Premium Only Content

5 Tips For California FTB Offer In Compromise Success

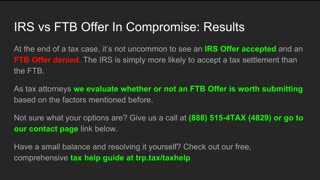

Getting an Offer In Compromise accepted with the FTB can often be harder than getting one for the IRS. Often a tax debt case ends with an IRS Offer accepted and an FTB balance with a payment plan.

Here are 5 tips to help you get a successful Offer In Compromise for the FTB:

1. File all required tax returns

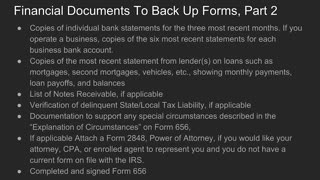

2. Submit all required documentation

3. Fill out your forms as accurately as possible

4. Recognize that your age is a factor being considered by the FTB

5. If they do not accept your initial amount, ask how much will they accept

See our FTB Offer In Compromise guide:

trp.tax/tax-guide/ftb-offer-in-compromise/

Check out our free tax help guide:

trp.tax/taxhelp/

Get help from our expert tax attorneys by calling (888) 515-4829 or going to:

trp.tax/start/

-

1:33

1:33

TaxResolutionProfessionals

4 years ago5 Tips For Offer In Compromise Success by a Tax Attorney

33 -

4:16

4:16

TaxResolutionProfessionals

4 years agoIRS vs FTB Offer In Compromise: The Similarities, The DIfferences

29 -

9:13

9:13

TaxResolutionProfessionals

4 years agoOffer In Compromise Formula: How The IRS Calculates Tax Settlements

13 -

3:44

3:44

KGTV

4 years agoIn-Depth: Experts say COVID winter surges offer warning for California

151 -

1:12

1:12

KTNV

4 years agoTips for Entrepreneurial Success

3 -

6:43

6:43

TaxResolutionProfessionals

4 years agoHow Do I File My Offer In Compromise With The IRS?

13 -

LIVE

LIVE

Grant Stinchfield

1 hour agoBiden’s Inner Circle Cracks! It's the Presidency That Wasn’t!

186 watching -

1:32:47

1:32:47

Graham Allen

4 hours agoCandace Owens vs TPUSA! It’s Time To End This Before It Destroys Everything Charlie Fought For!

140K557 -

2:02:57

2:02:57

Badlands Media

11 hours agoBadlands Daily: 12/4/25

49.2K6 -

2:14:23

2:14:23

Matt Kohrs

14 hours agoLive Trading Stock Market Open (Futures & Options) || The Matt Kohrs Show

32K