

1:14:57

JULIE GREEN MINISTRIES

3 hours agoRUSSIA IS ABOUT TO RELEASE SOMETHING THAT WILL CRUSH THE ESTABLISHMENT

65.5K156 -

LIVE

LIVE

GritsGG

1 hour agoWin Streaking! Coloring Hair at End of Stream! Most Wins 3435+ 🧠

53 watching -

Welcome to the Rebellion Podcast

20 hours ago $0.03 earnedMonday Funday - WTTR Podcast Live 8/25

12.2K1 -

1:21:24

1:21:24

Game On!

16 hours ago $0.06 earnedTom Brady And The Las Vegas Raiders ARE BACK! 2025 NFL Preview!

30.7K1 -

4:01:45

4:01:45

The Bubba Army

3 days agoShould RaJa Jackson Be Arrested? - Bubba the Love Sponge® Show | 8/25/25

40.2K7 -

LIVE

LIVE

FyrBorne

15 hours ago🔴Warzone M&K Sniping: Builds So Strong They Think I'm Hacking

197 watching