Schedule H for Household Employee Taxes. Who Needs to File?

If you hire a household worker, you need to carefully assess whether the individual is an employee or a contractor. If the individual is deemed to be an employee of yours, you are now an employer.

As a U.S.-based employer, you as an individual are now required to withhold payroll taxes, pay payroll taxes (Social Security & Medicare), and pay State Unemployment Taxes (SUTA) and Federal Unemployment Taxes (FUTA).

The responsibilities of being an employer are immense.

In this video, I discuss the following topics for a taxpayer that hires a household employee:

1. Employee vs. contractor worker classification

2. Apply for an EIN for payroll purposes

3. Schedule H, Forms W2 & W3, Forms 941 & 940

4. Federal payroll tax withholding and matching

5. State & Federal Unemployment Taxes

Purchase our tax guides and tutorials here:

https://gumroad.com/jasondknott

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

#IRS #NannyTax #HouseholdEmployee

Follow Jason here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

-

1:17

1:17

onlinetaxpreparers

3 years agoOnline Tax Preparation And Filing Service For Individual Returns

13 -

![[2024-01-16] URGENT: DO NOT FILE YOUR TAX RETURN YET (wait until Jan. 29th)](https://hugh.cdn.rumble.cloud/s/s8/6/T/a/3/r/Ta3rp.0kob.jpg) 11:33

11:33

ninjaman1994

5 months ago[2024-01-16] URGENT: DO NOT FILE YOUR TAX RETURN YET (wait until Jan. 29th)

272 -

48:40

48:40

FreedomLawSchool

4 months agoDo you need to file and pay STATE income tax?

2.11K2 -

30:10

30:10

FreedomLawSchool

8 months agoIf I filed an IRS extension to file a 1040 Form, am I required to file by October 15th? (Full)

9843 -

11:08

11:08

CryptoCovert

2 years agoSplassive.com Do this now!!! NO TAXES FOR 24HR NEW U.I.

20 -

![How To Create A Health Clinic Management System With Scheduling & Invoicing In Excel [FREE DOWNLOAD]](https://hugh.cdn.rumble.cloud/s/s8/1/l/R/_/7/lR_7e.0kob-small-How-To-Create-A-Health-Clin.jpg) 2:46:19

2:46:19

Excel For Freelancers

1 year agoHow To Create A Health Clinic Management System With Scheduling & Invoicing In Excel [FREE DOWNLOAD]

84 -

11:13

11:13

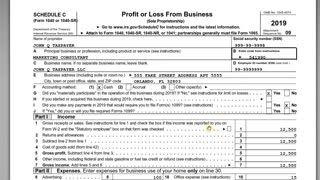

Jason D Knott

2 years agoIRS Schedule C with Form 1040 - Self Employment Taxes

771 -

2:04:43

2:04:43

FreedomLawSchool

8 months agoIf I filed an IRS extension to file a 1040 Form, am I required to file by October 15th?

1.09K5 -

1:20

1:20

onlinetaxpreparers

3 years agoOnline Income Tax Services - Individual Tax Returns Preparation And Filing

67 -

1:05

1:05

ReplaceYourMortgage

1 year agoCan Interest on HELOC be Taken as an Interest Expense for Rental Property on Schedule E?

4