How to Complete IRS Form 1099-NEC for an Independent Contractor

Form 1099-NEC is filed by individuals or entities that are engaged in trade or business, and make payments to contractors in the ordinary course of their trade or business.

The 1099-NEC reports nonemployee compensation to an individual or entity if the total payments exceed $600 during the tax year.

Personal payments are NOT reportable. In this video, I discuss a common fact pattern where a business makes a payment to a contractor in the course of its business, and how to complete Form 1099-NEC.

Purchase our tax guides and tutorials here:

https://www.udemy.com/user/jason-knott-2/

https://gumroad.com/jasondknott

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

Follow Jason here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

#IRS #1099NEC #Form1099

DISCLAIMER: I am a licensed attorney and certified public accountant (CPA) in the State of Florida. I am not a financial advisor. The information provided in this video is for entertainment purposes only. No such communication is provided in the course of an attorney-client relationship, and no communication is intended to constitute legal advice. You should speak with your own tax and legal professionals to discuss your circumstances before performing any of the tax, legal, or accounting strategies demonstrated in this video. Thank you.

-

0:29

0:29

johnnycarolina

1 year agoWho Really Needs IRS Form 1099 NEC?

22 -

0:43

0:43

johnnycarolina

1 year agoHow does a Federal 1099 NEC Form affect on taxes?

26 -

4:54

4:54

yellowgenius

1 year agoWe don’t need the IRS

8 -

1:34

1:34

Powerhouse Business Solutions

6 months agoHow to Claim Your Self Employed Tax Credit Fast - SETC for 1099 Contractors

67 -

30:10

30:10

FreedomLawSchool

8 months agoIf I filed an IRS extension to file a 1040 Form, am I required to file by October 15th? (Full)

9843 -

![Can I Get Workers Comp If I Am Not An Employee? Independent Contractor? [Call 312-500-4500]](https://hugh.cdn.rumble.cloud/s/s8/1/a/s/d/h/asdhj.0kob-small-Can-I-Get-Workers-Comp-If-I.jpg) 3:09

3:09

Law Office of Scott D. DeSalvo, LLC

9 months agoCan I Get Workers Comp If I Am Not An Employee? Independent Contractor? [Call 312-500-4500]

10 -

11:13

11:13

Jason D Knott

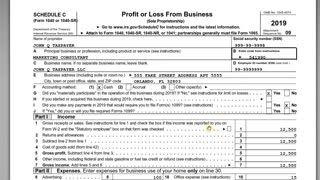

2 years agoIRS Schedule C with Form 1040 - Self Employment Taxes

771 -

24:52

24:52

FreedomLawSchool

1 year agoAre you a State National and so you do not need to file and pay income taxes? (Full)

3841 -

51:34

51:34

FreedomLawSchool

1 year agoI got an IRS Form 1099 – Does this mean I must file Form 1040 and pay Individual Income Tax?

299 -

1:50:33

1:50:33

FreedomLawSchool

1 year agoAre you a State National and so you do not need to file and pay income taxes?

1.27K12