Can a Non-U.S. Person be a Partner in a U.S. LLC

It is more common these days for a U.S. LLC to have both U.S. and non-U.S. owners.

The entity might be legally formed within the U.S., but owners can be spread across the globe as more businesses operate in international commerce.

If a non-U.S. person joins a U.S. LLC, it does create specific reporting and withholding obligations for the LLC and members.

Purchase our tax guides and tutorials here:

https://gumroad.com/jasondknott

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

#Taxes #LLC #Form1065 #IRS

Follow Jason here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott/

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

-

5:32

5:32

Jason D Knott

2 years agoAutomatic Conversion of a Single-Member LLC to a Partnership

52 -

13:32

13:32

Jason D Knott

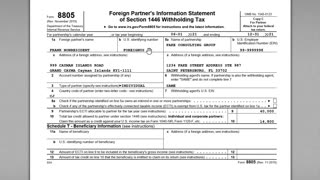

2 years agoHow to Fill Out IRS Form 8804 & 8805 for Foreign Partners

7811 -

0:42

0:42

Chuck The Contractor

5 months agoSeparate your personal and business finances if you have an LLC.@businessanywhere

-

7:15

7:15

WealthGamePodcast

5 months agoLLC Tax Options Explained: Choose the Right One

32 -

2:08:57

2:08:57

JackBBosma

1 year agoSeeking Solveres Independent Business Owner Members

1 -

0:27

0:27

Small Business Tax Savings Podcast

1 year ago💼 An agreement is an important part of entering into a business relationship with someone.

-

4:26

4:26

WealthGamePodcast

8 months ago🏡 Buying Property or a Business with a Partner? Learn How!

16 -

2:09:21

2:09:21

JackBBosma

1 year agoSeeking Solveres Independent Business Owner Members

15 -

13:15

13:15

thejaredpilon

1 year agoTransfer a Business to an Employee

2 -

43:07

43:07

Love Travel Adventure

1 year ago💥👉 Own NOTHING Control EVERYTHING Best Accounting Firm For Lease & Owner Operator Truckers 👈💥

1