IRS Form 1040 Schedule 3 - Intro to the Different Fields

Taxpayer's should include Schedule 3 with their Form 1040 if they have additional tax credits or payments that are not already reflected directly on Page 2 of the Form 1040.

In this video, I discuss each line item on Schedule 3 and cover what additional forms or schedules may be required with your Form 1040.

Form 8880: https://youtu.be/w7AdRIAZmWg

Form 5695: https://youtu.be/1fI71WzZo5w

Form 8962: https://youtu.be/w8Xz4V0k-7A

Form 4868: https://youtu.be/nJ6dfk7zDD8

Form 4136: https://youtu.be/V2BLs1Izkdg

Form 2439: https://youtu.be/4-h2T81In4Y

Purchase our tax guides and tutorials here:

https://www.udemy.com/user/jason-knott-2/

https://gumroad.com/jasondknott

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

Follow Jason here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

#IRS #Form1040 #Schedule3

DISCLAIMER: I am a licensed attorney and certified public accountant (CPA) in the State of Florida. I am not a financial advisor. The information provided in this video is for entertainment purposes only. No such communication is provided in the course of an attorney-client relationship, and no communication is intended to constitute legal advice. You should speak with your own tax and legal professionals to discuss your circumstances before performing any of the tax, legal or accounting strategies demonstrated in this video. Thank you.

-

1:11

1:11

HISAdvocates

1 year agoIRS Related Questions

-

1:20

1:20

TaxResolutionProfessionals

1 year agoIRS Form 4506-T - When To Use It

14 -

5:55

5:55

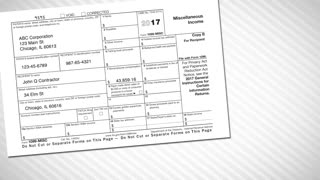

TeoAnon17

1 year agoCorrecting IRS Form 1099s

41 -

12:48

12:48

Delta Pines Subdivision

9 months agoJMRI Operations Pro - Custom Schedules (Part 5)

28 -

46:34

46:34

FreedomLawSchool

1 year agoQuestions to ask a Tax Preparer before hiring them to fill in IRS 1040 forms for you to sign.

45 -

1:47:22

1:47:22

Book Club Analysis

1 year agoOn Schedule F and at-will federal employment (Part 2/2)

112 -

1:47:24

1:47:24

Book Club Analysis

1 year agoOn Schedule F and at-will federal employment (Part 1/2)

115 -

18:01

18:01

JoeLustica

1 year agoFee schedule additional information

3.21K24 -

41:46

41:46

Patriot Radio News Hour

9 months ago🚨 IRS ON A HIRING SPREE: EVERYTHING YOU NEED TO KNOW NOW! 🚨

28 -

1:02:51

1:02:51

Realironeagle1

9 months agoTHE HOUR OF THE TIME #1873 IRS - NOT AN AGENCY

89