Premium Only Content

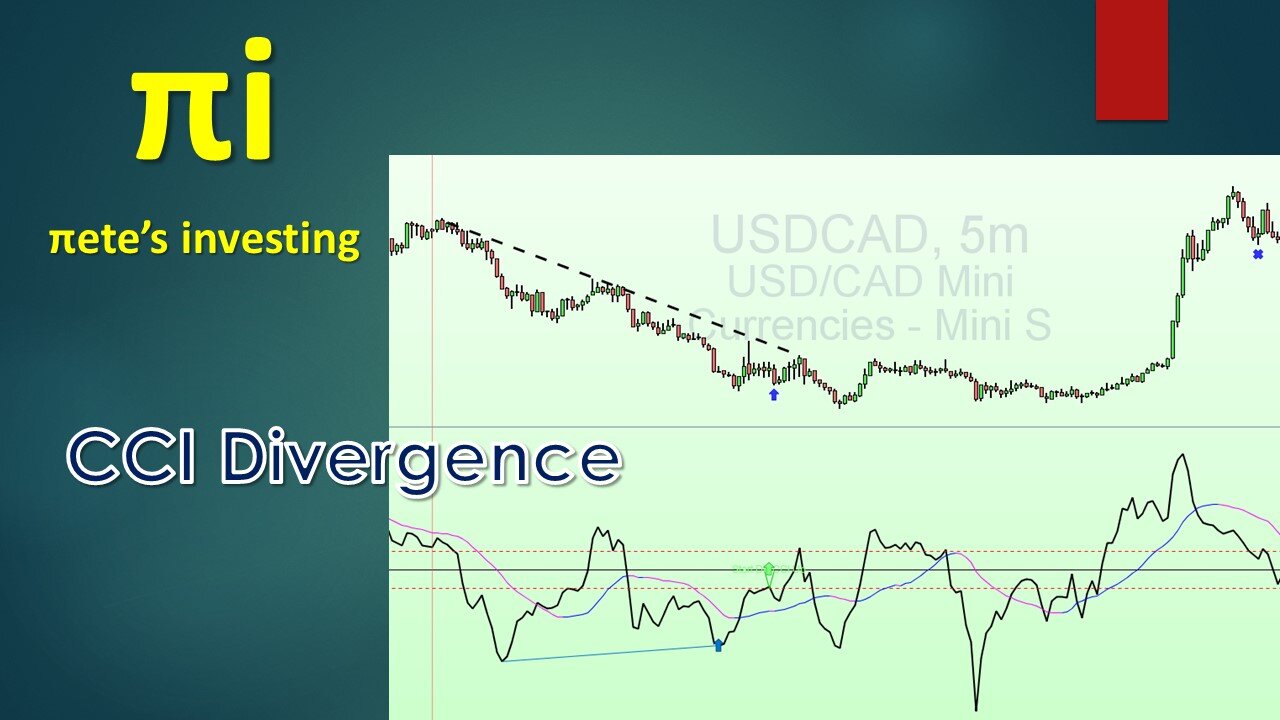

Trading the CCI20 Divergence strategy with Average Down, Long or Short.

Trading the CCI20 Divergence strategy with Average Down, Long or Short.

Welcome to Pete’s investing updates

in this strategy edition we will be talking about .... ( Simple Bluechip Trading with the Commodity Channel Index strategy and applying a % Gain and Average Down approach, going Long or Short)

Don't forget...

First always remember to review petesinvesting channel playlists

Updated every weekend I look at the charts of some select blue chip shares as well as some key world sharemarket indices.

As always click on the SUBSCRIBE button as well as the NOTIFICATION bell and LIKE this video to support this channel.

If you want me to review an Index a share, a commodity or a FOREX pair, put it in the comments and I'll cover it in a future video

Things

to consider:

•We track and trade on a Daily chart since we want to back test and see results of trades back during the GFC as well as Covid effects.

•We track and back test Revenue over Drawdown requirements

(as a %) to optimize our returns with less exposure.

•Brokerage is included in our back testing. I use $8 per transaction each time we buy or sell. Revenue shown may change slightly depending on your brokerage costs.

•Our Back testing transacts with $2,000 per trade. ie everytime you purchase $2k worth of shares in the instrument you want to invest.

To increase Revenue (ie returns) simply increase this. But beware this will also increase your Drawdown, so ensure you factor in this with your money management strategy.

Lets get started

Remember...

Don't forget to subscribe / LIKE and hit the notification bell and review the PETESINVESTING channel playlists for further reference.

Using a Daily price chart, we review the weekly progress of a sample of Bluechip stocks from Australia, the US and Europe - Telefonica (TEF.BME), Commonwealth Bank Of Australia (CBA.AX), BHP Group Ltd Australia (BHP.AX), JPMorgan and Chase (JPM.NYSE), Volkswagen AG (VOW.XETRA), Johnson & Johnson (JNJ.NYSE), Caterpillar Inc (CAT.NYSE).

Showing any new open and closed positions, profitability and draw down requirements dependent on the trend of the respective price charts.

Supporting videos:

Alligator strategy explained:

https://youtu.be/1SMSRQV7GZE

Rumble updates

https://rumble.com/register/peteeight/

Bitchute updates:

https://www.bitchute.com/channel/pTjWs2A7K9Br/

Become a PetesInvesting Patreon member with same day updates on

https://www.patreon.com/petesinvesting

Money Management:

https://youtu.be/nvvcldeeZS4

Average Down Do's and Don'ts

https://youtu.be/SZbh2Me4kq0

Simple Trading Strategy with CCI and Avg Down technique

https://youtu.be/w35_YtV4YQU

Simple trading strategy https://youtu.be/ibVzRwCX-3Q

Average Down Strategy https://youtu.be/RFCb5S78D8o

#bluechiptrading #sharetrading

-

12:29

12:29

Petes Investing

8 days agoGold & Silver STILL in short term DECLINE

60 -

15:29

15:29

Petes Investing

3 years agoTrading the Alligator strategy with % Gains and % Average Down

363 -

9:40

9:40

bammy123

4 years agoMy Divergence Trading Strategy Explained (150$ DAILY)

34 -

10:50

10:50

Petes Investing

4 years agoSimple CCI Average Down strategy explained.

275 -

12:13

12:13

Petes Investing

3 years agoTrading the Alligator strategy with top US Dividend growth Stocks.

367 -

2:47:40

2:47:40

Barry Cunningham

8 hours agoBREAKING NEWS: WATCH PARTY WITH PRESIDENT TRUMP ON THE LAURA INGRAHAM SHOW (AND MORE NEWS)

157K31 -

2:36:50

2:36:50

Blabs Games

14 hours agoLet's Get Those 5 Stars! Jurassic World Evolution 3 Playthrough #7

52.1K5 -

1:03:59

1:03:59

Flyover Conservatives

1 day ago$117K Paywall to Protect School’s Indoctrination? The Education System’s Biggest Secret w/ Nicole Solas | FOC Show

44.8K1 -

2:31:34

2:31:34

We Like Shooting

17 hours ago $5.11 earnedWe Like Shooting 636 (Gun Podcast)

34.7K2 -

1:53:24

1:53:24

RiftTV

7 hours agoFBI Director Kash Patel Sues Elijah Schaffer for $5 MILLION?!

62.4K35