How do U.S. Gift Taxes Work? IRS Form 709 Example

Have you heard that the U.S. federal government taxes gifts? Believe it or not, you might have to report gifts on a federal tax return if the fair value exceeds certain amounts during the year.

Generally, the donor is required to file all gift tax returns and pay any potential gift taxes. The recipient of the cash or property is not responsible for any gift taxes unless certain exceptions apply (e.g., gifts from non-U.S. persons).

U.S. individuals are allowed an annual gift exclusion of up to $15,000 for the 2020 and 2021 tax years. Any gifts over this amount must be reported.

Purchase our tax guides and tutorials here:

https://gumroad.com/jasondknott

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

Follow Jason here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

#IRS #GiftTaxes #Form709

DISCLAIMER: I am a licensed attorney and certified public accountant (CPA) in the State of Florida. I am not a financial advisor. The information provided in this video is for entertainment purposes only. No such communication is provided in the course of an attorney-client relationship, and no communication is intended to constitute legal advice. You should speak with your own tax and legal professionals to discuss your circumstances before performing any of the tax, legal or accounting strategies demonstrated in this video. Thank you.

-

11:13

11:13

Jason D Knott

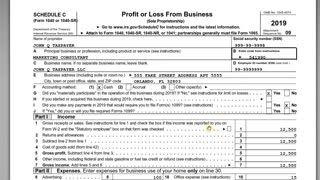

2 years agoIRS Schedule C with Form 1040 - Self Employment Taxes

771 -

5:52

5:52

TaxResolutionProfessionals

2 years agoHow does the IRS collect back taxes?

19 -

5:02

5:02

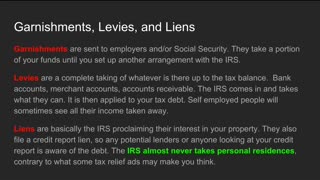

TaxResolutionProfessionals

2 years agoHow does the IRS collect back taxes?

11 -

35:29

35:29

Candace Owens

12 hours agoWhy I Left This Religion | Candace Ep 16

78.3K179 -

1:00:59

1:00:59

Lou Dobbs

12 hours agoLou Dobbs Tonight 7-1-2024

90.6K67 -

1:48:30

1:48:30

Donald Trump Jr.

17 hours agoJill & Joe Have Dems Pressing the Panic Button, Taking Your Questions live! | TRIGGERED Ep.150

216K400 -

2:36:18

2:36:18

WeAreChange

12 hours agoBlack Sex Magic Explained... And Elite Satanic Pedo Culture Exposed!

95.6K45 -

50:14

50:14

Kimberly Guilfoyle

15 hours agoLandmark Supreme Court Immunity Case, Plus Dems' Prop 47 Madness, Live with Jesse Binnall & ASM Bill Essayli | Ep. 138

87.5K47 -

1:03:39

1:03:39

In The Litter Box w/ Jewels & Catturd

1 day agoBidens Blame Staff | In the Litter Box w/ Jewels & Catturd – Ep. 598 – 7/1/2024

128K72 -

7:03:22

7:03:22

Akademiks

20 hours agoDrake's Goons Run Down on Rick Ross in Vancouver! PND vs Chris Brown. Wunna a Rat? Foolio Alive?

158K31