Premium Only Content

30 TRILLION NATIONAL DEBT

WHO IS HOLDING ALL THIS DEBT?

The U.S. national debt exceeded $30 trillion for the first time, reflecting increased federal borrowing during the coronavirus pandemic.

Total public debt outstanding was $30.01 trillion as of Jan. 31, according to Treasury Department data released Tuesday. That was a nearly $7 trillion increase from late January 2020, just before the pandemic hit the U.S. economy.

The total debt comprises debt held by the public and intragovernmental debt. The debt milestone comes at a time of transition for U.S. fiscal and monetary policy, which will likely have implications for the broader economy. Many of the federal pandemic aid programs authorized by Congress have expired, leaving Americans with less financial assistance than earlier in the pandemic.

Quick Rise

U.S. debt has increased by nearly $7 trillion since the start of the Covid-19 pandemic.

U.S. total public debt outstanding, daily

Source: Treasury Department

Meanwhile, the Federal Reserve has signaled it could soon begin to raise short-term interest rates from near zero in an effort to curb inflation, which is at its highest level in nearly four decades.

“This is a jaw-dropping number that is a real cause for concern,” said Maya MacGuineas, president of the nonpartisan Committee for a Responsible Federal Budget. “It is the result of both borrowing for really important crises, most notably the Covid pandemic, but also trillions and trillions of borrowing for no reason other than politicians have stopped being willing to pay the bills.”

Congress during the Trump and Biden administrations authorized trillions of dollars in spending for pandemic programs aimed at supporting small businesses, unemployed workers, families with children, renters, and other groups. Those programs included the expanded child tax credit, enhanced unemployment benefits, and the Paycheck Protection Program.

The Treasury Department declined to comment on the public-debt milestone.

“In responding to the downturn in the economy induced by the pandemic, we felt and I strongly believe that it was appropriate to engage in spending that wasn’t financed by tax increases,” Treasury Secretary Janet Yellen said at the World Economic Forum last month.

“It’s important to evaluate debt sustainability in the context of the interest-rate environment,” she said, adding that the interest burden of U.S. debt is “very manageable” because of low-interest rates.

The national debt of the United States is the total unpaid borrowed funds carried by the federal government. [4] Government debt increases as a result of government spending, and decreases from tax and other revenues. Both of these fluctuate during the course of a fiscal year.

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year, the national debt increases as the government need to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

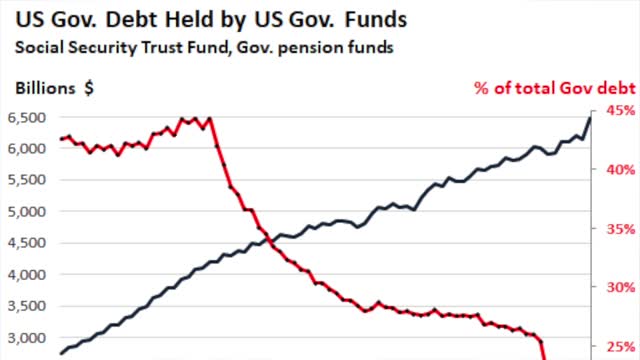

"Debt held by the public" – such as Treasury securities held by investors outside the federal government, including those held by individuals, corporations, the Federal Reserve, and foreign, state, and local governments.

"Debt held by government accounts" or "intragovernmental debt" – is non-marketable Treasury securities held in accounts of programs administered by the federal government, such as the Social Security Trust Fund. Debt held by government accounts represents the cumulative surpluses, including interest earnings, of various government programs that have been invested in Treasury securities.

Historically, the U.S. public debt as a share of gross domestic product (GDP) increases during wars and recessions and then subsequently declines. The ratio of debt to GDP may decrease as a result of a government surplus or via growth of GDP and inflation. For example, debt held by the public as a share of GDP peaked just after World War II (113% of GDP in 1945) but then fell over the following 35 years. In recent decades, aging demographics and rising healthcare costs have led to concern about the long-term sustainability of the federal government's fiscal policies.[3] The aggregate, gross amount that Treasury can borrow is limited by the United States debt ceiling.

-

13:48

13:48

NONCONFORMING-CONFORMIST

1 year ago $0.01 earnedThe World As We Currently Know Will Change Forever

361 -

DVR

DVR

Flyover Conservatives

9 hours agoIs AI Actually Alien Intelligence? Dr. Jason Dean Exposes the Dark Side | FOC Show

10.3K -

1:47:36

1:47:36

Glenn Greenwald

5 hours agoJD Vance and Rand Paul Clash on Due Process: War on Terror Echoes; Has the U.S. Given Up on Confronting China? Ben Shapiro's Latest Falsehoods About Israel | SYSTEM UPDATE #510

83K65 -

LIVE

LIVE

RaikenNight

3 hours ago $0.14 earnedExploring the Galaxy of No Mans Sky

145 watching -

LIVE

LIVE

Spartan

5 hours agoRanked and Expedition 33 (NG+4 and all enemies Set to 10x health)

63 watching -

LIVE

LIVE

Jokeuhl Gaming and Chat

8 hours agoDARKTIDE - Warhammer 40k w/ Nubes and AoA

90 watching -

2:19:56

2:19:56

Nerdrotic

14 hours ago $3.03 earnedNerdrotic Nooner 513

40.1K2 -

BigTallRedneck

4 hours agoRANKED FINALS W OMEGA

12.3K -

LIVE

LIVE

Eternal_Spartan

11 hours ago🟢 Eternal Spartan Plays Final Fantasy 7 Rebirth Ep. 3 | USMC Vet | Join the Best Chat on Rumble

68 watching -

1:39:52

1:39:52

megimu32

3 hours agoOTS: Ace Ventura & The Death of 90s Comedy

14.8K8