How Is Income Allocated for an S Corporation Form 1120-S?

Once you make an "S" Corporation for your entity, you need to file a Form 1120-S and follow all of the federal tax rules that apply to S corporations.

One of the central tenants of S corporations is the entity must only have one class of stock.

One class of stock essentially means that all items of income, expense, credits, and distributions must be allocated in proportion to the ownership interest percentages of each person.

If you have an S corporation with multiple owners, you need to be mindful of these allocation rules.

Purchase our tax guides and tutorials here:

https://gumroad.com/jasondknott

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

#IRS #Taxes #Form1120S #Scorporations

Follow Jason here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

-

8:00

8:00

Jason D Knott

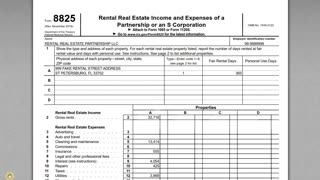

2 years agoIRS Form 8825 - Reporting Rental Income and Expenses

234 -

11:20

11:20

JasonDKnott

2 years agoHow to Fill Out a Protective Form 1120-F for a Foreign Corporation

54 -

9:33

9:33

Jason D Knott

2 years agoIRS Form 1040 Schedule B - Interest and Dividend Income

52 -

6:16

6:16

Ignace Aleya

21 hours agoI Created Planet of the Apes at Home

4835 -

13:39

13:39

Hannah Barron

16 hours agoBowfishing for Stingrays with Heather Lynn

2.72K13 -

51:27

51:27

The Lou Holtz Show

14 hours agoThe Lou Holtz Show Season 1 Episode 13 | Sage Steele on Her Journey in Sports Journalism #podcast

9893 -

6:35

6:35

Dr. Nick Zyrowski

4 days agoWorst Type of Fat On Your Body That Causes Disease

1.62K2 -

3:51

3:51

Brownells, Inc.

14 hours agoFrom the Vault: Remington 11-87 from "No Country for Old Men"

1.33K4 -

25:25

25:25

Degenerate Plays

15 hours agoThe Button Basher Makes A Gamble - Assassin's Creed : Part 4

1.58K2 -

45:45

45:45

Science & Futurism with Isaac Arthur

22 hours ago $0.10 earnedBattlefleets

2.29K2