Does My LLC Partnership Need a New EIN?

Every LLC formed in the U.S. should have its own federal employer identification number (EIN), which serves as the entity's taxpayer ID number.

Under certain circumstances, the LLC may need to apply for a new EIN if there is a change to ownership or entity structure, even if the LLC remains the same under state law.

In this video, I cover the circumstances where an LLC taxable as a partnership would need a new EIN after a change in ownership.

Purchase our tax guides and tutorials here:

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

#IRS #LLC #PartnershipTaxation #Form1065

Follow Jason here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

-

3:53

3:53

Dailycaller

2 years agoBiden Speaks About New AUKUS Partnership

1.35K9 -

4:16

4:16

The Daily Caller

2 years agoJoe Biden Announces New Trilateral Partnership

80227 -

5:32

5:32

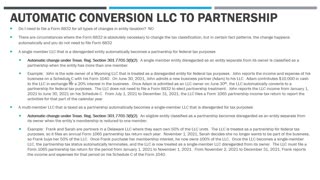

Jason D Knott

2 years agoAutomatic Conversion of a Single-Member LLC to a Partnership

52 -

1:59

1:59

Reuters

2 years agoU.S., Britain, Australia announce new security partnership

3183 -

1:10

1:10

KTNV

2 years agoRaiders' Darren Waller launches new partnership

6 -

2:22

2:22

amagras

2 years agoDoes Fairchild need more control?

8 -

20:38

20:38

LIONSROAR3:8

2 years agoTHE POWER OF PARTNERSHIP!

47 -

16:01

16:01

Bearing

22 hours agoTikTok has Reached NUCLEAR Levels of CRINGE

13.2K22 -

5:46

5:46

Chris Jericho

17 hours agoTalk Is Jericho Highlight: Renny Harlin Talks The Strangers & Nightmare On Elm Street 4

12.6K1 -

17:05

17:05

DEADBUGsays

1 day agoThe Beast Of Manchester

6.69K4