Premium Only Content

SBA Loans for Your Small Business

An SBA Loan is a government backed loan that can be used to start or expand a business. The loan has certain requirements for eligibility, such as size standards, proving the ability to repay the loan and solid business purpose. The SBA works with specific lenders to offer their programs which eliminate the risk from the lender since they are backed by the government.

Simple Application

Our simple 15 second online application can get you matched with offers in minutes.

No Cost Advisor

You'll get matched with your own dedicated Business Financing Advisor at no cost!

Larger Amounts

Get matched with the best financing options with the highest funding amount.

Express Funding

Our Fintech Speed can reduce your SBA loan process to as little as 45 days!

What Do You Need To Qualify?

3+ Years in Business

You can qualify for our top financing options with as little as 3 years in business.

$83,000+ Monthly Gross Sales

The minimum revenue to qualify for financing options are $83,000+ per month, or $1,000,000 in annual gross sales.

680+ Credit Score Required

We have financing options for all credit profiles. To qualify for funding from the SBA, a 680+ credit score is required.

Simple 15-Second

Business Loan Application

After completing this simple application, we'll pair your with a dedicated Business Financing Advisor to choose the best financing options for your business!

Get Funding Now: https://go.mypartner.io/business-financing/?ref=0014x00000kfYIAAA2

Courtesy of: https://alternativesmallbusiness.fund

-

17:02

17:02

GritsGG

13 hours agoBest Warzone Bundle Ever? Happy 4th of July!

7.28K1 -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

166 watching -

23:30

23:30

The Pascal Show

14 hours ago $0.51 earned‘I FEAR FOR MY LIFE!’ Diddy’s Ex-Chef Speaks Out After Explosive Verdict!”

4.75K2 -

5:45:57

5:45:57

MyronGainesX

15 hours ago $17.40 earned7/4 Merch Drop, Iran Checkmates US? HasanAbi Big Beautiful Bill MELTDOWN And More!

40.5K24 -

6:17:39

6:17:39

SpartakusLIVE

10 hours ago#1 All-American HERO delivers JUSTICE and LIBERTY to the streets of Verdansk

55.6K1 -

51:22

51:22

IsaacButterfield

9 hours ago $2.85 earnedAustralia Bans Kanye & Trump To Host UFC At The White House

16.1K11 -

1:58:26

1:58:26

JustPearlyThings

10 hours agoModern Women Are Saying NO To Independence Day | Pearl Daily

140K134 -

1:43:32

1:43:32

Barry Cunningham

9 hours agoTHE PRESIDENT TRUMP WHITE HOUSE FIREWORKS DISPLAY AND INTERVIEW WITH GENERAL MICHAEL FLYNN

53.7K35 -

31:54

31:54

Iggy Azalea

6 hours ago $5.94 earnedPlaying a lil blackjack on my casino, Mother.land

45K9 -

25:45

25:45

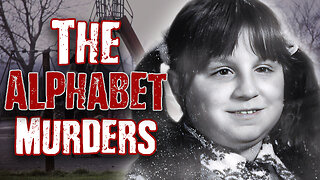

Scary Mysteries

21 hours agoThe Alphabet Murders: Rochester’s Eerie Triple Tragedy

21K7