Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Offer In Compromise Time Frame - Here's How Long An IRS Offer In Compromise Takes, Most Of The Time

3 years ago

3

It can change quite a bit, but on average from our cases:

Wage Earners with simpler financials: 5-9 months

Self-employed Individuals: 7 months to 1.5 years

Now, these time frames might go up or down, but the IRS technically needs to respond within 2 years. Yes, there are some cases that go really close to that 2-year mark and if an appeal is required, maybe even longer.

That's a reason to look out at the billing practices of the tax firm you hire. Sometimes endless monthly fees can drag on while the IRS is just sitting on your case. During that time, nobody is doing any work on it from the tax firm's end.

Loading comments...

-

9:13

9:13

TaxResolutionProfessionals

3 years agoOffer In Compromise Formula: How The IRS Calculates Tax Settlements

13 -

6:43

6:43

TaxResolutionProfessionals

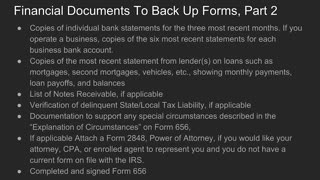

3 years agoHow Do I File My Offer In Compromise With The IRS?

13 -

4:16

4:16

TaxResolutionProfessionals

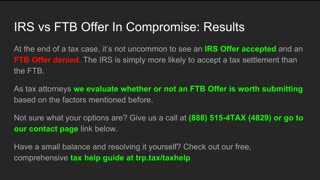

3 years agoIRS vs FTB Offer In Compromise: The Similarities, The DIfferences

29 -

1:33

1:33

TaxResolutionProfessionals

3 years ago5 Tips For Offer In Compromise Success by a Tax Attorney

33 -

10:56

10:56

LifeAdventuresWithCam

3 years agoPerfection takes time

22 -

1:17:36

1:17:36

vivafrei

4 hours agoThe Epstein Fallout CONTINUES! Gavin NewScum Supports Child Trafficking? AND MORE!

120K71 -

1:39:06

1:39:06

The White House

5 hours agoPresident Trump Participates in a Roundtable with First Responders and Local Officials

33.9K21 -

![[Ep 706] LIVE From TPUSA - SAS Tamp, FL | Bongino vs Bondi | Gen-Z is Awake!](https://1a-1791.com/video/fww1/51/s8/1/A/E/s/1/AEs1y.0kob-small-Ep-706-LIVE-From-TPUSA-SAS-.jpg) 51:03

51:03

The Nunn Report - w/ Dan Nunn

4 hours ago[Ep 706] LIVE From TPUSA - SAS Tamp, FL | Bongino vs Bondi | Gen-Z is Awake!

15K6 -

LIVE

LIVE

StoneMountain64

6 hours agoRematch BEST Tricks to RANK UP

85 watching -

50:04

50:04

Watchmen Action: Ezekiel 33:6 - Equip The Church To Engage The Culture

4 hours ago $1.04 earnedThe Watchmen Brief LIVE From Turning Point SAS Conference!

21.1K2