Premium Only Content

Negative real risk-free interest rate implications

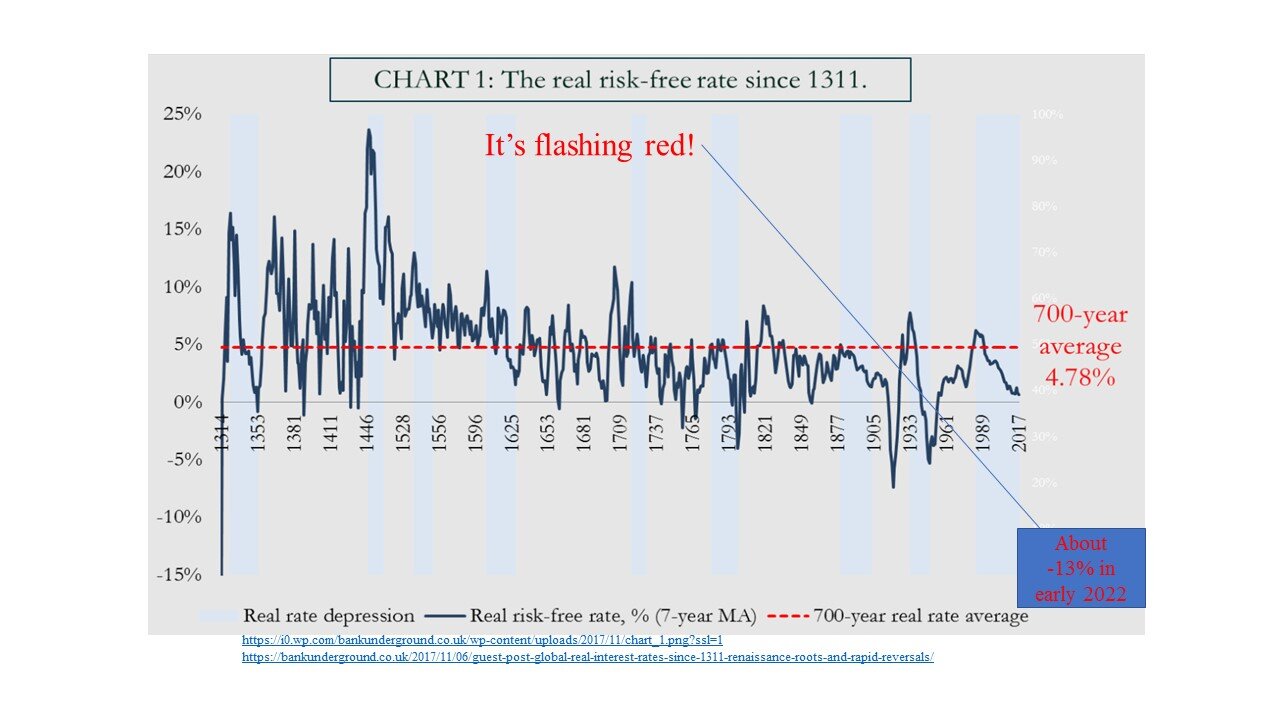

The real risk-free rate is flashing red. A bit of air is starting to come out of bubble stock & bond markets, given the sharp retreat in NASDAQ meme stocks and a persistent, albeit it still muted rise in the benchmark interest rate, the 10-year Treasury. We have ramping insanity, until recently exploding tyranny in OECD nations from Australia to Canada to America, rapidly rising inflation and debt, faltering productivity, terrible economic, financial, and social policy, unparalleled debt, the evisceration of constitutional fidelity and inalienable rights protections for citizens, an open US southern border, and growing geopolitical instability from the Ukraine to Taiwan. If we juxtapose all that against historically negative real risk-free interest rates of up to -13% if we assume a 15% rate of consumer inflation instead of 7.5%, we probably have the most disjointed valuation landscape in the history of recorded time. if we revert back to historical CPI rates that featured more representative consumption weights, no substitution, no fake housing costs, and no hedonics. The chart at the outset of this audio will allude to that. My audio ties into it and asset valuation implications.

-

13:29

13:29

Clintonjaws

14 hours ago $10.64 earnedCNN Host Stops Show & Plays Surprise Clip Forcing Democrat To Correct Lie

19K9 -

14:55

14:55

World2Briggs

17 hours ago $1.10 earnedThe 10 U.S. Cities Americans Can No Longer Afford — 2025 Edition

2.93K -

8:19

8:19

Millionaire Mentor

16 hours agoATC Whistleblower EXPOSES Obama’s Dirty FAA Secret

4.38K5 -

LIVE

LIVE

BEK TV

23 hours agoTrent Loos in the Morning - 11/21/2025

197 watching -

LIVE

LIVE

The Bubba Army

22 hours agoCHICAGO SUBWAY FIRE ATTACK - Bubba the Love Sponge® Show | 11/21/25

2,026 watching -

57:31

57:31

Side Scrollers Podcast

17 hours agoBlabs VS DuckTales

5.98K10 -

8:52

8:52

MetatronGaming

13 hours agoOverwatch 2 New Hero Vendetta La Lupa

109K10 -

1:37:16

1:37:16

omarelattar

22 hours agoEx-Mafia Boss: I Made $8 Million Every Week Until The FBI Destroyed My Life! What I Learned...

23.9K2 -

16:18

16:18

Actual Justice Warrior

15 hours agoJasmine Crockett DESTROYED For Epstein Lies

9.46K17 -

38:25

38:25

Coin Stories with Natalie Brunell

19 hours agoBlackRock's Robbie Mitchnick on Bitcoin ETF Inflows, Risk-On vs Risk-Off & Digital Gold's Future

16.2K5