Form 1120 Schedule B - Additional Info For Schedule M-3 Filers

Schedule B is required with a Form 1120 corporate tax return for M-3 filers with more than $50 million in assets.

Not many corporations fall within this category, but if you do, make sure you are completing all required Schedules.

In this video, I discuss Schedule B and one example where it is a required filing for a corporation with an investment in an underlying partnership entity.

Purchase our tax guides and tutorials here:

https://www.udemy.com/user/jason-knott-2/

https://gumroad.com/jasondknott

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

Follow Jason here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

#IRS #Form1120 #ScheduleB

-

1:47:24

1:47:24

Book Club Analysis

1 year agoOn Schedule F and at-will federal employment (Part 1/2)

128 -

18:01

18:01

JoeLustica

1 year agoFee schedule additional information

3.56K24 -

7:28

7:28

EduFlip

7 years agoHave Multiple Forms feed information to a Single Sheet

31 -

![How To Create A Dynamic Appointment Scheduler In Excel [Part 1]](https://hugh.cdn.rumble.cloud/s/s8/1/B/Y/N/r/BYNrb.0kob-small-How-To-Create-A-Dynamic-App.jpg) 1:11:18

1:11:18

Excel For Freelancers

3 years agoHow To Create A Dynamic Appointment Scheduler In Excel [Part 1]

62 -

44:26

44:26

The Perimeter

6 months agoAGENDA 2030: RIGHT ON SCHEDULE?

8702 -

12:48

12:48

Delta Pines Subdivision

11 months agoJMRI Operations Pro - Custom Schedules (Part 5)

28 -

![How to Send Multiple Staff Appointments From Excel To Google and Outlook Calendars: [Part 2]](https://hugh.cdn.rumble.cloud/s/s8/1/D/H/O/r/DHOrb.0kob-small-How-to-Send-Multiple-Staff-.jpg) 1:04:34

1:04:34

Excel For Freelancers

3 years agoHow to Send Multiple Staff Appointments From Excel To Google and Outlook Calendars: [Part 2]

96 -

2:20

2:20

NorzLightworker

7 months agoRedemption Appointments - Latest Information

55 -

11:13

11:13

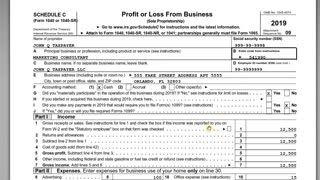

Jason D Knott

2 years agoIRS Schedule C with Form 1040 - Self Employment Taxes

811 -

10:09

10:09

Quickregisterseo Advertising Services and Software and Education

3 years agoHow to fill out the campaign information form after ordering from Classifiedsubmissions.com

7