Premium Only Content

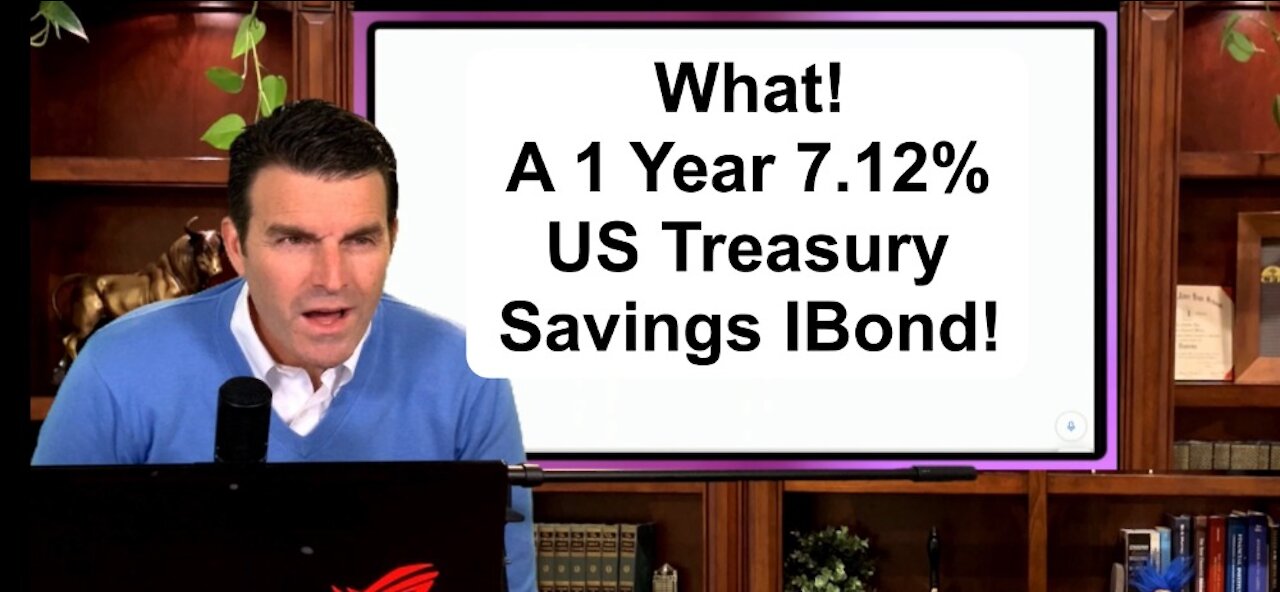

The 7.12% 1 Year US Treasury Ibond Rate You Might Want To Know About! Compare To CD's & Savings Account

Has anyone told you about the 1 Year 7.12% US Treasury Ibonds? If not I will in this video! How to buy, how much can you buy, how long do you have to hold them, how the rate is calculated all to help you determine if these are suitable for you.

Bill Wilkins, Certified Financial Planner Practitioner TM of 29 years discusses the 7.12% US Treasury Ibond Rate

If you are getting value from our podcasts and would like to support us, You can now buy us a cup of coffee! @ https://www.buymeacoffee.com/PursuingTheBest . And or Please share the video with others who you think might find it valuable.

If you are interested in complimentary financial planning that strives to help you achieve the life you desire sooner than later, please click this link https://www.rightcapital.com/sign-up?referral=5BQAHbDZtiChIDBrOLmUxw&type=client.

After you enter in the basic profile data above we will get in contact with you to discuss a time to meet. We provide up to 30 minutes of complimentary planning.

See our Emergency Prepping Kit here:

https://kit.co/PursuingTheBest/the-best-emergency-prep-products-we-ve-found-so-far

1) Do it yourselfers can continue to use our financial and investment planning software for just $8.99 a month, Cancel anytime. See how just adjusting your budget monthly, retirement age, social security start dates, downsizing or upsizing your home, private schooling for kids vs not, pool purchase, landscaping, remodeling etc....impacts your long term lifestyle from daily living to taxes to estate planning etc... Track your investments all in one location. Track your bank account and credit card transactions all in one location. After a year of using the software we do provide an additional 30 minutes of consultation. This does not include asset management or specific recommendations.

2) Hourly Consulting Fee beyond upfront complimentary planning. Minimum $200 for a half hour, $100 for each 15 minutes after that (Includes use of our software for 12 months.) This involves no money management.

3) Full Discretionary Asset Management, Financial Planning engagement. Fee is based on asset size. We do everything for you, includes build and monitor your financial plan, investment planning, recommendations and discretionary management, research, meetings with your CPA, Attorney, family, trading, access to our software, money movement back and forth to your bank when needed, beneficiary updates, provide necessary tax reporting forms and more etc.... Fees are based on asset size under management with an overall minimum of $500 per year.

Thank you so much for watching, We truly hope this video had information that will help you or someone you know pursue the life you desire sooner than later.

If you are getting value from our podcasts and would like to support us, You can now buy us a cup of coffee! @ https://www.buymeacoffee.com/PursuingTheBest . We thank you so much for any support whether it’s Smashing The Like Button on our YouTube videos, Watching our videos or being a client! 😎

Standard & Poors/Dow Jones References to index reports are sourced from the link below. https://urldefense.com/v3/__https://www.spindices.com/spiva/*/reports/regions__;Iw!!Cz2fjcuE!z8AXD28-PQ_Xr3q4LiseOdIID0XvDdtT0YwkanPK-1S6tcGGYsmC_t3_Zhni_NYc-mM$

The content in any of Wilkins Wealth Management Group's Videos should not be construed as tax, legal, insurance, engineering, construction, health & safety, electrical, construction, financial advice or other and may be outdated or inaccurate, it is your responsibility to verify all information to practice all safety precautions, consult your attorney, your cpa, financial advisor etc... before acting on any information in this video. Please see important disclosures at the end of each video as well. Thank you!

Bill Wilkins 513-641-6307

William.wilkins@lpl.com

-

8:39

8:39

LeftRightOut Podcast

4 years agoYour savings account is robbing you!

93 -

5:33

5:33

KTNV

3 years agoAFCU Youth Savings Account Promotion

1 -

LIVE

LIVE

Spartan

6 hours agoSpartan - Pro Halo Player for OMiT | Scrims vs OMiT Black

350 watching -

2:47:11

2:47:11

crgoodw1n

5 hours agoMonday stream Pt.2! Max Traders are almost here!

21.2K1 -

1:28:30

1:28:30

Gurk

4 hours ago $0.58 earnedMLB CO OP

25.8K -

1:46:27

1:46:27

Tim Pool

13 hours agoSin Frontera: The End of Illegal Immigration

201K66 -

3:42:40

3:42:40

VapinGamers

5 hours ago $1.36 earnedDestiny 2 - Edge of Fate Legendary Run and AD Testing RTMP Pass Thru - !rumbot !music

22K3 -

2:24:23

2:24:23

Joker Effect

5 hours agoULTRA MEGA STREAM! Let's review things... Also... Joker was right... again! What a surprise :) Also.. what the heck is @NetAxisGroup ?

15.3K -

1:01:11

1:01:11

Jamie Kennedy

1 day agoWhy the Epstein Cover-Up Still Matters | Ep 214 HTBITY W Jamie Kennedy

15.8K3 -

2:11:56

2:11:56

LIVE WITH CHRIS'WORLD

1 day agoLIVE WITH CHRIS'WORLD - WE ARE READY FOR ACCOUNTABILITY

11.5K7