Premium Only Content

MARCH 2, 2022 IMPORTANT NEW BULLETIN!!! IRS ISSUES FAQS FOR TAX YEAR 2021.

MARCH 2, 2022 IMPORTANT NEW BULLETIN!!! IRS ISSUES FAQS FOR TAX YEAR 2021.

The Internal Revenue Service today issued frequently asked questions (FAQs) for the 2021 Earned Income Tax Credit to educate eligible taxpayers on how to properly claim the credit when they prepare and file their 2021 tax return.

The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families in the form of a credit to either reduce the taxes owed or an added payment to increase a tax refund. The amount of the credit may change if the taxpayer has children, dependents, are disabled or meet other criteria.

These FAQs detail what the EITC is, how it was expanded for 2021, which taxpayers are eligible, and how to claim it.

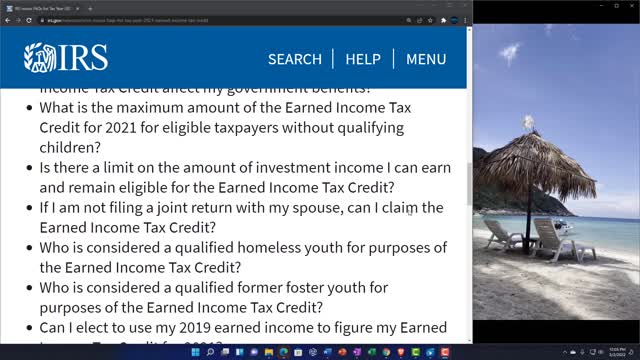

The 17 new FAQs are:

What is the Earned Income Tax Credit?

What is earned income?

What are the earned income limits for taxpayers without qualifying children?

How old must I be to claim the Earned Income Tax Credit if I do not have qualifying children?

Do I need to have a Social Security number (SSN) to be eligible to claim the Earned Income Tax Credit?

Do my qualifying children need to have SSNs in order for me to claim the Earned Income Tax Credit?

What are the age requirements for claiming the Earned Income Tax Credit if I have a qualifying child?

What are the earned income limits for individuals with a qualifying child?

Will any refund that I receive because I claimed the Earned Income Tax Credit affect my government benefits?

What is the maximum amount of the Earned Income Tax Credit for 2021 for eligible taxpayers without qualifying children?

Is there a limit on the amount of investment income I can earn and remain eligible for the Earned Income Tax Credit?

If I am not filing a joint return with my spouse, can I claim the Earned Income Tax Credit?

Who is considered a qualified homeless youth for purposes of the Earned Income Tax Credit?

Who is considered a qualified former foster youth for purposes of the Earned Income Tax Credit?

Can I elect to use my 2019 earned income to figure my Earned Income Tax Credit for 2021?

Can a student claim the Earned Income Tax Credit for 2021?

What is a specified student for purposes of the Earned Income Tax Credit?

File for free and use direct deposit

Taxpayers with income is $73,000 or less can file their federal tax returns electronically for free through the IRS Free File Program. The fastest way to receive a tax refund is to file electronically and have it direct deposited into a financial account. Refunds can be directly deposited into bank accounts, prepaid debit cards or mobile apps as long as a routing and account number is provided.

More information about reliance is available.

-

0:36

0:36

Danny Rayes

2 days ago $0.40 earnedFacebook Needs To Be Stopped...

1.89K2 -

LIVE

LIVE

Total Horse Channel

15 hours agoAMHA World Show 2025 9/21

1,521 watching -

1:29:02

1:29:02

Game On!

1 day ago $6.26 earnedTHEY'RE BACK! NFL Wise Guys Return For Week 3 BEST BETS!

26.3K2 -

6:16

6:16

China Uncensored

1 hour agoHow Trump Plans on Stopping Russia and China—Without Firing a Shot!

3.7K3 -

33:13

33:13

Ohio State Football and Recruiting at Buckeye Huddle

13 hours agoOhio State Football: 10 Things We Learned Watching Washington's Win over Colorado State

2.25K -

1:14:04

1:14:04

NAG Entertainment

13 hours agoKickback w/ Leon - Rocket League: Road to GC

8.59K -

30:13

30:13

Degenerate Plays

1 hour agoBritish Insults Are Hilarious - Call of Duty: Modern Warfare 2 (2009) : Part 2

3.94K1 -

6:42

6:42

NAG Daily

17 hours agoCharlie Kirk: His Words. His Vision. His Movement.

29.6K25 -

21:42

21:42

Jasmin Laine

19 hours ago“Kimmel Isn’t a Victim, Charlie Kirk Was”—Gutfeld OBLITERATES Liberal Media Over FAKE Outrage

30.3K26 -

33:59

33:59

ComedyDynamics

23 days agoBest of Jim Breuer: Let's Clear the Air

77.2K20