Can I File a Form 1065 For My Single Member LLC?

If you formed a single-member LLC to conduct your business, you are probably wondering about what type of tax returns you need to file.

When a business forms an LLC, there are certain default tax rules that come into play, which must be followed unless you file an election to be taxed otherwise.

A single-member LLC is by default a disregarded entity for federal tax purposes. The LLC can file an election to be taxed as a C or S corporation, or it can add a new LLC member to make it a partnership.

Purchase our tax guides and tutorials here:

https://gumroad.com/jasondknott

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

#IRS #Taxes #Form1065 #Form1120S

Follow Jason here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

-

5:37

5:37

Jason D Knott

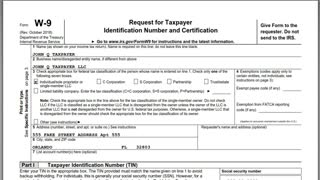

2 years agoHow to Fill Out a Form W-9 for Single Member LLCs

85 -

9:05

9:05

Jason D Knott

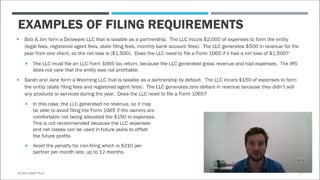

2 years agoDo I Need to File Form 1065 Return if the LLC Lost Money?

46 -

0:16

0:16

The Post Millennial Live

2 years agoGen. McKenzie: “Every single US service member is now out of Afghanistan.”

693 -

1:04

1:04

JB Bliss #12 Moundtime Orange 12u

2 years agoSingle

629 -

1:28

1:28

JB Bliss #12 Moundtime Orange 11u

2 years agoSingle

129 -

0:14

0:14

JB Bliss #12 Moundtime Orange 11u

2 years agoSingle

193 -

0:16

0:16

JB Bliss #12 Moundtime Orange 11u

2 years agoSingle

123 -

0:16

0:16

JB Bliss #12 Moundtime Orange 11u

2 years agoSingle

202 -

0:13

0:13

JB Bliss #12 Moundtime Orange 11u

2 years agoSingle

190 -

0:11

0:11

JB Bliss #12 Moundtime Orange 10u

2 years agoSingle

55