How to Fill Out a Protective Form 1120-F for a Foreign Corporation

If a foreign corporation sells products to customers located in the U.S., the foreign corporation may have a potential U.S. tax exposure.

Foreign corporations may file a Form 1120-F on a protective basis, whereby the corporation takes the position it is engaged in U.S. trade or business but has no U.S. source income effectively connected with that U.S. trade or business.

In this video we cover the following topics:

1. When should a foreign corporation file a protective tax return.

2. What elements of the return should be completed.

3. What treaty-based positions should be disclosed.

Purchase our tax guides and tutorials here:

https://gumroad.com/jasondknott

https://www.udemy.com/user/jason-knott-2/

Check out our website for more:

https://www.lawofficesofjasonknott.com/blog/

Need more help? Schedule a consultation:

https://calendly.com/jason-knott

Follow Jason here:

Twitter: https://twitter.com/jasondknott

Instagram: https://www.instagram.com/jasondknott

TikTok: https://www.tiktok.com/@jasondknott

LinkedIn: https://www.linkedin.com/in/jason-d-knott/

Patreon: https://www.patreon.com/jasonknott

Quora: https://www.quora.com/profile/Jason-Knott-17

-

5:41

5:41

Jason D Knott

2 years agoForm 5472 Reportable Transactions for Foreign Owned LLC

59 -

13:32

13:32

Jason D Knott

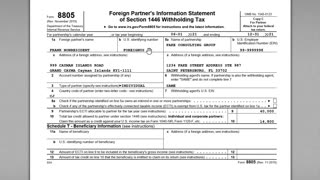

2 years agoHow to Fill Out IRS Form 8804 & 8805 for Foreign Partners

7811 -

3:06

3:06

ISF Depot

1 month agoGlobal Operations: Ensuring ISF Compliance for Foreign Subsidiaries

2 -

4:33

4:33

THE PROFESSIONAL NOMAD PODCAST

6 months agoWhy should i use an International Attorney to start a Foreign Company?

42 -

2:41

2:41

ISF Expert

3 months agoISF Filing For International Trade

1 -

2:09

2:09

ISF Expert

3 months agoHow to Complete ISF Filing for Customs Forms

1 -

1:00

1:00

Emily Bron

5 months agoNavigating Tax Implications for Expat Business Owners: Strategies for Private Corporations

-

4:22

4:22

ISF Template

1 month agoCompliance Essentials: ISF Authorization for Corporate Imports

1 -

2:46

2:46

CorporateServicesSingapore

1 year agoGuide to Audit and Compliance for Foreign Investors in Singapore

4 -

5:44

5:44

Wisdom for Dominion

7 years ago4 Laws for Building An International Business