IRS Form 5452 - How to Report Nondividend Distributions for Your Corporation

If you are an owner in a "C" corporation, you know all too well the double taxation issues.

Tax at the entity level, and then the second layer of tax when dividends are distributed to shareholders.

Cash dividend distributions, however, are only subject to tax to the extent they are distributions from earnings and profits (E&P). If you take a dividend distribution in excess of E&P, that is a non-dividend distribution that is NOT taxable.

You need to complete Form 5452 to document the correct amount of nontaxable dividends.

Purchase our tax guides and tutorials here:

https://gumroad.com/jasondknott

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

#IRS #Taxes #Form1120 #Form5452

Follow Jason here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

DISCLAIMER: I am a licensed attorney and certified public accountant (CPA) in the State of Florida. I am not a financial advisor. The information provided in this video is for entertainment purposes only. No such communication is provided in the course of an attorney-client relationship, and no communication is intended to constitute legal advice. You should speak with your own tax and legal professionals to discuss your circumstances before performing any of the tax, legal or accounting strategies demonstrated in this video. Thank you.

-

0:42

0:42

Investmenting

1 year agodividend Income

8 -

5:19

5:19

PassiveIncomeLiving

5 months agoAll Dividends We Received In January 2024

23 -

6:17

6:17

hkim2294

1 year agoIRS Warns US Taxpayers to Report Transactions of at Least $600 From 3rd Party Networks

20 -

6:54

6:54

Jason D Knott

2 years agoHow to Complete IRS Form 7203 - S Corporation Shareholder Basis

445 -

7:01

7:01

LenaPetrovaCPA

7 months agoTax Form 1099-Misc Explained | What Is IRS Form 1099-Misc

331 -

12:44

12:44

Jason D Knott

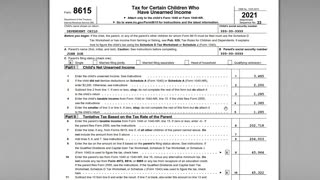

2 years agoHow to Report Kiddie Taxes using IRS Form 8615

743 -

1:47:54

1:47:54

FreedomLawSchool

1 year agoEmployees: When and how to claim EXEMPT from Income Tax Withholding on Form W-4

1.73K5 -

6:22

6:22

dspicer847

1 year agoMy dividend income with a $56,000 account

-

2:22:13

2:22:13

MintingCoins

1 year agoIRS Plans to Tax NFTs as Collectibles — Rich Pay-up to 28% on Profits + ENS DAO Small Grants!

61 -

4:01

4:01

GaryLeland

3 years ago👉IRS Clarifies Reporting Requirements For Bitcoin

69