Automatic Conversion of a Single-Member LLC to a Partnership

Form 8832 is an entity classification election to change the default tax treatment of an LLC to an alternative classification.

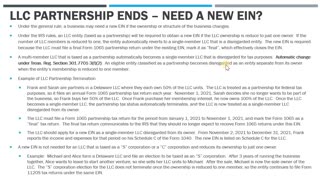

In some cases, however, you do not need to file Form 8832 to change the tax classification.

The most common automatic changes are a single-member LLC to a partnership, and then a partnership to a single-member LLC.

Purchase our tax guides and tutorials here:

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

#Taxes #IRS #Form8832

Follow Jason here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

-

5:56

5:56

Jason D Knott

2 years agoDoes My LLC Partnership Need a New EIN?

44 -

LIVE

LIVE

Laura Loomer

4 hours agoEP55: LIVE COVERAGE OF THE FIRST PRESIDENTIAL DEBATE WITH LAURA LOOMER

2,158 watching -

57:56

57:56

Kim Iversen

5 hours agoFIGHT NIGHT! Will Trump Be An Ass and Will Biden Stroke Out?

79.5K32 -

4:15:08

4:15:08

WeAreChange

5 hours agoBIDEN DOWN: The Michelle Obama Countdown Begins!

60.4K33 -

1:27:55

1:27:55

Glenn Greenwald

6 hours agoCNN’s Kasie Hunt Has Humiliating Meltdown Ahead of Biden-Trump Debate; SCOTUS Protects Biden Administration's Social Media Censorship Program from Review | SYSTEM UPDATE #290

107K88 -

1:21:03

1:21:03

Donald Trump Jr.

12 hours agoDebate Day, Exclusive Interview with Glenn Beck | TRIGGERED Ep.149

155K228 -

1:20:59

1:20:59

Havoc

6 hours ago90's Vs. Now | Stuck Off The Realness Ep. 2

32.6K -

2:10:26

2:10:26

Roseanne Barr

5 hours agoDanger Close with Patrick Byrne Part 2 | The Roseanne Barr Podcast #54

75K24 -

7:38:21

7:38:21

Akademiks

8 hours agoFoolio Murder about to be Solved?? Yungeen Ace RICO otw? Gunna vs Thug. Sexy Redd vs King von sis

120K22 -

1:08:28

1:08:28

The Late Kick with Josh Pate

4 hours agoLate Kick Live Ep 525: CFB's Best Rivalries | Kirby Treatment | EASports CFB Ratings | SEC Overrated

18.9K