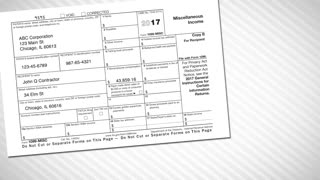

How to Deduct Student Loan Interest on Form 1040 using IRS Form 1098-E

If you borrowed money to fund your college education, the student loan interest expense on your payments may qualify as a tax deduction.

If you started making payments on those loans, the loan company will issue you a Form 1098-E at year-end which shows the amount of interest expense included in the payments.

Student loan interest is deductible up to a maximum of $2,500 (as of 2020), but it is subject to certain phaseouts.

Purchase our tax guides and tutorials here:

https://gumroad.com/jasondknott

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

#IRS #Taxes #StudentLoans

Follow Jason here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

-

4:04

4:04

The Joel Ley Podcast

1 year ago $0.01 earnedAbolish Student Loan Debt!

24 -

5:08

5:08

Minute Math

8 months ago $0.01 earnedSolving the Compound Interest Formula for the Initial Amount - How Much Should I Save for College?

128 -

2:27:08

2:27:08

RadiantClone

1 year agoRecoupment IRS Form 706 & IRS Form 709

490 -

4:15

4:15

The Ramsey Show Highlights

2 years agoHow Can I Minimize The Interest On My Student Loans?

25 -

0:54

0:54

RighteousJaime

8 months agoStudent Loan payment is back on.

5 -

14:01

14:01

JazzWealth

1 year agoSocial Security Reduced For Student Loan Payments

2 -

1:02

1:02

ddelevante

1 year agoHOW TO DELETE STUDENT LOANS!

16 -

1:32

1:32

chycho

1 year agoHow the Government Should Handle Student Loan Forgiveness: Student Debt

9 -

2:00

2:00

WEWS

1 year agoHere’s how to apply for student loan forgiveness

-

5:55

5:55

TeoAnon17

1 year agoCorrecting IRS Form 1099s

42