IRS Schedule C with Form 1040 - Self Employment Taxes

If a U.S. taxpayer is self-employed, they must report their income and expenses on Schedule C of Form 1040. The earnings are subject to self-employment taxes, as well as federal income taxes.

So what are the particular rules and what's required?

In this video, we will cover the following:

1. Sole proprietorships and single-member LLCs.

2. Home office expenses

3. Auto expenses and mileage reimbursements

4. Schedule SE tax worksheets

5. Limitations on deductions

Purchase our tax guides and tutorials here:

https://www.udemy.com/user/jason-knott-2/

Check out our website for more posts:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

#Taxes #IRS #ScheduleC #SelfEmployed

Follow Knott PLLC here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

-

3:56

3:56

The Emerald Corner

7 months agoDemystifying Self-Employment Taxes - Once and For All

100 -

7:16

7:16

TheHeadlinersGame

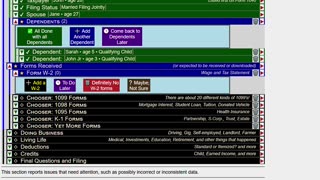

2 months agoTax Prep all on one page - Video #1

8 -

6:07

6:07

cowcountry

3 years agoA1 C13 13:4 Work Together

58 -

5:55

5:55

TeoAnon17

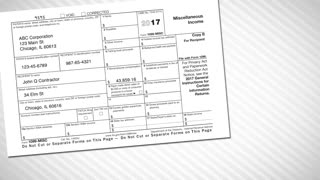

1 year agoCorrecting IRS Form 1099s

42 -

20:52

20:52

Lou Scatigna, The Financial Physician

1 year agoIncome Tax Season Has Officially Arrived

208 -

44:40

44:40

FreedomLawSchool

1 year agoAre you really “SELF-EMPLOYED”? If so, do you owe income taxes according to US law?

102 -

6:37

6:37

FreedomLawSchool

1 year agoYou got an IRS Form 1099. Must you file a Form 1040 & pay federal income tax by April 15th? (Short)

305 -

16:23

16:23

Scott Alan Miller Living in Nicaragua

1 year agoAdventures in Nicaragua Taxes | Vlog 1 December 2022

3 -

17:36

17:36

FreedomLawSchool

1 year agoYou got an IRS Form 1099. Must you file a Form 1040 & pay federal income tax by April 15th? (Full)

277 -

0:22

0:22

Mesquite Today

2 years agoThursday Evening with David and Shannon