Premium Only Content

Can My Bank Back Out of a Commitment Letter?

Save 2% When You Buy: https://www.hauseit.com/buyer-closing-credit/

In this tutorial video, we'll go over what a commitment letter is, how binding it is, and under what scenarios a mortgage lender could back out of a loan commitment letter before a residential sale closes.

We'll go over the difference between a pre-approval vs a loan commitment letter. We'll explain how a loan commitment letter will often have many additional terms and outs for the bank, such as requirements for additional documentation needed in order to get a clear to close, or outs for the bank if certain things happen.

We'll also talk about what some of the most common outs for banks to pull funding might be, such as a loss of income. This can happen if the prospective borrower loses his or her job, and thus his or her source of income, prior to closing.

The bank will typically call the borrower's employer just prior to closing, i.e. 1-2 day, to verify employment. If for some reason the borrower lost his or her job before closing, then the bank will most likely exercise its right to cancel its commitment to lend, and thus utilize an out of the commitment letter.

Save 6% When You Sell: https://www.hauseit.com/agent-assisted-fsbo/

.

.

Hauseit Group LLC, Licensed Real Estate Broker

Tel: (888) 494-8258 | https://www.hauseit.com

_

#hauseit #hauseitmiami #hauseitflorida

-

59:21

59:21

Adam Does Movies

5 hours ago $1.24 earnedMore Reboots + A Good Netflix Movie + Disney Live-Action Rant - LIVE

29.6K -

36:28

36:28

TheTapeLibrary

14 hours ago $7.86 earnedThe Disturbing True Horror of the Hexham Heads

57.8K5 -

DVR

DVR

JdaDelete

1 day ago $1.22 earnedHalo MCC with the Rumble Spartans 💥

37.3K5 -

3:52:22

3:52:22

Edge of Wonder

9 hours agoChristmas Mandela Effects, UFO Drone Updates & Holiday Government Shake-Ups

33.8K7 -

1:37:36

1:37:36

Mally_Mouse

7 hours agoLet's Play!! -- Friends Friday!

39.3K1 -

57:45

57:45

LFA TV

1 day agoObama’s Fake World Comes Crashing Down | Trumpet Daily 12.20.24 7PM EST

35K15 -

1:27:17

1:27:17

2 MIKES LIVE

6 hours ago2 MIKES LIVE #158 Government Shutdown Looms and Games!

30.9K10 -

1:07:34

1:07:34

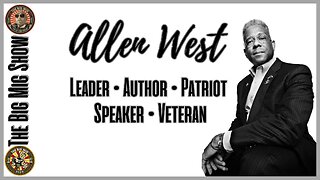

The Big Mig™

11 hours agoVeteran, Patriot, Leader, Author Allen West joins The Big Mig Show

30.3K8 -

1:06:47

1:06:47

The Amber May Show

1 day ago $1.18 earnedBloated CR Failed | What Did The View Say Now? | Who Kept Their Job At ABC| Isaac Hayes

18.5K2 -

59:29

59:29

State of the Second Podcast

4 days agoAre We Losing the Fight for Gun Rights? (ft. XTech)

32.8K3