How to Fill Out IRS Form 8804 & 8805 for Foreign Partners

When a partnership earns U.S. source effectively connected income, it may be required to file Form 8804 & 8805 if there are any foreign partners in the partnership.

The first step is to determine whether the partnership is engaged in U.S. trade or business and has U.S. source ECI.

We have a video here: https://youtu.be/rb3r7FftWfc

Purchase our tax guides and tutorials here:

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

Follow Jason here:

Patreon: https://www.patreon.com/jasonknott

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Quora: https://www.quora.com/profile/Jason-Knott-17

#Form8805 #Form8804 #ECI

DISCLAIMER: I am a licensed attorney and certified public accountant (CPA) in the State of Florida. I am not a financial advisor. The information provided in this video is for entertainment purposes only. No such communication is provided in the course of an attorney-client relationship, and no communication is intended to constitute legal advice. You should speak with your own tax and legal professionals to discuss your circumstances before performing any of the tax, legal or accounting strategies demonstrated in this video. Thank you.

-

11:20

11:20

JasonDKnott

2 years agoHow to Fill Out a Protective Form 1120-F for a Foreign Corporation

52 -

5:41

5:41

Jason D Knott

2 years agoForm 5472 Reportable Transactions for Foreign Owned LLC

59 -

5:37

5:37

Jason D Knott

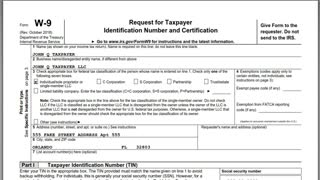

2 years agoHow to Fill Out a Form W-9 for Single Member LLCs

81 -

41:01

41:01

Jason D Knott

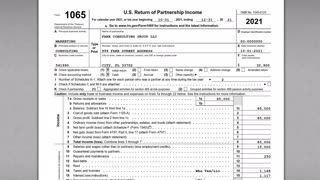

2 years agoHow to Fill Out Form 1065 for 2021. Step-by-Step Instructions

102 -

LIVE

LIVE

Laura Loomer

1 hour agoEP47: Georgia GOP Rocked With Anti-Trump Scandal Ahead of State RNC Convention

1,848 watching -

2:20:49

2:20:49

Roseanne Barr

2 hours agoWe finally got Ryan Long!!!! | The Roseanne Barr Podcast #48

22.4K41 -

1:01:06

1:01:06

The StoneZONE with Roger Stone

4 hours agoWill Terrorists Take Down America's Power Grid? With Glenn Rhoades | The StoneZONE w/ Roger Stone

3.86K15 -

DVR

DVR

Edge of Wonder

4 hours agoAce Ventura: Mandela Detective, King Charles Portrait & Weird News

8.21K5 -

1:40:05

1:40:05

The Quartering

8 hours agoWhy Modern Women Suck w/Hoe_Math

32.3K34 -

1:43:26

1:43:26

Robert Gouveia

4 hours agoGarland SHAKING over CONTEMPT; Congressional MELTDOWN; Fani RAGES at Senate; Tish INVESTIGATED

24.1K32